Finally the markets are getting interesting again!

The last 6 months have been a struggle. The markets have been SO boring. Not anymore.

Of course, we can’t yet know whether the past two trading days are a brief horror movie or the beginning of an apocalypse. And I’m certainly not joining those offering opinions about the future of the US economy as though they have a clue. My view: nobody has a clue, but they all want your clicks.

What little I did over the past year including diversifying so that, when a next crash came I would be likely to have stocks to sell in order to invest in those that had unreasonably dropped. That process has begun, as discussed in my Trade Alerts and in the Focused Investing Chat.

Yesterday a subscriber posted: “Portfolio down 10% in two days, my dividend income changed by 0%.” Me too.

The next challenge is not to burn through my dry powder too fast. This could go on a while, or longer.

A Brief Primer on Oil and Gas

We’ve picked up some subscribers without any background in energy investments. There are some resources:

Paid subscribers see my holdings monthly, and annual subscribers have access to my real-time, real-dollar portfolio.

I discuss which investments are the safest in my annual Go-Fishing article.

From the Focused Investing Home Page (focusedinvesting.substack.com) you can see what has been published. Just looking at titles, 21 items over the past year have been oil-and-gas related.

We discuss related issues in the Chat often.

Here follows an overly brief summary and generalization. Individual companies differ often from the descriptions below. But one has to start somewhere.

Midstreams: These make their money primarily from “toll-booth” models, where they charge to transport products from place to place. They have the safest dividends, have relatively large yields, and are likely the first place to invest.

Their pricing reflects levels of perceived risk, mainly from debt but sometimes from company-specific concerns. Their earnings are mostly but not entirely independent of the market prices of what they transport.

Midstreams here are the most like Real Estate. They should move little with various news, but often move too much. Here are the dividend yields from three of them over the past year:

The Big Picture on E&Ps: After midstreams, there is big picture on Exploration & Production companies, or E&Ps. Commodity prices, including those for oil & gas, go through large fluctuations and stock prices respond.

Indeed, stock prices often over-react, extrapolating temporary trends indefinitely forward. Even so, as an investor you may not get the returns you seek until the commodity prices come back up. This wait can be years.

Low commodity prices may also threaten your dividends. My preference in this space is for producers having two features:

They pay dividends that will be covered even at “trough prices.”

Their costs of production are in the bottom half of the costs for total North American production.

In short, E&Ps are a different game than real estate or even midstreams. That can give you some nice decorrelation, but also can become frustrating.

Now some comments by category.

Supermajors: These firms, including Chevron (CVX) and Exxon-Mobil (XOM) in the US, are huge and hugely diversified. They participate in nearly every subsector of oil & gas. They carry extremely high credit ratings.

Their dividend yields are never huge but may be even safer than those of the midstreams. But the stock prices move with oil prices.

Major Producers: These firms have Market Caps of tens of billions of dollars. They often have a primary focus, such as natural gas or oil, but tend overall to have low costs and a lot of flexibility.

Examples include oil-focused Canadian Natural (CNQ) and Diamondback Energy (FANG) and gas-focused Tourmaline (TOU:TSX) in Canada and EOG Resources (EOG) in the US. These firms all have excellent resource depth.

The two gas-focused firms have held up better than the oil-focused ones lately, but they all dropped a lot in price last week:

Overall the markets have been afraid that oil prices would drop and stay low (a persistent media narrative) and has punished these producers. In my view this group makes good income plays, if you like the yield.

In contrast to oil, gas prices have been improving. This will be reflected in higher payouts. We will see what the markets do about prices.

Small Producers: A common feature of the small producers is higher costs. Their Free Cash Flow and dividend coverage drops very strongly as oil prices drop, and their stock prices should follow.

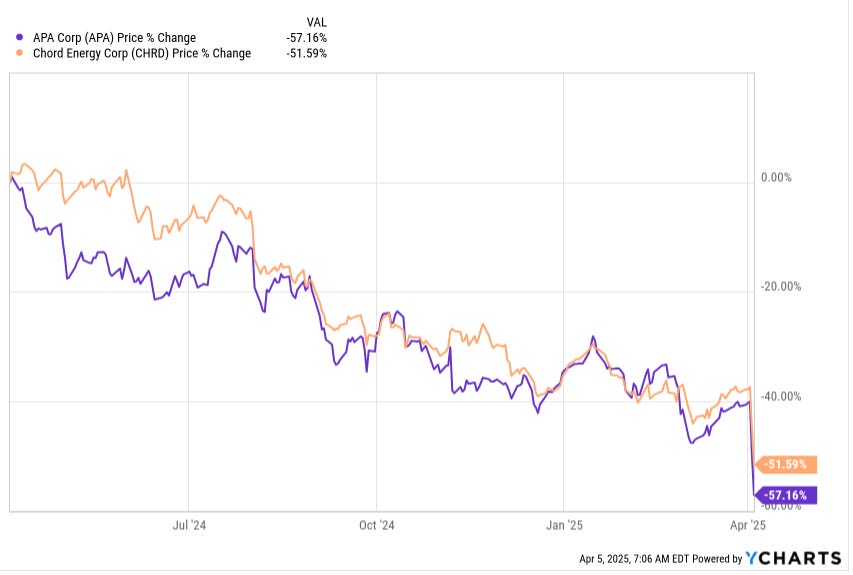

However, I think the market has overdone that even before the most recent drop. Examples for which there are articles from me include Chord Energy (CHRD) and APA Corp (APA). I have been a buyer of both over the past year.

There is risk in these producers. But this is not so much of something like bankruptcy. A prolonged period of oil at $50 or below could lead to elimination of their dividends. Also, a price recovery will await increased oil prices.

In response to all of that, the prices of these firms often fluctuate wildly. A 10% daily move on no news is never surprising.

Focused Investing News

Forthcoming:

My piece on Federal Realty (FRT) is likely to be out this week. I’ve also spend some time on SL Green (SLG). That one is tough to understand, but clearly is no Go-Fishing stock.

I also am doing some thinking about different perspectives on discount rates, and will end up publishing something about that. Plus I’ve realized that I really should do a piece with the REIT growth theory clearly laid out.

But if the market turmoil continues, I’m likely to publish something else focused on opportunities that have emerged.

Personal News:

Some pictures from heaven and hell:

And on the seventh day the power came back, and it was good.

The Great Ice Storm of 2025 came a week ago. We had power lines down in two places on my quarter mile of road. That was typical across 12 counties, and many locations will take much longer to be restored.

In my county at one point 91% of the properties were without electricity. We were under a shelter-in-place order for three days. Something like 1,000 crews, from many states, have been working 17 hour shifts and are still going.

I’m thanking myself for getting a natural-gas powered generator put in a few years ago. I’ve been focused on how it may help me survive the likely blackouts to come thanks to governor Gretchen Whitmer’s green mandates. But first it turned out to help withstand an onslaught from Mother Nature.

Member News

Material since February 28 has included the following.

This past week:

A perspectives article, to all subscribers

A monthly update for March

A deep dive on EPR Properties, with an extensive free preview

The previous week:

A perspectives article, to all subscribers.

A deep look at Regency Centers, to paid subscribers with an extensive free preview.

A Brief Note on Vicinity Centres, to all subscribers.

Two weeks ago:

A perspectives article, to all subscribers.

A reconsideration of Armada Hoffler after their dividend cut, to all subscribers.

A Brief Note on Slate Grocery REIT, to all subscribers.

A Trade Alert to paid subscribers.

March 2 through March 14:

Items that went to paid members, often including a free preview of much of the article:

My analysis of the new, post-merger Whitecap Resources.

A Brief Note providing an update on risk for Alexandria Real Estate, in response to macro events.

A Brief Note on Western Midstream

My analysis of the Orion dividend cut.

Four Trade Alerts that can be seen here.

Paid members also have access to the Focused Investing Chat.

A note on my approach to restricting access: Anything providing details of my trades and portfolio is restricted to paid subscribers, as is anything I consider to be immediately actionable. Most articles with information it seems members may act on usually have a preview section followed by a paid section where the real meat is.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

I have rolled out my new portfolio organization, replacing the old one. It has a “Go-Fishing” bucket and a separate “Quality Gains” bucket, with the latter seeking to hold quality companies for income or growth, but having moderate risk.

There are in addition a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing Chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger (ouch?). You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!

Really enjoyed the read. This stock market crisis shall pass. I learned a lot of lessons in the military. As a retired combat vet, every day I get up is a blessing.

As for your shelter in place without electricity, that really made me smile. Sorry! Happened to me in the early 80’s and 9 months later our son was born. 😀

Thank you for the knowledge