Broken trends, or just noise?

I often discuss trends in the market in this space. They are strange at the moment. Here are some changes in prices over the past three months:

These trends are not what the past three years have trained us to expect. Specifically:

A declining treasury rate makes distant cash flows more valuable and so should boost REITs specifically and stocks in general.

We certainly have seen REITs react strongly, going up when interest rates go down. So far, not in 2025.

A declining oil price threatens the profits of oil companies. But they went up.

Midstreams sometimes follow oil prices though for the most part they should not.

All the established patterns were broken.

In fairness, Enterprise turned in a well-received earnings report so maybe that was the story there. But good earnings reports have not helped REITs at all in recent years.

So what is going on? Is this just fear of the US presidential administration? Or has the economy weakened far more than the official statistics seem to show?

No opinion here, except my usual mantra. Buy companies with solid balance sheets and business models, paying a well-protected dividend. Diversification, as in any approach, can reduce volatility but is less important beyond holding perhaps 15 stocks.

As to me at the moment, the oil patch has kept my portfolio up. It stands within 2% of its all-time high. And despite dividend cuts by two small holdings, the dividends from companies I consider secure are up nearly 5% and my total dividends are down only about 1% over that three month period.

It seems a good time for opportunistic decisions and a bad time for big changes in strategy. I’m pleased that the subscribers in my chat room are mostly looking to buy stocks they see as too cheap.

Snippets

Office Towers: We seem to be seeing more cases of towers actually selling for incredibly cheap prices in foreclosure. There have been a few such headlines each week this year.

The capital to take these opportunities has been gathering and circling for years. More lenders appear to be biting the bullet and taking their losses. This will seed a lot of renewal.

Focused Investing News

Forthcoming:

I have had a repeated experience, for some years. Someone asks me about a REIT or energy company that is not well known. I look at a few things and decide I don’t like it as an investment. Then I forget the details.

So the next time I get asked it is like a trip through a dimly remembered dream. Well, enough of that! My new resolution is to put out a note every time I do this, so perchance not to dream again. This week I did that for Slate Grocery REIT.

Personal News:

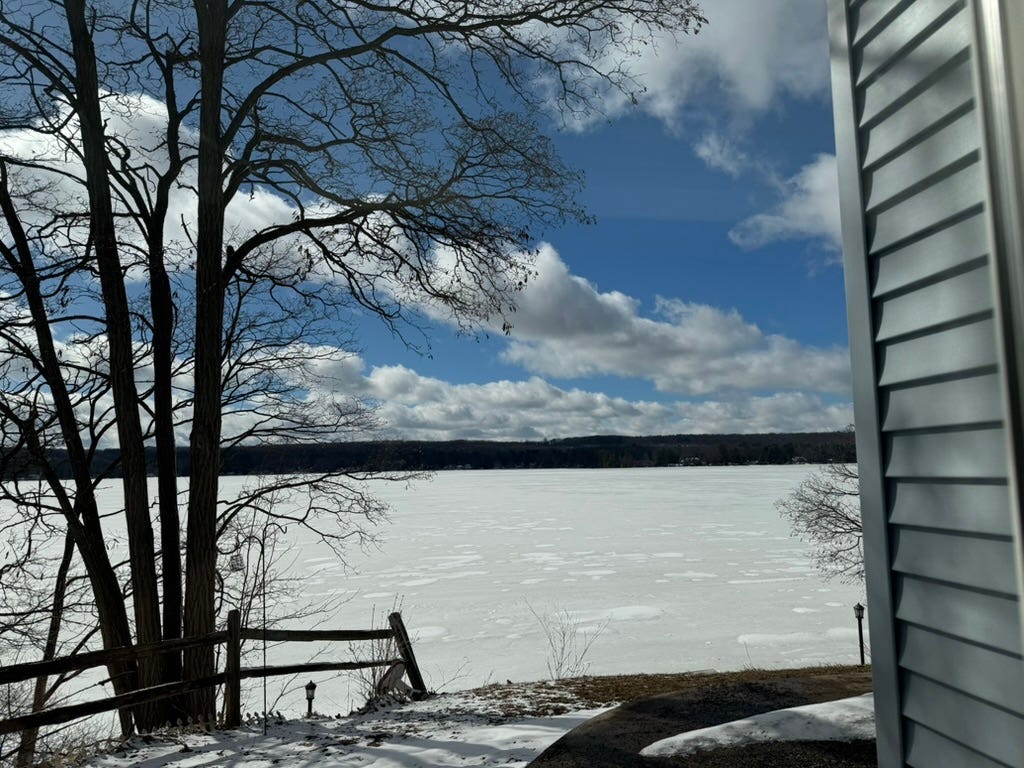

It’s March weather here. Today peaks in the low 20’s (F). Tomorrow will be in the mid 40’s. Then it will repeat, with variations. Snow, then melt. Eight inches to go to 200 for the winter.

Some of the blue skies over white on the lake still take my breath away.

Member News

Material since February 17 has included the following.

This past week:

A perspectives article, to all subscribers.

A reconsideration of Armada Hoffler after their dividend cut, to all subscribers.

A Brief Note on Slate Grocery REIT, to all subscribers.

A Trade Alert to paid subscribers.

February 10 through March 14:

Three of these perspectives articles, to all subscribers.

Items that went to paid members, often including a free preview of much of the article:

My analysis of the new, post-merger Whitecap Resources.

My analysis of Alexandria Real Estate and a later update on risk there.

A Brief Note after earnings on Armada Hoffler and one on Western Midstream.

My analysis of the Orion dividend cut.

Paid members have access to the Focused Investing chat.

A note on my approach to restricting access: Anything providing details of my trades and portfolio is restricted to paid subscribers, as is anything I consider to be immediately actionable. Most articles with information it seems members may act on usually have a preview section followed by a paid section where the real meat is.

As it happened, this past week’s articles were both free. The point of providing all that free material is to let free subscribers see my approaches and thinking, based on which some may choose to go paid.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

I have rolled out my new portfolio organization, replacing the old one. It has a “Go-Fishing” bucket and a separate “Quality Gains” bucket, with the latter seeking to hold quality companies for income or growth, but having moderate risk.

There are in addition a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger. You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!

In the low 20's ( C* ) here in Jerusalem ;-)