Some bears seem to be predicting doom for the largest life-science landlord. What will actually happen and what is the stock worth?

This is the first of my annual updates on firms I own or may own. I wait for the annual 10-K to do them, and Alexandria Real Estate (ARE) is surprisingly prompt in getting theirs out.

Alexandria is also the one REIT I consider deeply undervalued at the moment. See these articles from last year.

This is not to say that I buy all their hype, or all the hype of their boosters. To my eyes, this is overall an ordinary REIT. It has plusses and minuses, as we will see.

On the other hand, the hype of the ARE shorts is also over the top. Led by Jonathan Litt, they cherry pick negatives and make it seem as though ARE is headed nowhere but down, economically.

We will start with some hype-free reality.

The Reality of Alexandria

About 10% of publicly listed REITs have credit ratings of BBB+ or higher. Alexandria is one of them.

Why is that?

At 32% their ratio of long-term debt to gross assets is among the lowest for REITs.

Their weighted average term to maturity for their debt, of 12.7 years, is among the longest.

Their 3.86% weighted average interest rate is at the low end.

Their newly placed $550M of debt was at 5.5%, 100 bps above the current 10-year treasury rate. The bond markets have no concerns about this company.

Their debt is nearly all fixed rate, insulating them from short-term variations in interest rates.

Here are their debt maturities, which are nicely laddered:

On average over the next decade, they need to refinance $750M per year. If 10-year rates stay flat, the incremental 160 bps of interest will increase those costs by $12M each year.

This headwind, for each year it continues, will reduce the growth rate of Funds Available for Distribution (FAD) by 110 bps on average. We are seeing impacts of this magnitude across many blue-chip REITs.

Rents and Construction

REITs absolutely love to brag about their “below-market rents.” And analysts who pump those REITs treat that as money good.

But here is the thing. Markets change.

Renewal rents go down as well as up. We’ve been seeing this lately in the Industrial sector and we certainly are seeing it in Life Science.

What’s more, rent behavior is lumpy. Even ARE with their 391 properties does not have enough to avoid variability based on location and submarket.

Yet every quarter we see lots of tea-leaf reading about what their quarterly renewals or expirations mean. Color me bored.

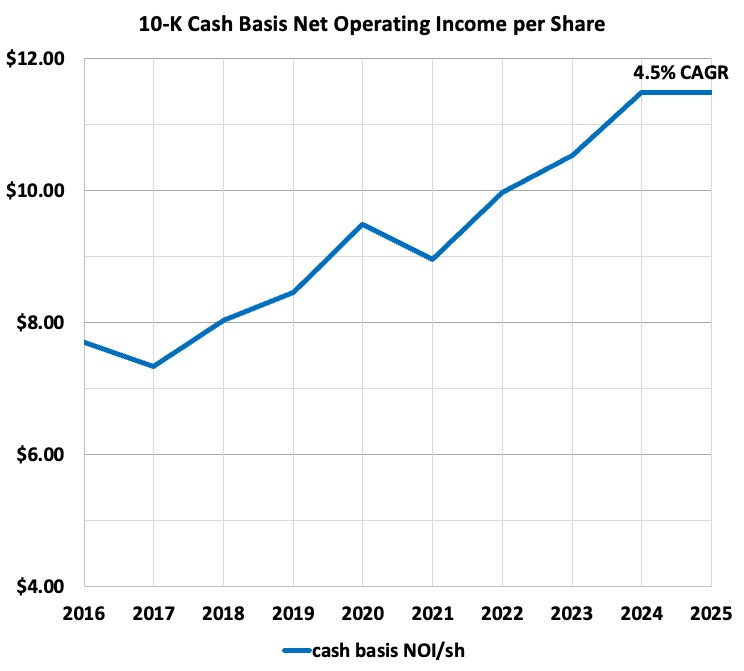

The noise was that their rents were rocketing upward in 2021 and crashing hard last year. As I’ve discussed elsewhere, the fundamental measure of progress is per share Net Operating Income (NOI/sh) on a cash basis. Here it is:

There has been good historical growth, but times are challenging and initial guidance is for NOI/sh to be flat in 2025. What’s more, year-end occupancy is guided to be 92.6% for 2025, down from 94.6% for 2024. More below on that.

The long-term CAGR of 4.5% for NOI/sh, after the flat growth in 2025, places Alexandria in the upper half of REITs. But it is not exceptional. They have been growing like a quality, blue-chip REIT should.

Let’s see what is going on.

Oversupply, But for How Long?

Much of the discussion you see relates to the overall market for life-science properties. It is a mess, and will be for some time.

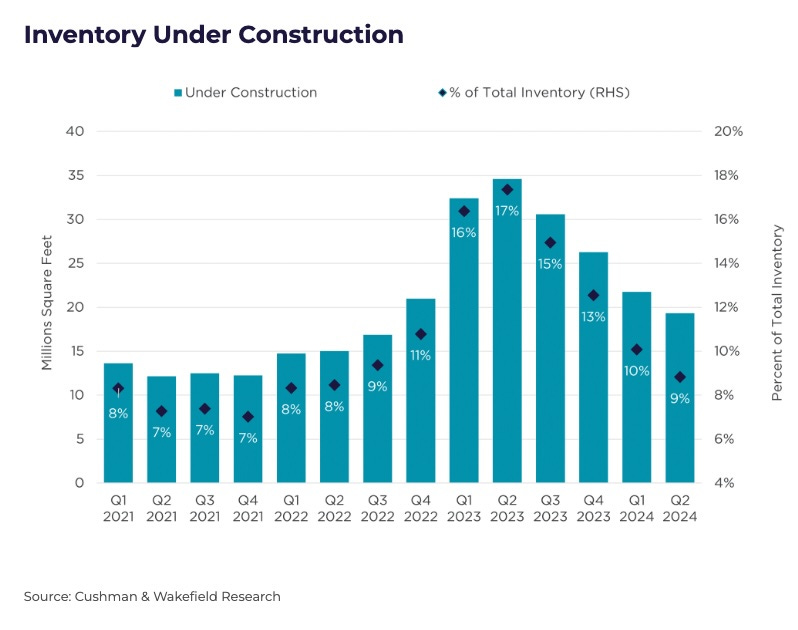

Why? This:

It takes time to get construction going, so the surge in 2023 reflects decisions made a year or two earlier, during peak euphoria.

No wonder vacancy rates have increased and rent growth is challenged. From a Cushman & Wakefield report:

Total vacancy rate increased 350 basis points (bps), from the fourth quarter of 2023 to the second quarter of 2024, and is now 17.9%.

Softer demand and an increase in vacant sublease space has translated to

lower asking rents in some markets.

Overall asking rent growth … remained positive at an average of 4%.

The strong appetite for highly amenitized, newly constructed class A space is expected to push asking rents higher as a significant amount of new space delivers in the sector through 2025.

But the amount of supply shown above is also misleading. Here is Alexandria CEO Peter Moglia from the Q4 2024 conference call, highlighting things real-estate services company JLL found about the troubled Boston lab market. [Throughout this article, quotes are edited for clarity and length.]

… there is a flight to quality for both geography and ownership. 40% of all urban leases signed in 2024 were in … Alexandria's urban submarkets, meaning that only 6% of leases were transacted in other submarkets. According to JLL, 1/3 of the leasing deals were signed by Alexandria and another experienced owner. This is proof that location and sponsorship really matters.

Second, JLL estimates that at least 1/3 and probably closer to 40% of today's available lab space is made up of zombie buildings, meaning the building is unleasable because it's a bad office conversion, an undesirable location and/or an inexperienced owner.

Executive Chairman Joel Marcus implies that there are a lot of zombie buildings also in South San Francisco, the other market that is a serious problem. He said that the “sore thumb is South San Francisco, [where there is] a reckless oversupply by people who really didn't know what they were doing.”

If you take out the zombie buildings, the market is far less oversupplied. Alexandria focuses on highly amenitized properties and on having most of their properties in good locations for networking. The fraction of their properties in these “Megacampuses” is 77% and growing.

Things look better ahead. Construction is now back near where it was in 2021 and is plunging. And not only is construction activity plummeting; it is also becoming more targeted. Cushman & Wakefield again:

There has also been a shift in the type of projects in the construction pipeline. Nearly 27% of the projects delivering in 2024 are preleased, meaning most space is being built as speculative (spec). For projects delivering in 2025, over 58% are preleased, indicating that the pipeline is comprised of mostly build-to-suit projects rather than spec.

But still, the noise from the new Trump administration included a cancellation of all government grants, which lasted about 24 hours. This stimulated a lot of worry porn by click-hungry writers and scared investors. (Credit to my subscriber Robert for “worry porn.”)

Part of the big picture here is that Congress sets the budgets from which those grants come. The administration on its own cannot just stop those funds, though they may have an impact at some level.

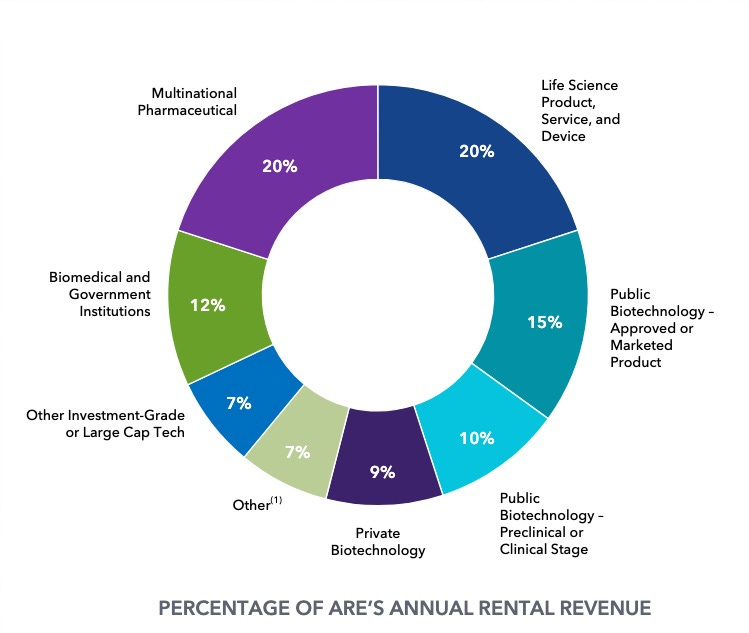

More importantly, life science activity today is mostly not government-funded. For Alexandria’s top 20 tenants, 92% of rent is from investment-grade or publicly traded large-cap tenants. Look at the breakdown of Alexandria tenants:

Little of this activity is immediately threatened by changes in the flow of funds from government. But the NIH funded universities and related institutions are very experienced and very effective at screaming that the sky is falling, and being heard. So if cutbacks go anywhere, expect lots more worry porn.

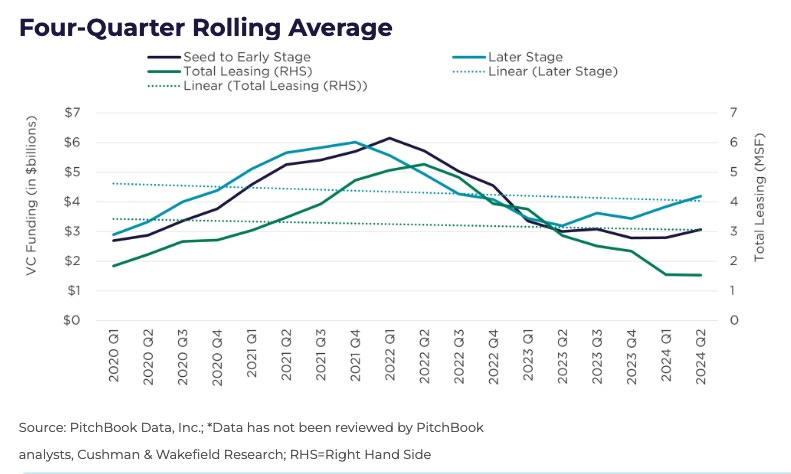

What does drive a lot of growth in life science these days is Venture Capital (VC) funding. This has bottomed:

So the end of the oversupply period is in sight, and we have entered a new upward phase of the VC cycle. But a real recovery could still could take awhile. Alexandria claims to be cautious about new construction (Q4 8-K):

We generally will not commence new development projects for aboveground construction of new Class A/A+ laboratory space without first securing significant pre-leasing for such space, except when there is solid market demand for high-quality Class A/A+ properties

Looking ahead based on the recent 8-K, there are a roughly equal mix of development and redevelopment properties under construction. Alexandria has leased 89% of space to be stabilized in 2025 and 66% of space to be stabilized in 2026.

The 2026 stabilizations have initial occupancy dates ranging from before 2025 into 2026. The two largest properties, which total about half the rentable square feet (RSF), are 100% leased and so are built to suit.

But for 2027 their developments and redevelopments are only 15% leased, mainly in the Greater Boston and South San Francisco areas. Here more than 20% of the RSF, with zero pre-leasing represents “a project focused on demand from our existing tenants in our adjacent properties/campuses.”

Apparently Alexandria decided that demand will be solid in those locations targeted for stabilization in 2027. We will see how that goes, as demand is not solid now. But the space for 2027 stabilization is only about 5% of their total. If it takes longer to lease up, this will be another smallish headwind.

The Costs of Occupancy

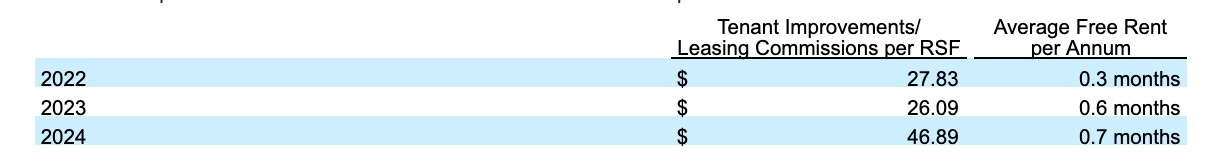

It is a renter’s market today, and new tenants seek rent discounts. These are implemented as periods of free rent at the start of the lease. Here is the recent history for Alexandria:

Note that 0.7 months per annum for a 15-year lease amounts to roughly an initial year after occupancy and before rent payments start.

Now let’s turn our focus to occupancy. There is a cycle associated with lease expirations. Most of them are renewed but some go vacant and then the space must be renovated before a new tenant takes occupancy.

Until the new tenant occupies the space, it is considered vacant and reduces the overall occupancy. For strong REITs, this is the main factor that keeps occupancy below 100%. They are sitting on very few vacant and unleased properties.

Alexandria seeks to minimize the reduced occupancy by building easily re-used spaces. But it is natural that, during renters’ markets, the tenant will seek and get more modifications to the space on the landlord’s nickel. Alexandria has been impacted, as you can see in the table above. (For reference, the annual rental revenue is running near $57 per square foot.)

Right now, to bring onboard a new tenant, Alexandria has to renovate the space, taking a year. Then there is a year of free rent. And on top of that the renovations cost nearly a year’s worth of rent.

So turning over a tenant creates a shortfall of about three years’ rent on the space. This is not unique to Alexandria. It happens all over real estate (though the impact is less in net-leased, free-standing retail).

If the rate of new vacancies runs close to 3% per yr, and re-occupation of the space takes two years, then occupancy will run at 94% or a bit more. This has been the story since 2020:

For 2025 an increase in vacancies will push year-end occupancy down, as mentioned above. From the Q4 24 earnings call:

These projected results for 2025 include the impact [on same-property NOI] of approximately 3.4% on a cash basis from the $768,000 of lease expirations expected to go vacant in 1Q '25 spread across 4 projects. … Occupancy for year-end '25 is guided to be 92.4%, which includes approximately 2% vacancy coming from the 4 projects,

So there will be reduced rental revenues from the unusual fraction of vacancies. A return to a more balanced market will eventually produce a tailwind of a few percent of revenues.

The recurring capex for such renovations fluctuates over time. It increased rapidly across 2024. I used the run rate for H2 of 2024 to estimate the 2025 number. It comes in at 15% of cash NOI.

That 15% is up there, and is nearly twice the 9-year average of 8.5%. Note, though, that some office REITs often have more.

Offsetting the growth of recurring capex will be the 3% rent escalators in nearly all of the Alexandria leases. That is the main reason that guidance for cash NOI ends up flat. We consider years after 2025 below.

Next we turn to cash flows and earnings, then work our way to valuation.