My time off got interrupted this week by the appearance of a hit piece on Alexandria Real Estate (ARE).

I have recently written that ARE is the Simon Property Group (SPG) of the present period. In my view ARE is deeply undervalued and is the best long-term value play in REITs today.

The hit piece was on Seeking Alpha by often bearish analyst Trapping Value, or TV. It matters that TV is focused on predicting the market behavior until his next article on them a few months downstream. My focus is on fundamental value and is much longer-term than that.

Hoping to buy my next tranche of ARE at $90, I rather hope his short-term bearish take is correct. And while his chewing on a small and totally normal-business drop in occupancy my help agitate the market, it has zero long-term significance.

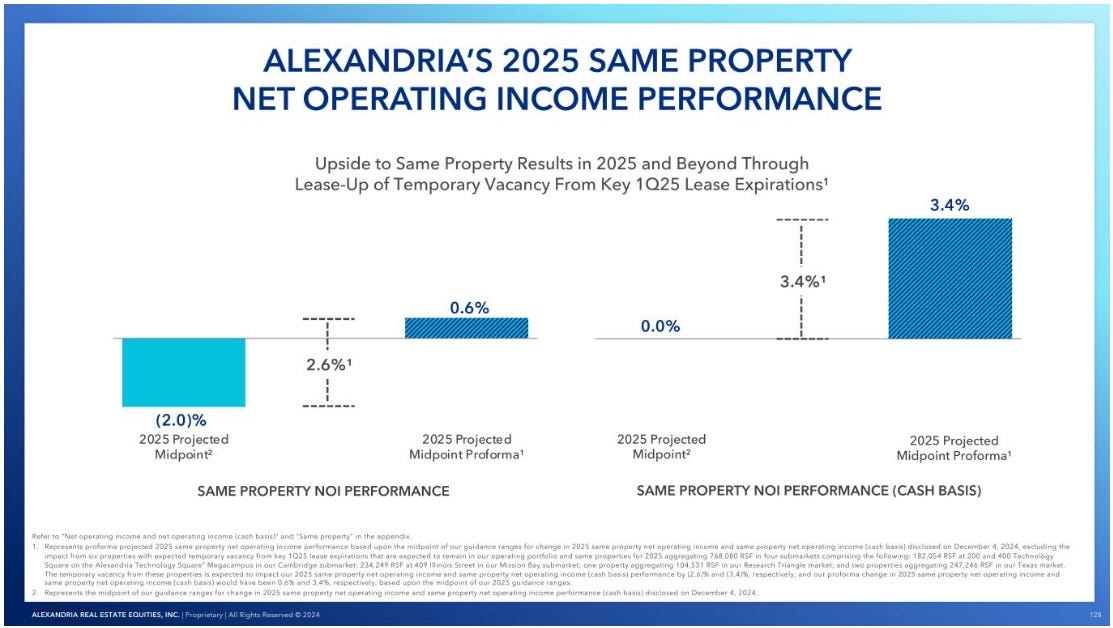

He also overstates the impact by showing only the left, GAAP-based (i.e., fantasy) half of this graphic:

It is the right, cash-based part that actually matters.

Similarly, he focuses on the projected 2025 dispositions at a high cap rate ($1550M at low to mid 7s cap rate, reducing NOI by about $110M). If that $1550M is reinvested at a 6% yield (low for ARE), the net loss will be $20M, or 1.3% of 2023 cash NOI.

Beyond that, ARE is delivering $160M of new, preleased NOI in 2025, though a lot of the benefit may come in 2026. So at worse those difficult dispositions will slow NOI/sh growth a bit.

Now that disposition cap rate is definitely a buyer’s-market number. But going that direction is better than issuing more common stock, now paying a 5.5% dividend. And they need capital to support the in-progress development pipeline.

[An aside here: a lot of financial types write (and apparently think) as though any business change can be made instantly at no cost, and that any decision should be based strictly on short-term finanical analysis. What happens when those guys get control of an actual business? See Boeing.]

So here again, a focus on those dispositions may help agitate the market. Go TV! Help me buy more ARE cheaper.

New Supply from Conversions?

The part of the piece that has more potential substance is the claim that conversions of existing office space to lab space will have a major impact on supply. Here is some perspective.

I did not find the story that such supply would have a major impact credible. This quote from the article would have anybody with real-world experience of projects falling off their chair laughing: "We proved to them through a study that a standard office building could house a lab."

It is iron-clad guaranteed that the actual cost will be far in excess of whatever estimate was in the study. But the client was the University of Toronto, seeking to add lab space within a deeply urban environment and not very sensitive to cost.

This is supposed to represent the destruction of Alexandria’s moat? Give me a break

The potential wave of such supply is implied to be about 60 projects. At Alexandria’s average 100k of rentable square feet (RSF) per building, this would be 6M RSF. The projects will typically be much smaller, too.

We have about 400M RSF of life-science space in the US and have been adding 20M per year recently. Spread that 6M (and likely much less) over a few years and it becomes a very small impact.

The article provides a reference allegedly showing how innovative minds are improving conversions. What it showed me is that large numbers of buildings do not qualify and that for those that do one can see costs and costs and costs.

Such conversions will only make sense for some buildings and often in special circumstances. There was some good discussion of this aspect in a 2019 earnings call by Boston Properties (BXP).

One more item: The linked CoStar article tells a story that turns my stomach. Rather than manage to install a long chimney stack to vent fume hood, the solution was “to install ductless fume hoods with filters that remove impurities.”

So now one is going to depend, for the safety of one’s people and the purity of one’s processes, on lots of filters that must be regularly changed by humans? As an operations type this horrifies me. As a COO, I would never sign up for it.

Bottom Line

I find lots of drama but little substance in the arguments in this piece. But perhaps they will help the market get more bearish.

I’m no blind fan of ARE, as my recent articles on them showed. But they are the SPG of the present period. I made a ton of money on SPG and expect to do the same on ARE.

I’d love to buy more tranches of ARE at ever-lower prices.

Please click that ♡ button. And please subscribe and share. Thanks!

Happy New Year to you and yours Paul. Wishing you good health, happiness, love, and an abundance of spectacular Red Wine. 2024 was quite a year for our Wolverines!! Go Blue. I am happily adding ARE here, and I will add more if it goes lower. Soon to be my largest REIT holding.

Completely off topic but Bill Ackman just tweeted that Fannie Mae and Freddie Mac are major opportunities due to Trump administration likely "removing them from conservatorship" in the next two years.

I've no idea what that actually means. But it is very unlike Bill Ackman to make any of his stock picks public (or at least that's what he said in his tweet). Any thoughts? His reasoning is long and detailed, too much to copy and paste, but hopefully this link will work:

https://x.com/BillAckman/status/1873818034428694837