Sometimes figuring out the meaning of financial results reported by a REIT feels like playing a game of hide the pea. It’s under one of those shells but which one?

The REITs almost all do some level of what I describe as “SEC-compliant cheating.” They present their results in a way that in my opinion is misleadingly positive.

In my article last week, REITs: Structure of Growth, I detailed the logical steps starting with Net Operating Income (NOI) and ending with Funds Available for Distribution (FAD) and a stock price.

On the whole Alexandria Real Estate (ARE) has really good disclosures. But.

In their new Quarterly Supplemental, they show (i.e. brag about) the growth of per share Funds From Operations (FFO) and dividends. They show a version of FFO/sh that is sensibly diluted and adjusted to correct for some distortions introduced by GAAP.

They also note their (low by implication) dividend payout ratio of 54% and high level of cash retained after dividends. One imagines that Alexandria wants you to think that their dividend is extremely secure. And there is no doubt that multitudes of silly authors will make that point for them.

My issue is that the adjusted FFO/sh does not include certain actual costs. The easy one is maintenance capex, which one finds in a typical place. On a TTM basis, it has run about 6% of the adjusted FFO. That is probably low on average but is not our focus today.

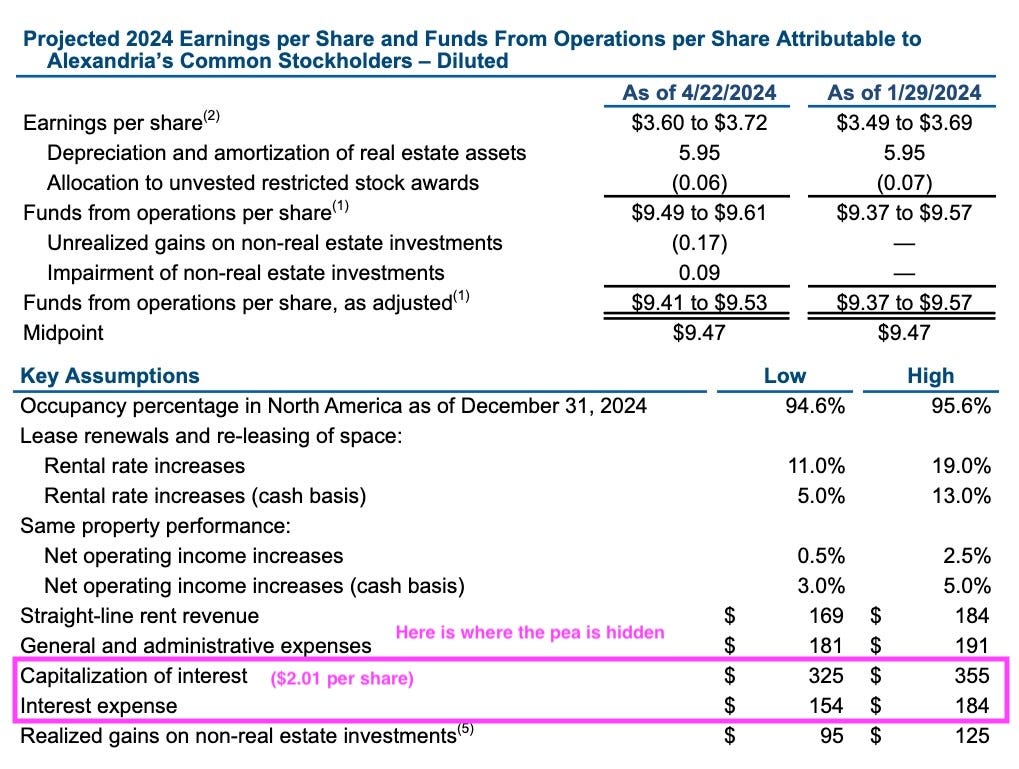

But there are other peas and thanks to recent experience I knew where to look. from the Supplemental:

What you can see is total interest expenses of about $500M. But only $160M will show up on the income statement. About two-thirds of their interest costs end up folded into numbers describing changes in capital.

That’s about two bucks a share. And the usual maintenance capex kicks in another 60 cents. So Cash (or Funds) Available for Distribution is actually near $6.90 and the payout ratio is not 54% but rather 74%.

Now a payout ratio of 74% of FAD is not bad. But it is also only a bit better than the typical value for quality REITs, near 80%.

In my February article about Alexandria, on Seeking Alpha, my conclusion was that they are ordinary after all. We’ve just seen one aspect of that.

Thanks Paul, excellent.

This does not break the thesis, right?

You are simply pointing out that they (and many authors) talk better of them than what they really are.

On another, but similar, topic: do you keep stock based compensation in mind? To my understanding, it is not mandatory to deduct this from the Free Cash Flow calculation, but if one does, it can paint a very different picture of available Free Cash Flow. Many super investors have complained about this in the past and that this should be ammended by GAAP accounting standards.

Curious to thear your thoughts