What I missed about Orion Properties (ONL) and a new look forward.

Orion just reported year-end 2024 earnings. These were not surprising, as they have laid out their path quite clearly.

They also cut the dividend 80%, which I had not expected when I looked at them closely and bought a small holding last fall. But it was an upside position, not mainly an income one, so the cut would not matter, especially if it let the upside come sooner or made it more secure.

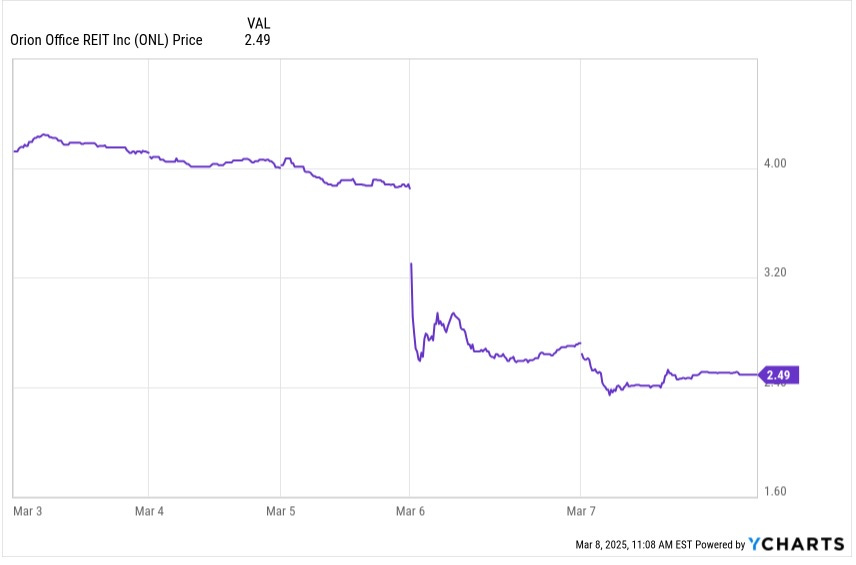

The market, however, did not like this at all:

Such dividend cuts produce a turnover in the investors, as income investors leave and deep value investors come in. The stock-price is often suppressed for a time. Let’s take a look at what this firm might be worth, when things settle down.

History and Narratives

Orion began operations in late 2021 with properties spun off from Realty Income (O) soon following their merger with VEREIT. The Orion management team has much overlap with that from VEREIT.

The initial narrative was grim. Orion owned suburban, single-tenant office properties with short lease terms. These are a difficult asset class, because of the high costs of retenanting. But with the rise of Work From Home during the pandemic, their properties were considered substantially worthless by many.

A decline into bankruptcy was widely expected. We had seen this movie before in retail, with Spirit Master Trust and it seems further along today with Office Properties Income Trust (OPI).

This perspective was my mental baseline, which is why I got the story wrong. I was too influenced by the narrative that the initial set of properties were all doomed. It seemed they might be able to build a much smaller, new portfolio with the proceeds of selling off their initial one. This was the initial basis of my quantitative thinking.

But Orion management never bought that narrative. They have worked hard at re-leasing.

Over time their narrative became one of transforming into a REIT focused on what they now call Dedicated Use Assets, such as medical, lab, R&D, flex and non-CBD government. The idea is that these “properties where our tenants conduct business that cannot be replicated from home or other generic office locations will have higher usage, stronger rents and higher likelihood of lease renewal thus stabilizing cash flows and increasing our growth profile.”

At present such assets make up 32% of their portfolio. My take is that this approach has a good chance to become a viable path for this REIT, if they manage the tranformation without ending up bankrupt.

What is the Path?

There was and is still a question of how Orion gets to that new portfolio. Limiting cases: 1) Sell off all of the initial properties as leases expire and use the proceeds to purchase the new portfolio, and 2) Retenant all the properties whose leases expire, with an emphasis on the new desired types. Here is relevant history on this:

For 2022, the year-end vacancies are shown. After that the red bars show the annual increase. Orion began life with 10 vacant properties. By the end of 2022 they were down to a net of 5.

At the end of 2022, Orion had roughly equal amounts of disposed property, re-leased property, and still-vacant property. Then in 2023 it looked like they were running close to case 1, selling all they could.

But this flipped in 2024 when they re-leased far more than they sold. And they now describe the re-leasing pipeline a quite full and active.

Overall, case 2 above looks more likely to me now. As we will see below, this change has financial consequences.

Meanwhile vacancies have kept increasing, though at a slower rate. It takes time to re-lease and then re-occupy vacant properties.

As of last December 31, they have three properties that have been vacant at least since 2022 and three more that went vacant during 2023 and are still vacant. From the end 2022 through 2024 they have shed 11 properties but are still at 10 vacant ones, with 4 leases set to expire in 2025.

[These numbers ignore the long story, not worth retelling, of a group of six outdated properties once occupied by Walgreens. These properties, accounting for 574 ksf, are now slated for demolition.]

Overall to date and in round numbers, they have re-leased about 2 Msf, have sold about 2 Msf, have 2 Msf vacant, and are demolishing 0.5 Msf. Something will happen with the vacant ones; it remains to be seen what.

That releasing has also extended their lease terms. Quoting the recent earnings call: “We exited 2024 with a portfolio weighted average lease term or WALT that now stands at 5.2 years, up from 4 years at the same time last year, which reflects our stabilizing portfolio.”

Out of that initial 10.5 Msf, only about 4 Msf remain to go through a first lease expiration.

The Retenanting Cycle

Case 1 above is easy to think about financially. You get some proceeds; these have been averaging more than $30/sf. Then you use them to buy properties. Easy.

Re-leasing, especially in renters’ markets, is more costly and complex. One has tenant improvements and related costs, amounting more or less to a year’s rent. These take a year typically, during which you get no rent. Then the lease has another year of free rent on the front end.

So you are out the capital cost of the improvements while also losing two years worth of rent. Ouch.

Consider a simple case where you release 20% of your properties every year for 5 years, at 90% of the prior rent. Here is how that plays out:

The total rent drops more than 40% before later recovering to 90% of the original. But if you consider the costs, the rent less those retananting costs drops below 40% of the original value for several years.

Your problem is that you may not have the money to cover the shortfall. Cash from Operations (CfO) has run less than half of rents for Orion, so costs have been more than half.

However, there are other factors at play. You do get NOI from the re-leased properties, eventually. And you get proceeds from the properties you sell.

In the following, I share some modeling of the interplay to see where that leaves Orion.