Is this one worth an investment, or not?

My opinion was asked about one of the many Canadian REITs holding assets in the US, Slate Grocery REIT (SGR.UN on the TSX and SRRTF on the pink sheets in the US).

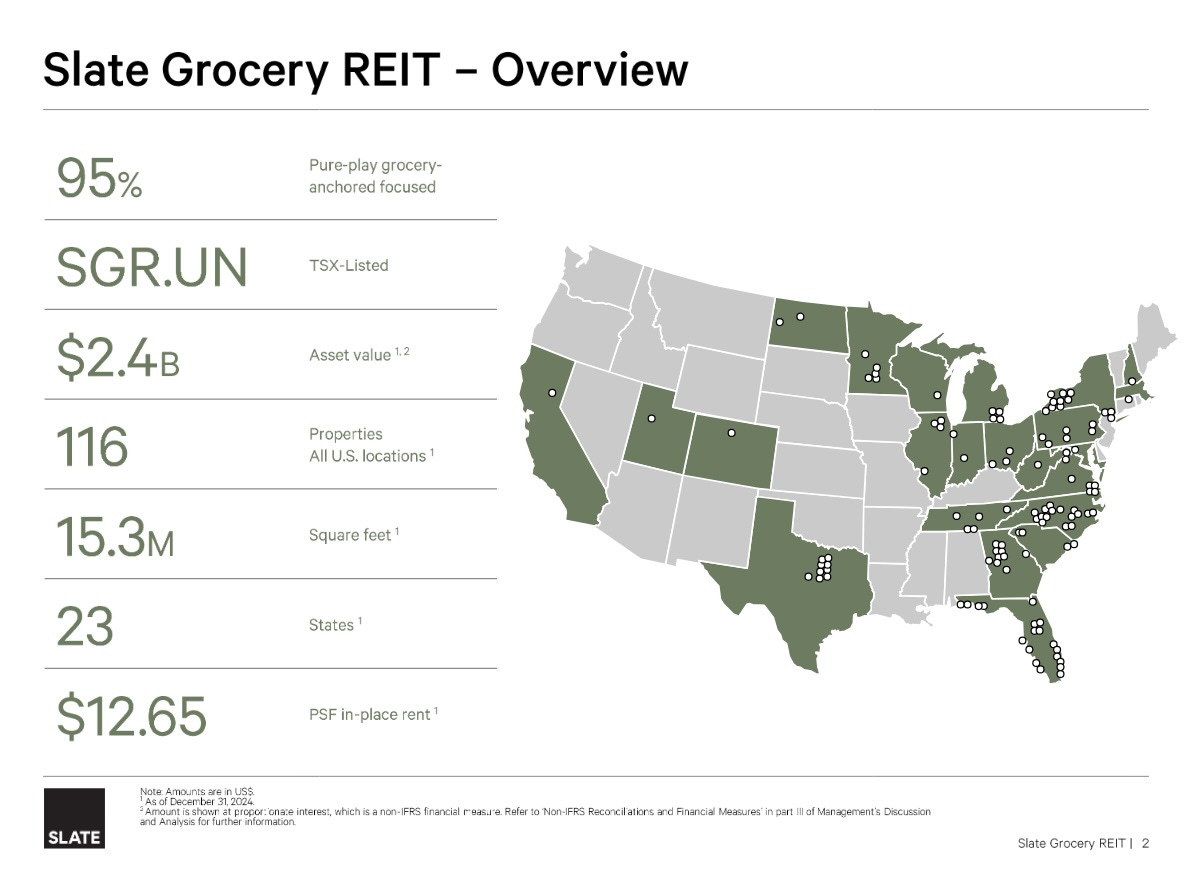

Here is the property map and their overview:

There are things that matter which this does not tell us:

What is their corporate structure?

What is the story on their debt? Most Canadian REITs don’t look good here.

What is their approach to growing income?

Corporate Structure

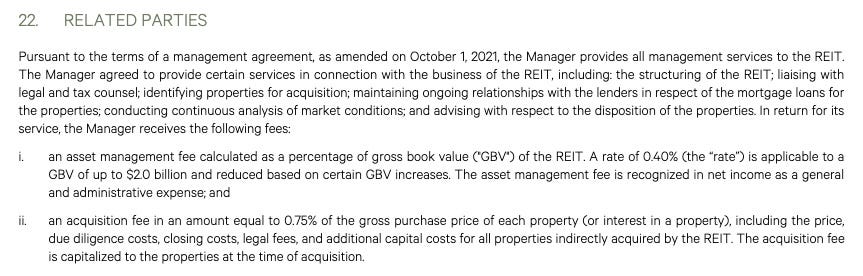

Slate turns out to be externally manged. And as is so often true, the manager is incentivized only to grow assets, not shareholder earnings. From the MD&A:

The management and public shareholders are fundamentally misaligned. Shareholders don’t always get burned by this, but often do.

It is true that management holds just over 5% of the float and brags about this meaning they are “in alignment”. We see this parlour trick a lot. But their fees are in the $10M ballpark while their dividends are more like $3M.

With external managers, it is often all about the fees. My policy is to never invest in an externally managed REIT, unless it is a small startup and I like the growth prospects.

But we can keep going, just to see how this plays out.

The Debt

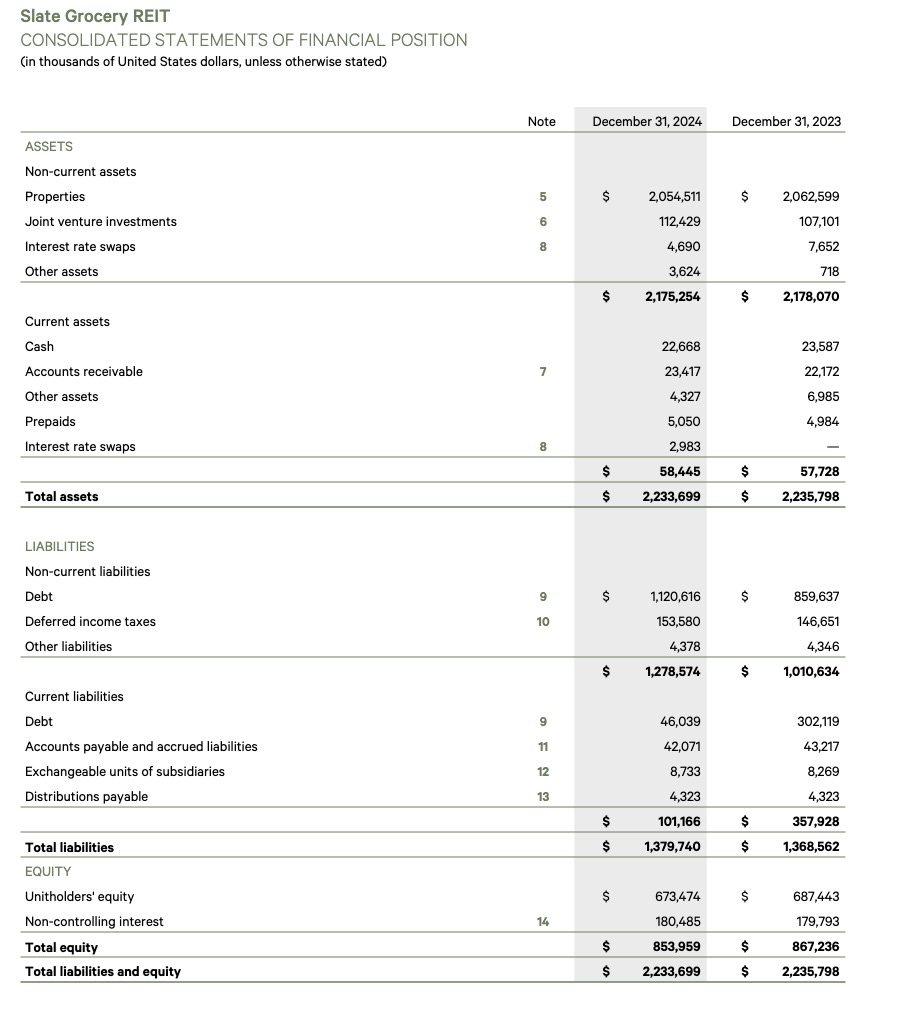

Next we take a trip to the balance sheet in the 2024 MD&A:

At face value, Debt is a bit more than half of Total Assets. We can remember that Canadian firms report under IFRS accounting and so that Total Assets is a made up number. It is supposed to represent an objective assessment of current market value, but can be and is fudged by various REITs.

Taking Total Assets at face value, the Debt Ratio is 50%. This is way too high for a public REIT, as it exposes them to big drops in Funds Available for Distribution if there are small drops in revenues.

We can keep going a bit, but I likely would stop here if checking things out just for myself.

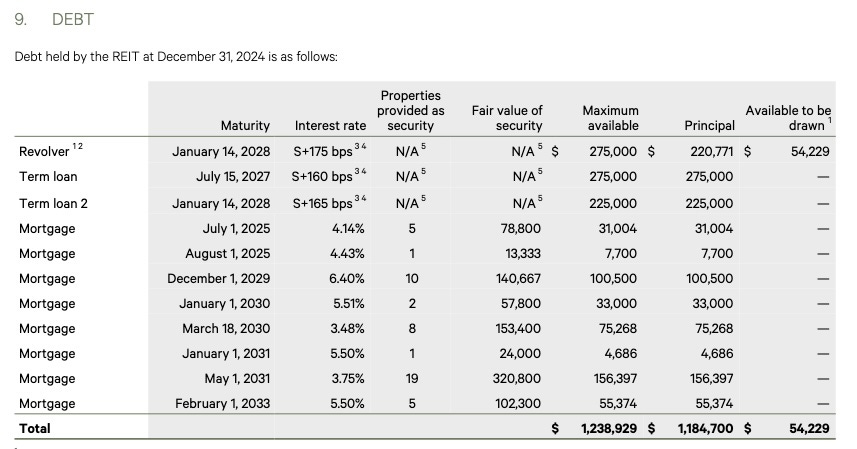

Next it is informative to look at the structure of the debt. Here also from the MD&A:

More than half their debt is in term loans and the revolver and matures within three years. They have paid for swaps to fix those interest rates, but still that debt has to be rolled.

It is bad form to carry a lot of debt on your revolver or term loans. This is how Macerich (MAC) got in trouble in 2020, and ended up substantially diluting shareholders. The had and have great properties, but total return over 10 years to today is -70% for MAC [vs +44% for Simon Property Group (SPG)].

Their near-term maturities, starting in 2027, are in the ballpark of $250M per year. That is more than 3x their $70M in Cash from Operations. The implication is that their very existence depends on the debt markets; they don’t have enough cash to do anything relevant. For reference, DIC Asset (now Branicks) was at about 4x in 2022, before they begain their 80% plunge.

My rule of thumb is that a good REIT has annual maturities near or below CfO. For comparison, Regency Centers (REG) has average annual debt maturities at about half of CfO. No wonder they carry multiple A-level credit ratings.

Business Model

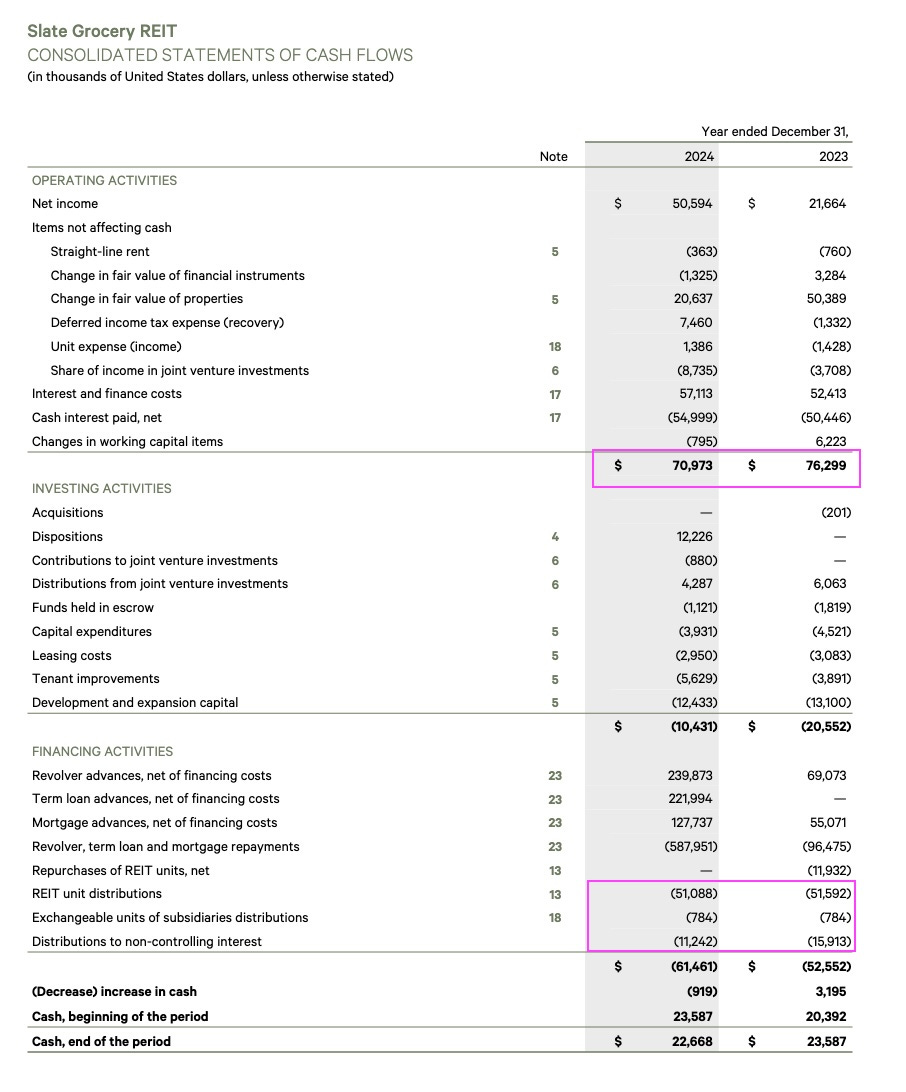

The questions are how they grow and can they grow? Look at the Statements of Cash Flows:

The boxes emphasize Cash from Operations — CfO — and the total distributions. Note that CfO is less interest costs here, as is standard in the US but often not in Canada.

Slate is paying out about 87% of CfO as distributions. And remember that CfO does not include recurring capex, which is near 15% of CfO here. Plus there is $12M of Development and Expansion Capital.

In short, Slate is paying out all or more than all of their Funds Available for Distribution — FAD — as dividends or other distributions. They are not issuing stock and are doing negligible capital recycling via dispositions. Without deeper analysis, it appears that their development capex is being funded by debt.

Looking through their investor presentation, Slate’s only argument for earnings growth is that their rents are substantially below market and so they will increase earnings through renewals as old leases expire.

There is zero information about the markets where their centers are, and in particular about neighborhood income and education. Providing this is standard in this sector, yet they do not.

Slate does not have the money to support serious redevelopment spending, let alone do new developments. But these are the paths by which the top Grocery REITs generally grow their earnings.

However, Slate management has no incentive to be concerned about that.

Now if you own this one will your nice fat dividends keep flowing? They might, so long as the US economy keeps clicking along.

But the dividend here is not protected. Invest at your own risk.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

Substack only lets me allow comments from all if the article is totally free. This one is. Comment away.

Check out the full range of material available to subscribers at

If a REIT is externally managed, I eliminate it eithout going further. But could there be circumstances when one could still add it (e.g., preferreds, unique focus/geographies/expertise, etc)?

Thanks RPD , avoided another one