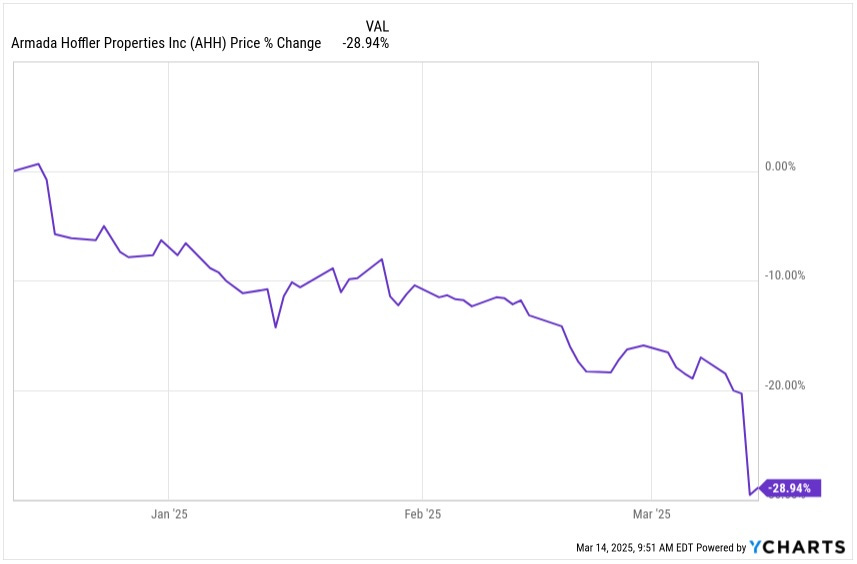

That is the question of the moment, after a long drop and then a plunge.

Diversified REIT Armada Hoffler (AHH) keeps making news, and not in a good way. My most recent coverage ended with this:

Their dividend remains at risk both relative to their debt and to the economy. … If you do own, this one must be watched and you still might take a loss. Pay special attention to the debt story as we get near and into 2026.

So now we’ve had a dividend cut and another 20% drop in stock price. Is it time to buy? Let’s see.

Their founding CEO just retired, after 40 years. He was an old private real-estate guy who converted the business to a REIT only a decade or so ago. But private real-estate guys do not fear debt the way public REITs must. More on that below.

Now new management is making new decisions. Last week they cut the dividend by 30%.

Backing up, in September Armada diluted shareholders by about 15%, as I covered here. The announced purpose was debt reduction, not growth. (My more thorough article from a year ago has more detail on the company.)

The debt reduction was badly needed, as Armada has long carried far too much leverage. On net, that share issuance was pretty much a wash for shareholders. The debt reduction sustained NAV/sh and the impact on cash flows per share was minimal. (NAV: Net Asset Value)

By their Q4 earnings release, covered here, they had also sold a couple retail properties, further reducing debt and also increasing their cash balance. But the ratio of Debt to Gross Assets was only reduced to about 50%, which is still too high if one aspires to an investment-grade credit rating from a major ratings agency. At that 50%, losses of income threaten dividends and growth (see below).

They also guided for an NFFO/sh of $1.05 at the midpoint, an 18% drop compared to 2024. Their NFFO/sh is close to Cash from Operations, obtained by taking the NAREIT FFO and removing non-cash items. (FFO: Funds From Operations; NFFO: Normalized FFO)

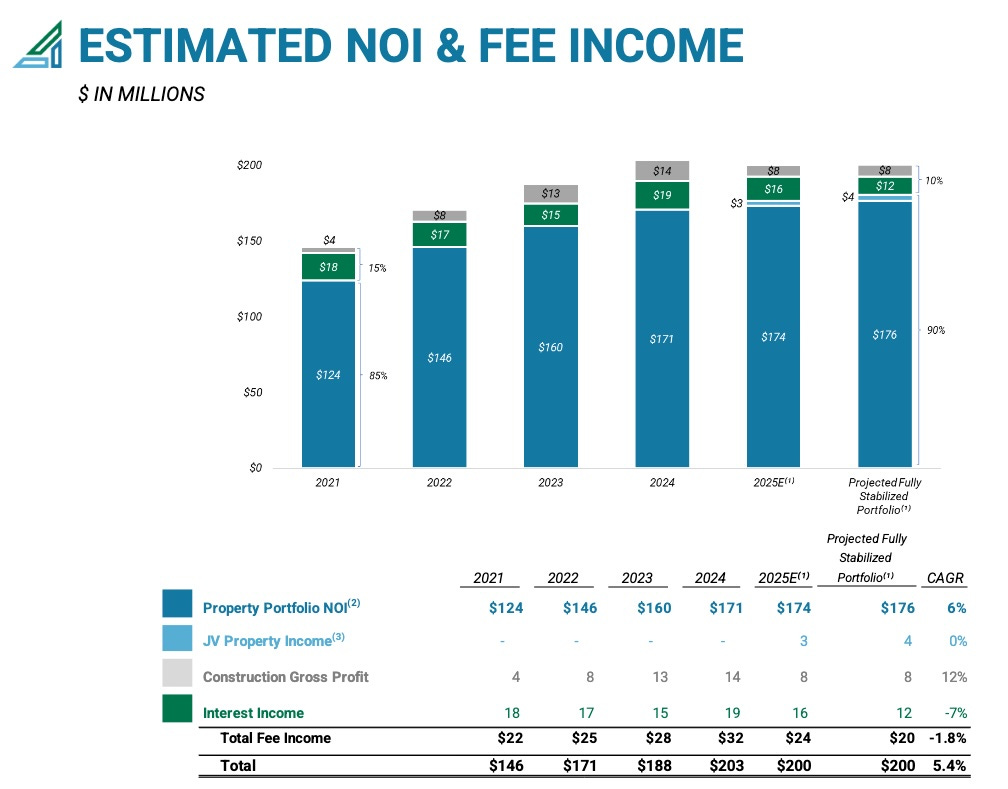

This plot from their Q4 presentation is relevant still:

Note that Net Operating Income or NOI from properties continues to increase, if very slowly. The fee income is what took a hit, thanks to reduced demand for construction (thanks in turn to interest rates).

In their announcement of the dividend cut, Armada notes that “The payout is now fully covered by property income without any consideration of fee income.” This is a good thing but not the only thing.

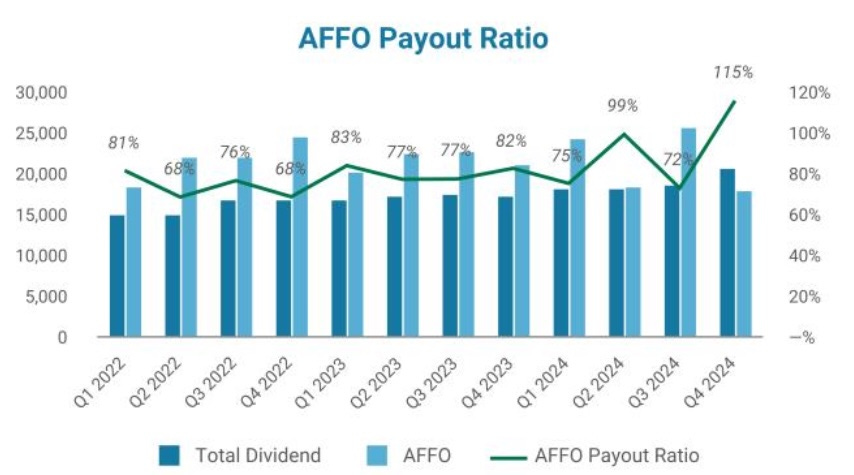

This next plot from that Q4 presentation is now out of date:

Their AFFO — Adjusted FFO — is calculated in typical ways. Over the past two years, it dropped from 81% to 73% of NFFO, reflecting increases in costs for tenant improvements and property-related capex.

In Q4 2024 AFFO did not cover the dividend payout. Based on the guided NFFO and assuming the ratio went back to 80%, AFFO would have barely covered the previous dividend for 2025.

But that is not the complete story, because some funds spent on interest expenses during construction are capitalized on the balance sheet yet are still paid out of cash on hand. In 2024 Armada accounted for $20M as capitalized interest, about 5x their historical average. This is associated with the Harbor Point projects that are nearing completion (and delayed).

That drops 2024 FAD/sh down to 62 cents, on which the new dividend would be a too-high 90% payout ratio. But that 2024 capex really is a one-time event.

Looking Ahead

If we drop that capitalized interest down to a more typical $4M in 2025 (and assume $25M of other capex on existing properties, down from $30M), then FAD/sh comes out at 74 cents. The payout ratio on the new dividend would be a solid 75%.

There are always frictional losses on the margins; Armada probably will be left with about $15M/yr for use to grow earnings or reduce debt. That is around 1% of the outstanding debt, so they can’t use it for meaningful debt reduction. But if invested at an 8% cap rate, those funds would increase the NOI by less than 100 bps and FAD by perhaps 150 bps.

This combined with rent increases is likely to produce growth at say 3%, less interest-rate headwinds and less any impacts if occupancy drops. And on top of that is the uncertainty from the fee-based NOI, projected to be 10% of the total.

But the main thing is this: At a Debt Ratio of 50% Armada is still severely exposed to decreases in revenue. Next I share how that would go. If you don’t like numbers skip to the italicized paragraph.

The income statement is superficially misleading because construction involves large revenues and nearly offsetting expenses. Restating the 2024 income statement without those elements shows that the property expenses for operating properties were about 33% of the revenues.

Holding the expenses fixed and dropping the revenues 10% decreases NOI by 15%. Interest expenses as a fraction of NOI increase to 41%.

Following through to CfO, it decreases by 28%. And using the forward assumptions described above, FAD drops by 41% to 40 cents a share, for which the new, reduced dividend would be a 140% payout ratio.

That’s a lot of numbers. Here is the bottom line: Thanks to their large debt, a 10% drop in property revenues would produce a 40% drop in cash earnings per share. This would push the payout ratio up to 140% and guarantee another dividend cut.

What REITs with such high debt did during the Great Recession was to substantially dilute shareholders (say 30% or 50%) and to cut the dividend by about the same fraction. To be clear, I am not predicting this. But it could happen and is why there is risk.

So what can they do?

Armada could embark on a 10-year plan to a better investment-grade rating, and perhaps they will. In that case, they would be back to being an income play, at whatever yield the market sets. And while their dividend-cut risk has been reduced, it still would be in no sense small.

Or they could sell property to deleverage. Today their interest expense is 44% of NOI. So sell 10% of Gross Property, reducing NOI by 10%, and use the proceeds to reduce the Debt by 20%.

NOI would drop but recurring costs would remain at about 20% of NOI while interest costs dropped. My estimate is that FAD/sh would drop about 6%, which would be partially offset by the growth discussed above.

My guess would be that this is the route Armada will take. But my guesses about such things are wrong a lot.

I thought the old Armada was stable (if foolish) so long as Lou Haddad was in control. There was risk, as discussed above, but it was clear.

For me today, there is a significant uncertainty what path they will take. I hope they are clear about it, once they know. The present uncertainty sensibly adds to the discount in the markets.

Pricing?

At today’s price of $7.70, AHH is at just under 10x of my projected 2025 FAD/sh. That is down from where it was. But in my view, there is still not a whole lot of upside from there to current fair value. If they are able to steadily grow FAD/sh at a few percent, then there will be small tens of percents of upside.

But if they manage to deleverage, one could see substantial upside like 30% or 50%. Comparing to other REITs, I have a hard time seeing this one as anywhere near a double. I have not yet sold my own tiny position, but that could happen soon.

So we are back again: an income play with potential, eventual, moderate upside. And repeating myself:

If you do own, this one must be watched and you still might take a loss. Pay special attention to the debt story as we get near and into 2026.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

Substack only lets me allow comments from all if the article is totally free. This one is. Comment away.

Check out the full range of material available to subscribers at

Paul, thanks for your take on AHH. Started buying after their secondary offering last year and have been adding since. Currently represents 1% holding, willing to go higher but would like to see some progress on their debt reduction and/or earnings improvement before getting much larger. I am hopeful that the recently completed projects (Harbor Point/T.Rowe Price) will start showing improvement in their NOI by Q1 or Q2. This is my first comment on Substack. I look forward to your future updates. Thanks again.

I thought there were some projects in the works and that 2025 was the bottom for revenues and in 2026 there is expected to be an increase. Is that the case? If so, what does 2026 start to look like?