Investing amidst chaos.

This week we had a huge windstorm. Of course, as it’s March. The photo above was the evening after, just peaceful.

The news flow, in contrast, has been a windstorm all year. Political developments, economic developments, and international developments all have been in turmoil.

A lot of that has been driven by the US president playing his version of “Let’s Make a Deal.” But just maybe we are seeing the beginning of a change in broad market leadership.

Despite the thousand or so articles I’ve seen telling me to buy the dip in Big Tech, the evidence is not persuasive. Here is some of it, from the past month:

This shows the equal-weight S&P 500 (RSP), down 2%, and the normal cap-weighted index (SPY), down 4%. YTD they have fallen about half that much. With SPY down more, the big techs have fallen further than the average market. Here are three of them, YTD:

What is notable is the volatility. Daily price moves in excess of 2% are not normal for this group. Will they proceed to fall a lot? Yes. When? Who knows?

In my own areas of real estate and energy, we are seeing strange things. REITs properly move in opposition to changes in ten-year Treasury rates, although usually to unreasonable excess. Lately we have seen some days when they move together.

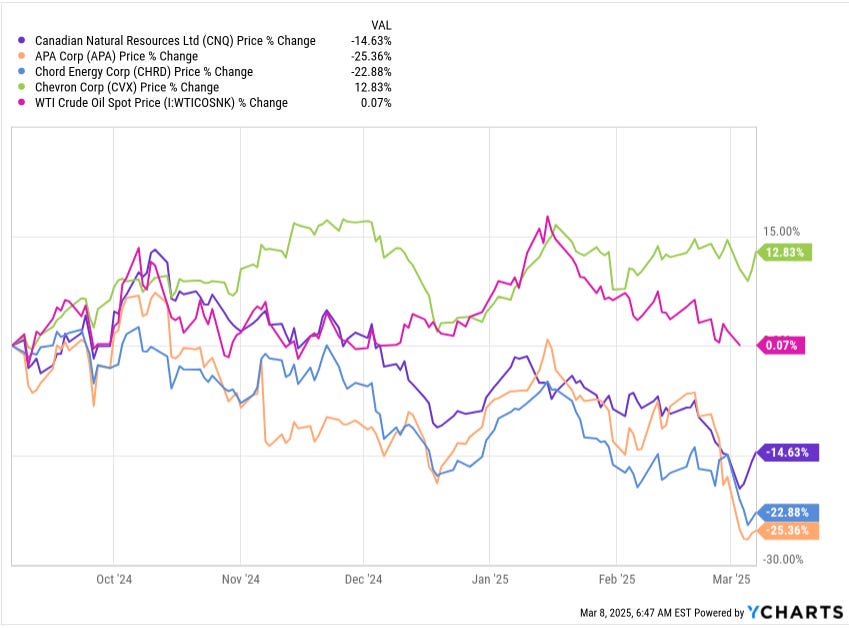

In energy, the oil price has been volatile as usual (magenta curve below). It is dropping lately, but over the past 6 months is flat. Of course, one finds plenty of people who know that the oil price will drop forever. Ha!

Meanwhile most oil production companies have plunged:

Sure, global supermajor Chevron is up some. But the bottom three curves show a genuine disconnect. They have fallen a lot, in seeming anticipation of an oil price crash that may or may not happen.

On top of that, Chord Energy (CHRD) and APA Corp (APA) have much higher cost of production than Canadian Natural (CNQ). The drop in CNQ makes no sense, unless you believe that President Trump will kill Canada, which misreads his playbook. Some friends and I have been adding.

Focused Investing News

Forthcoming:

It is tough to make progress on my portfolio redesign when annual 10-Ks are coming fast and furious, combined with some news that needs immediate attention. It will happen, to support holding more high-quality stocks with both income and upside. This element will be better aligned with the interests of many readers.

My article on Orion Properties (ONL) after their dividend cut will be out early next week. The following one will focus on Regency Centers (REG). The ONL news disrupted my attempt to get going on VICI Properties, while will come in due course. The main driver of what I work on for a while now will be when 10-Ks come out.

Personal News:

Here in Gaylord we did set the all time snowfall record. But now it is March weather, with highs (F) in the teens or 20s one day and the 40s or 50s the next. The accumulated snow is going.

In my monthly update last week I discussed Ukraine, which occupies my thoughts and emotions a lot. Lots of bad news there lately; my fingers are crossed.

Member News

Material since February 3 has included the following.

Items that went to all members:

Three of these perspectives articles.

My analysis of Plains All American.

Items that went to paid members, often including a free preview of much of the article:

My February Monthly Update

My analysis of Alexandria Real Estate.

A Brief Note after earnings on Armada Hoffler and one on Western Midstream.

My analysis of NNN REIT

Paid members have access to the Focused Investing chat.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

There are in addition a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger. You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!