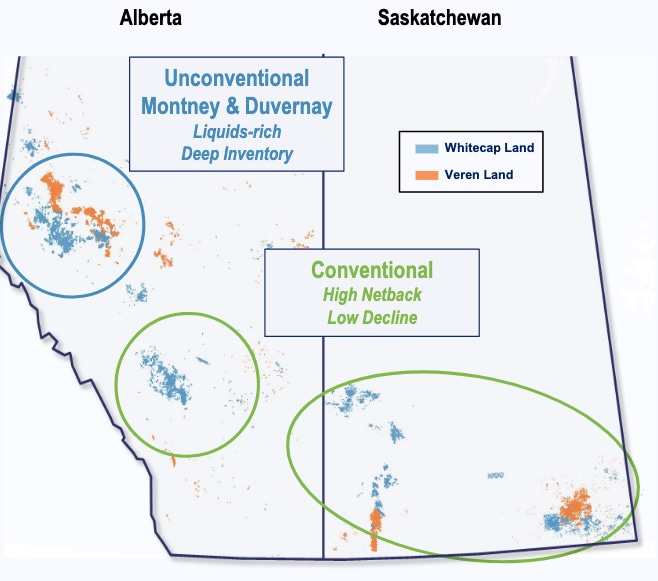

My take on the company formed by the merger of Whitecap and Veren.

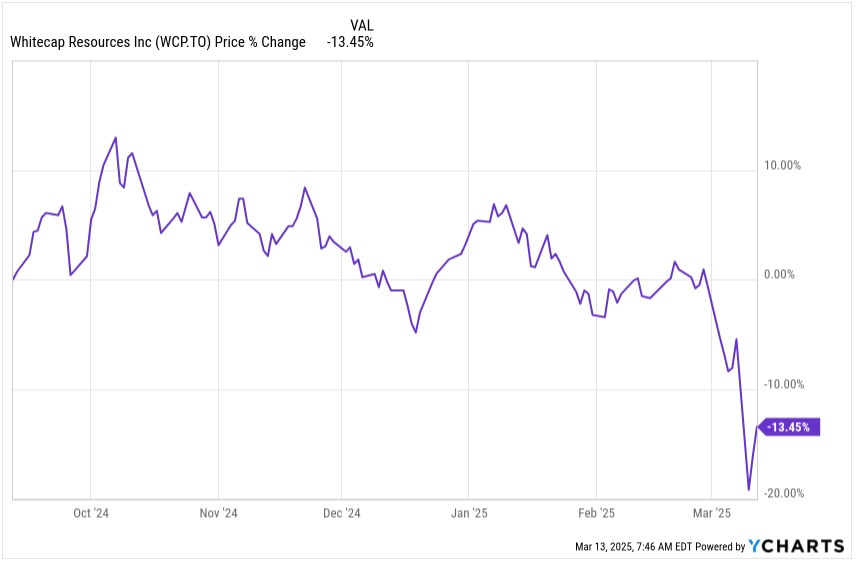

On Monday March 10, we got news of a merger of near-equals, between Whitecap Resources (WCP) and Veren Inc (VRN), both listed on the TSX. For WCP, the market hated it, dropping the price 20%.

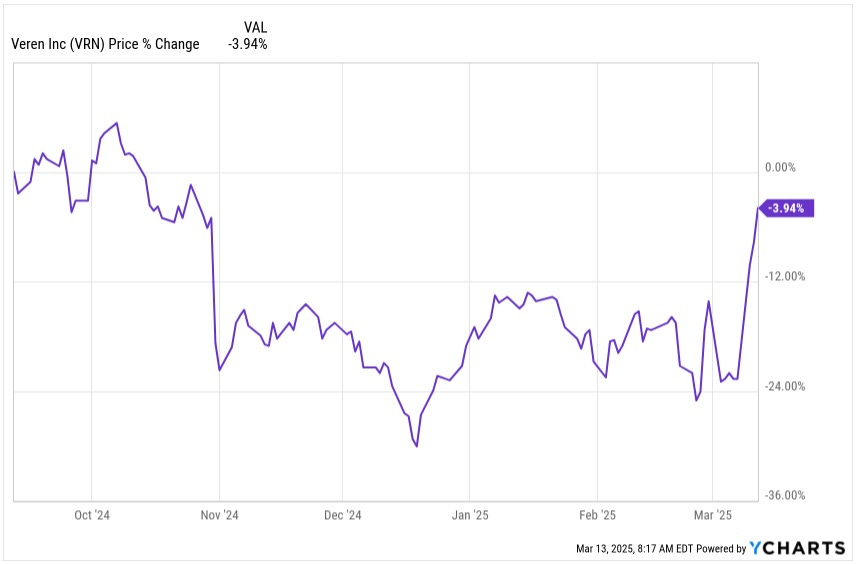

I might have bought the dip, but had no cash on hand at that moment. Since then, there has since been a significant recovery. Meanwhile, the market loved the merger for VRN, pushing it up 20%:

In effect, the market split the diiference at first, and has favored WCP since.

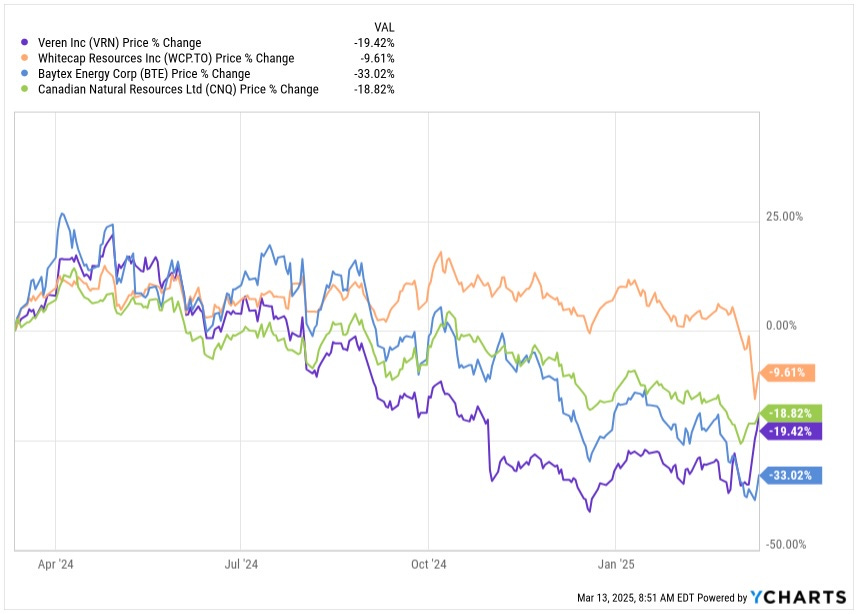

We will come back to these two firms. Before we do, though, some larger context and comparisons are worthwhile. Here are four relevant Canadian oil producers for a year ending just before the merger announcement:

Oil prices have dropped about 15% since last summer. But that is a small fluctuation for oil and on net oil has gone nowhere for two years. The market seems to have bought an oversupply narrative not reflected in the oil price, at least so far.

Canadian Natural Resources (my coverage here and here) is the big kahuna. From several perspectives they offer better value than the other three. Many of us, including me, have been buying the drop in CNQ across the past year.

I owned Baytex Energy (BTE) last year (coverage here). Baytex is a high-cost producer, with Free Cash Flow projecting to zero at an oil price near $60. No wonder their price is down a lot.

My exit from BTE last August was fortuitous and locked in some gains. For me, the cash was needed elsewhere and selling was not an investment decision. Sometimes you get lucky.

VRN dropped very strongly from last summer to January. They changed management in 2018 and have finished completely cleaning up their act.

I can find no reason in their news items or financials for the market to have punished VRN as much as it did. The story has seemed to be one of residual mistrust.

In contrast, why has the market appreciated Whitecap so much more than Canadian? It held WCP flat while dropping CNQ by 25%. Both firms have been doing fine. And Whitecap is the one with higher costs per barrel of oil (or of boe).

Now consider a full one-year chart through March 12:

Within the context discussed above, nothing stands out here. But the merger may improve the story for the new WCP. Let’s look.