My first take on the purchase of some Chevron assets by Canadian Natural Resources (CNQ) was that this is a small deal. But the impact turns out to be larger than it seemed.

All monetary quantities are in Canadian dollars, unless otherwise indicated.

The price per flowing barrel was US$72k, which is pricey but CNQ has a major focus on resources for the future. The total price was only $8.8B, about 8.3% of today’s Market Cap.

The impacts, though, are larger than that in some key ways. Here follows a summary, based on their presentation and conference call.

Overall, the added assets imply a 9.3% increase in 2025 liquids production (vs 2024 midpoint) to 92.5 kbbl/d. That is accretive for shareholders, but not by a huge amout.

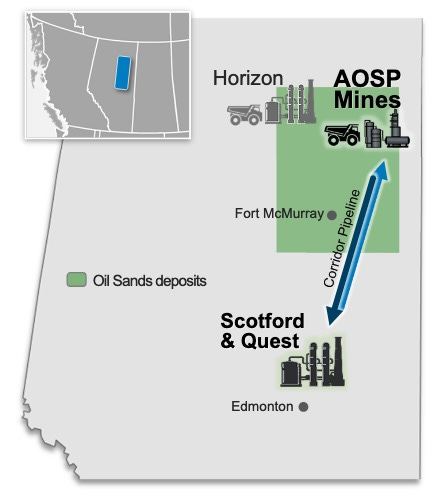

The total benefits will be larger. Let’s look at the two distinct assets involved and then the financials.