In my view the market is undervaluing APA Corporation (APA) and is likely to remediate that over the next few quarters. I recently added it to my portfolio.

This writeup shares my analysis. A key aspect is a recent, large merger. We will get there. But first…

APA is still usually referred to as Apache. Apache Corporation, founded in 1954, was absorbed in 2021 into the newly formed holding company, APA Corporation.

Why? Well perhaps they were hiding the non-PC name. [Aside: I would be pleased to see companies or sports teams named after my group. But alas, other than WASP, about all they could do is OWG (Old White Guy).]

APA has been an active acquirer. Their recent big acquisition just closed this year. It was of Callon Petroleum, a very longstanding operator in the Permian Basin.

The price tag was $4.5B. Not small for an acquiring company with a $10B market cap. More on Callon later.

Where and What

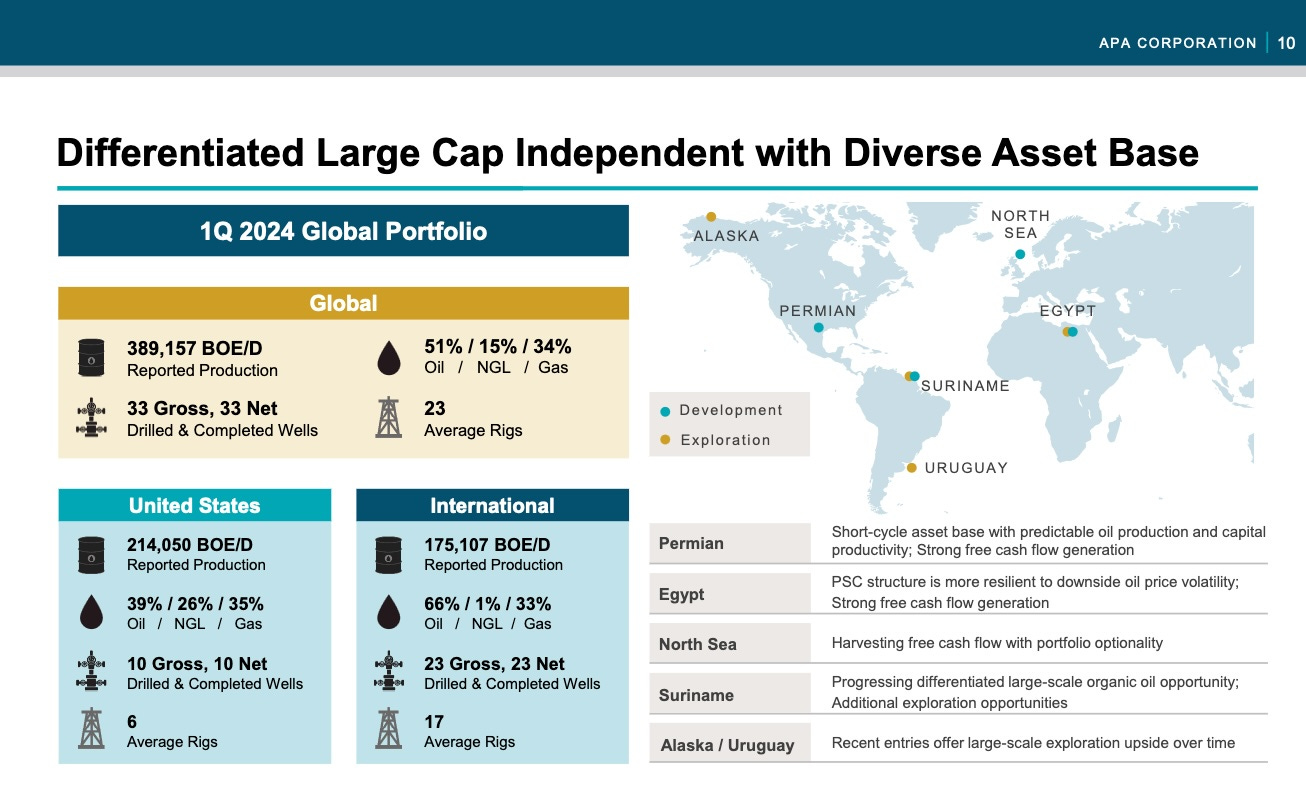

This slide shows the current scope of APA operations after the merger:

They describe themselves as a “large cap,” but in the energy business the really big firms are north of $100B. My description would be “mid cap”.

In 2023, the prices APA got for their products were $81/bbl for oil, $22/bbl for NGLs, and $2.9/Mcf of natural gas. The conversion is 6 Mcf to one BOE, so that is about $17/BOE for the gas.

The implication is that NGLs and natural gas are both small fractions of APA revenues. More than that, incremental changes in these have pretty much negligible impacts on revenues. This is why the discussion below will focus entirely on oil.

Brief comments on their regions of activity:

Permian: Post-Callon, their largest area of production and drilling. The Callon purchase increased their acreage in the Permian by 45%. Over time APA/Apache has sold off other US assets.

Egypt: Their second-largest area of production and drilling. They are a major player in the Western Desert there.

North Sea: APA is no longer drilling or exploring there. They have a portfolio of technically attractive drilling prospects that are not currently economic under the U.K. tax framework.

Offshore Suriname: They have identified 700 million barrels of recoverable oil on Block 58. Just on numbers that would support 200 Mbbl/d for nearly 10 years. They are looking toward a 2024 Final Investment Decision to drill.

Alaska & Uruguay: Areas of exploratory drilling. The hope is to get useful future production there.

Overall, proved reserves, before the Callon merger, had dropped 10% in the US and 15% overall in recent years. They were at less than 7 years of production, but had grown in 2023 by 95% of production, and mostly in the Permian.