No, Canada.

Perspectives This Week

Investing was again boring so let’s turn first to the wider world.

I give few recommendations but do recommend The Free Press on Substack. Nellie Bowles has a Friday column, TGIF, that alternately has me in stitches and tears. And horrified as it comes to light just how illiberal the Biden administration was.

One expects the right to try to establish a state religion. It has surprised to me to learn how much the left did so for a religion of woke identity politics.

Stephen Coonts wrote a lot of wonderful thrillers, and his right-wing politics became central and distracting only in later books. But when he published a novel featuring the forced suppression of the right by a thinly disguised Obama administration he lost me.

I thought such behavior much more likely from a Trump administration, since Trump has such strong authoritarian attributes. Yet this time around Trump seems a defender of free speech and it has become clear that Biden’s administration was not.

The lesson may not be to trust any politician and to expect that all presidents will seek to subvert the constitution. Guess that is not news.

As to the markets, earnings in my sectors are coming in strongly as expected. And mostly the markets are shrugging. Patience, grasshopper.

Canadian REITs

One of my subscribers wondered why I am not invested in any Canadian REITs. They often look good, in terms of raw parameters. (The following comments may not apply to all such REITs.)

Debt

This issue is my number one complaint with the Canadians. The US REITs went through a lot of dividend cuts and dilutive stock issuance across the Great Recession and the Canadians are very often set up to repeat that history.

The debt of US REITs has transformed since 2005. Unsecured debt was comparable to secured debt in 2005, and now is 5x as large. This gives much more flexibility to address problematic properties. You don’t get caught having to sell in a bad market, with the attendant hit to Net Operating Income (NOI).

You also can seek longer weighted average debt maturities with unsecured debt. NNN REIT (NNN) in the US is above 12 years, more than twice what Canadian Net (TSX:CNET) has. This again gives you more flexibility with your capital management.

There is also often a significant difference in the structure of the debt. Here is RioCan (TSX: REI.UN):

As of last Sept. 30, there was significant debt due in 2025. Federal Realty (FRT), in contrast, had nothing significant due for another year. This better insulated them from credit market crises.

In sum, the debt management of the Canadians often look to me like US REITs did in 2005. We know how that turned out. Canada is not inherently immune from financial crises or deep recessions.

Debt Ratios

One way the Canadian REITs promote themselves is to advertise their Debt Ratios, which often look near those of US blue-chip REITs. The Debt Ratio is the ratio of Net Debt to Total Gross Assets. But there is a fruit problem here, as in apples vs oranges.

In the US, under GAAP accounting, Gross Assets is based on purchase price. Now there are reasons why that can become a poor measure over time, but the impact is reduced by growth.

In Canada, under IFRS accounting, Gross Assets are based on an assessed cap rate, which clearly can be gamed. The result, after subtracting debt, is a Net Asset Value (NAV) that they report. I’ve written before about why NAV is a very uncertain number.

Debt to EBITDA

Things get even more confusing when you look at Net Debt/EBITDA. US blue-chip REITs run a ratio of 4x to 5x. Federal Realty (FRT) is higher at 5.8x. In contrast, Riocan is pushing 9x and the Canadians generally have larger numbers.

It seems odd that the Debt Ratio can be the same while Net Debt/EBITDA differs by 50%. Well, if you divide the first by the second, you have EBITDA/Total Assets. Then if you multiply by about 1.1, you have a cap rate.

The result: the implied operating cap rates are 50% to 100% larger for the American REITs. The ballpark values are 7.5% to 10% vs 5%.

On the one hand, the longer one owns properties in the US and increases the NOI from them, the smaller Net Debt/EBITDA will become. On the other hand, if Canadian property values are inflated by choice of cap rates, then Net Debt/EBITDA will increase from that effect.

In addition, if one bought a lot of properties during 2021 and much of 2022, one overpaid compared to present values. The Debt Ratio at purchase will have been smaller than it would be now for cap rates that reflect current market prices.

So do the Canadians just have more recently purchased properties, or are they cheating on NAV? Likely some of each.

Truth in Cash Flows

Amidst all the misleading accounting, the place to look for something close to truth is cash flows. Let me show you two things I look at.

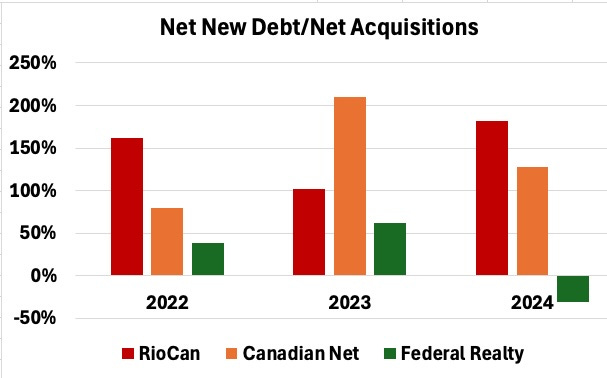

First is the ratio of incremental debt to net acquisitions. This is the Debt Ratio on new purchases. It directly impacts rate of NOI growth and will reflect the overall Debt Ratio for a stable company. Compare RioCan and CNET with FRT:

You see that FRT has averaged near 40% over the past three years, consistent with their overall average. In contrast, the two Canadians are above 100%. On net, they are adding properties by driving up debt, increasing risk. No thanks.

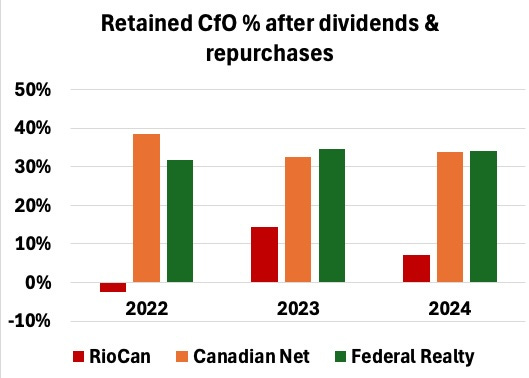

The other comparison tells you if a REIT can grow modestly by reinvesting retained cash (although recurring capex also has to be paid for). If you can’t do that, then growth depends on favorable stock markets or disposition cap rates.

RioCan is pretty much stuck by this measure, while CNET and FRT can both grow.

On rare occasions, I’ve let myself be talked into looking at some small Canadian REIT in detail, as I did last year with BSR REIT. So far I’ve ended up disappointed and uninterested.

Focused Investing News

Forthcoming:

My workup on Alexandria Real Estate (ARE) will be out this coming week and the one on NNN REIT (NNN) should be the following week. The main driver of what I work on for a while now will be when 10-Ks come out.

Personal News:

What a winter! Staying cold and the snow engine stays on. At 16 feet to date, we are already well above the normal snowfall for the entire winter.

Member News

Material over the past month has included the following.

Items that went to all members:

Three of these perspectives articles.

A review of how my 2024 Go-Fishing Portfolio performed.

A brief rant on how foolish it is to base investments on stock charts.

A brief note considering actual upside for real estate investments.

An article discussing REIT pricing.

Items that went to paid members, often including a free preview of much of the article:

My January Monthly Update

My full 2025 Go-Fishing Portfolio article.

My analysis of Plains All American.

My analysis of Chord Energy. Check out the comments for a worthwhile discussion of valuing commodity companies.

My analysis of Permian Resources.

Paid members have access to the Focused Investing chat.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

There are in addition a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger. You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!

Hey Paul good to get your updates. I've been crushed with consulting work the last couple of weeks and have slacked off on published articles. I've been helping one company prepare a reservoir drill-in fluid-distinct from a top-hole drilling fluid, for Aker BP in Norway. One requires a fluidsdoc and the other not so much. If we are successful this company will have a new product line to offer incorporating a base fluid with a wide moat. Then with another client I was teaching a class of young Ph.D chemists the intricacies of reservoir drill-in fluid design. They told me after the first day I was making their heads hurt. That may be a good sign. Either way it looks like they will need a fluidsdoc for the forseeable future. For now its back to putting out writeups. Cheers bud!

Thanks Paul for scratching below the surface on Canadian REITs. Their low Debt/Assets ratios never made sense to me with such a high Debt/EBITDA ratios.

One question I have is about the point you made for them possibly inflating their cap rates to make their debt/asset ratios look lower. How do their reported cap rates compare to US peers? I assume there has to be a big gap in cap rates to have such a disparity between Debt/Asset vs Debt/EBITDA ratios. Do you see such gap?