So many investors dismiss a stock based on the past 5 or 10 years of price action. They are fools.

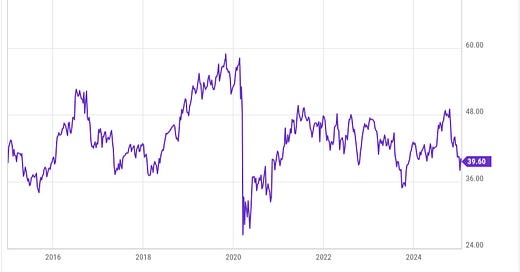

I made the mistake of making a comment on an article on Seeking Alpha, a province of many fools. My correspondent doubled down on the idea that NNN REIT (NNN) should be dismissed as an investment because of its poor price performance over the last 5 and 10 years. He was right that the price has gone nowhere since the start of 2015:

Now NNN does pay a significant dividend. But even on a total return basis, the CAGR for the past decade is below 4%.

If you think that the relevant story is in the price action, and that the future will resemble the past, then you will think that NNN is a poor investment today. But if you think the past is the future, then you are a fool.

NNN owns retail properties. If you have paid attention to retail, then you know that retail was challenged from 2017 through 2020. It would seem that this explains why the price was flat from 2015 through 2021.

But if you understand the NNN business model, then you know that they can grow cash earnings per share through a lot of challenges. The best easy way to look at this for REITs is to examine Cash from Operations or CfO per share. [FFO is not bad for NNN but there is a long story about why it is not reliable for REITs.]

NNN grew CfO/sh through the retail challenges of the late teens, validating the strength of their business model. The pandemic then disrupted the growth of CfO/sh, but nearly all the lost rent was paid back later. Overall, CfO/sh has grown at a CAGR of about 4% since the start of 2015:

So if the earnings multiple assigned by the market had been flat, then the price would be up 40% and total return would be in the high single digits. Economically, this is in the ballpark of what REITs should produce.

What has happened instead is that the ratio of Price to CfO/sh has dropped more than 30%.

This drop makes qualitative sense for the increase in cap rates (following interest rates). The current inability to grow well by issuing new stock is a minor contributing factor.

The conclusion is that NNN is priced at a low valuation. In a crash, it is unlikely to drop as much as more highly valued stocks. That is at least after the initial panic phase; one might get some great buying opportunities then.

I will argue in an article next week that NNN is probably undervalued but not by much. NNN is likely to produce a total return from here in the high single digits, if interest rates and cap rates stay where they are.

Perhaps more importantly, NNN is a good income investment. The yield today is nearly 6% and the business model will support dividend growth. Over the past decade it has grown about as much as CfO/sh, which is the expected outcome.

The chart is NOT the territory. Only by understanding the company and its segment can one know what the prospects are for investments in it.

In contrast to investing in NNN, one is dancing on the edge by investing in the broad market today.

The Equal-Weight S&P 500 (RSP), for comparison, is priced at about 20x EPS. This ratio has not dropped on net over 10 years, even as higher interest rates have reduced the value of future earnings. This does not make much sense.

I see this week’s Intelligent Investor column by Jason Zweig at the WSJ as relevant. He writes:

Whenever markets feel euphoric -- like, say, right now! -- I'm always haunted by a paragraph Goodman wrote in the late 1960s, during a mania that came to be known as "the great garbage market." Here it is, as published in his 1972 book Supermoney:

That’s the end of the rant. Have a great day and invest well!

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

Nicely reasoned.

Like JaxBill, I am satisfied with high single-digit returrns -- that- never or rarely look back.

not exactly on the thread RPD, but have you ever looked at CTRE CareTrust REIT in your travels?

best wishes

P