Reward and risk in Armada Hoffler.

Perspectives This Week

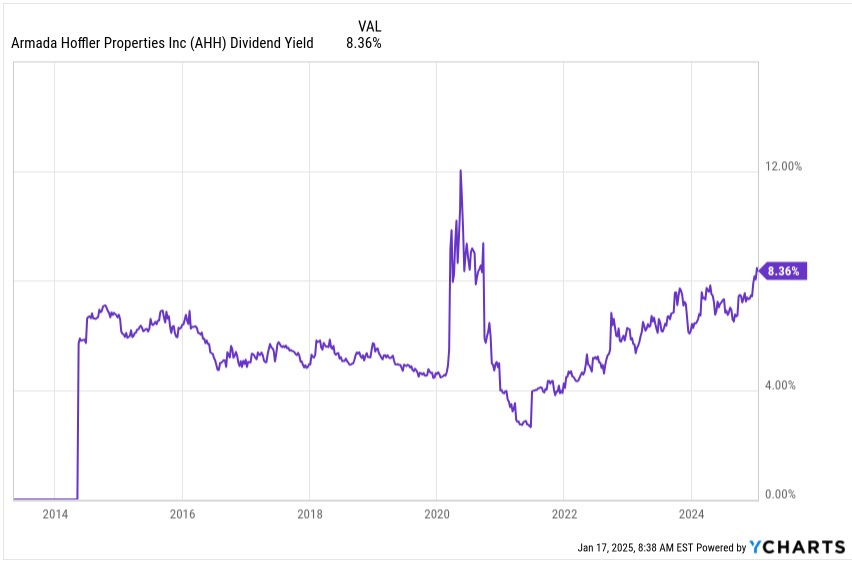

The stock price for Armada Hoffler (AHH) has been dropping rapidly lately. Their dividend yield is now above where it was at their REIT conversion and approaching pandemic levels:

This makes one wonder whether their business is in trouble but it is not (my most recent deep look is here).

Lots of investors are rushing to add to their holdings in response to this change in price. But the price action is not just a mindless market panic. Directionally it is the correct response to rising long interest rates.

But, you say, other REITs have not dropped nearly as much. That is true enough, but those REITs carry a lot less debt, relatively speaking.

The level of Debt to Gross Assets for AHH is near 60% and the payout ratio on actual cash earnings is quite high, well above 80%. This was also true of Camden Property Group (CPT) and many other REITs in 2006.

Across the Great Recession, many of those REITs not only cut their dividends by tens of percents but also diluted their shareholders by tens of percents. Globally, REIT prices and dividends recovered in a small number of years. Specific stories varied, of course.

CPT cut their dividends in 2009, and took until 2017 to exceed that level. But at the minimum they were only down 30%. Here is CPT total return from the peak in early 2007 to early 2020:

Total return dropped nearly 4x to the low during 2009 and got back to even only in 2012. From the early 2007 peak to early 2020 you got an 8% total return. That is neither great nor terrible.

The point is that AHH could do something similar, whenever the next big recession hits. AHH may be a sensible investment for some investors, but they should not go in without some perspective.

[CPT did dramatically improve their leverage and payout ratios. In a repeat of the Great Recession, they would not have to cut dividends or dilute shareholders.]

Snippets:

US oil production:

This chart is one of the more remarkable in the oil space. The number of active drilling rigs (middle chart) has been slowly declining for several years. Meanwhile, production has increased significantly. Improvements in efficiency have been very powerful.

Fannie and Freddie:

The MSM clickmongers are having fun speculating about whether the Trump administration will privatize Fannie Mae and Freddie Mac, and how this might disrupt the foundations of the universe. This IS a long-time holy grail of the Republicans.

There is a decent article with good perspective in Barron’s this week. A key quote:

Whether Trump will pull the trigger is debatable. His Treasury Department is swamped with other priorities, such as extending the 2017 tax cuts and dealing with the ballooning federal debt. With mortgage rates near multidecade highs at around 7%, there’s little incentive to disrupt the status quo.

You need holy grails. If you reach this one, you will have to invent something else, and why bother?

Focused Investing News

Forthcoming:

Energy is the focus for me in January. Permian Resources (PR) will be out this week, I hope. After that midstream Plains All American (PAA). That may take an extra week. There were good reasons, not so long ago, to avoid PAA, but they weren’t things one sees easily in the financials. They seem to be better now, but you will get my independent assessment. We may have missed the train on PAA for near-term upside, but will see.

Personal News:

I’m still reveling in a real winter, finally. Looking forward to a couple low-single-digit (F) days this next week. Cold here translates to dollars for local business. And not only tourism. Logging in the Upper Peninsula waits for the swamps to freeze hard, as does drilling in much of the Montney.

On top of that, this weekend is the best this year for NFL Football. The quarter finals, nearly always delivering four excellent games. I’m excited.

Member News

Material this month has included the following.

Items that went to all members:

Two of these perspectives articles.

The review of my 2024 performance.

A review of how my 2024 Go-Fishing Portfolio performed.

Items that went to paid members, often including a free preview of much of the article:

My full 2025 Go-Fishing Portfolio article.

My analysis of Chord Energy. Check out the comments for a worthwhile discussion of valuing commodity companies.

One Trade Alert.

Paid members have access to the Focused Investing chat.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

There are also a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger. You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!

Looking forward to PR next week. Fear I may have missed this one but you never know.

What is PR doing next week? I don't see anything on their site and don't believe they report until next month