New year, same markets.

Perspectives This Week

Everybody I know, including me, is talking about how the Wednesday scheduling of Christmas and New Years messed up their placement in time. Is it Monday? Again? Or Sunday, twice this week? At least we got an extra couple of Fridays.

The markets have seemed confused too. The S&P 500 is roughly flat since December 20.

After reaching an all time high November 30, my own portfolio dropped 4% in December before coming back up a bit with rebounding Crude Oil prices.

But this is all still interregnum volatility. The inauguration is weeks away and it will be weeks after that before the markets get enduring clues about what will happen.

With the current steady, cold weather, I will soon see ice fishing huts out on that lake. Maybe I should join them, eh?

Here some snippets that piled up over the holiday

China

WSJ:

More than 10 years into the Xi Jinping era, it has become clear that much of China’s growth under his watch was driven by unsustainable borrowing, real estate speculation and investments in factories and infrastructure the country didn’t really need.

Xi is digging in. He’s convinced that his top-down approach to managing China’s economy, with plans to make it an even bigger industrial power, offers the best path for China to eventually surpass the U.S. in economic might.

As Xi consolidated power, he asserted personal control over managing the economy, which previously was overseen by China’s premier, and surrounded himself with loyalists who had limited experience in economic policymaking.

Xi is flat out wrong and this is shaping up into a multi-decade disaster. Or longer — in 1434, emperor Zhu Zhanji closed China off from the world for centuries. In any event, it will be a lot worse than one could have hoped.

LNG

The Christmas eve edition of the RBN blog highlighted a growing development among those who transport LNG from US terminals to other destinations. Some of those companies are actively buying natural gas production assets and transportation capacity to feed the gulf coast terminals where they have long-term offtake agreements. This not only firms up their costs, it also takes both supply and demand out of the gas market.

Office Real Estate

There is some action here. Globe St. reported that:

Norges Bank Investment Management has acquired … full ownership of the [eight] properties, which comprise collectively for about 3.66 million square feet. … “By taking full ownership of nearly 3.7 million square feet across Boston, San Francisco, and Washington, D.C., we're demonstrating our conviction that well-located, high-quality office buildings will continue to deliver long-term value,” said Norges Global Co-Head Unlisted Real Estate, Per Loken.

The largest difficulty in understanding the office is looking at average results. The property type is stratified. … Office investment can make sense if investors can identify the properties companies will want and get them at a reasonable price.

I’m really curious whether we will see some of those REITs get active in acquisitions. This is one place where there is a lot of potential for value creation.

Mortgage REITs

Articles on mortgage REITs lately have included one pumping AGNC Investment (AGNC) and Annaly Capital (NLY) for their high yields, well above 10%. They were pitched as good ways to get income.

In contrast, an article by SA analyst Trapping Value, showed how NLY works and how they can get in trouble. That one is worth reading if you have access to Seeking Alpha.

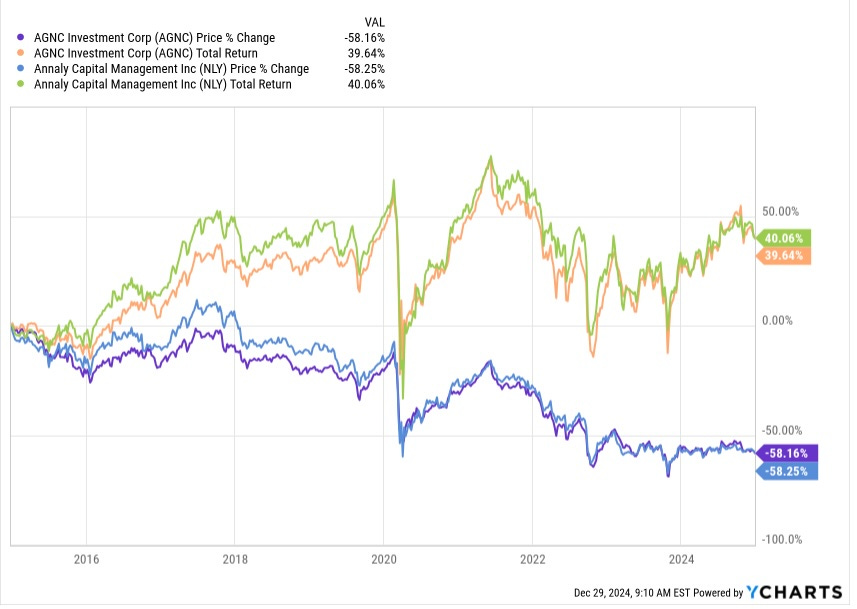

Meanwhile, check out the ten-year curves of price return and total return:

For the last seven years, the dividends paid to investors have only made up for their loss of capital. There is, in my view, zero point in investing in such a firm. You could do better by buying one-year bonds each year and paying yourself 15% of principal each year upon renewal.

These are excellent illustrations of the peril of focusing too much on yield or income as opposed to business models.

Focused Investing News

Forthcoming:

In order to publish my review of 2024 this past week, earlier than expected, I delayed the article introducing the 2025 Go-Fishing Portfolio. It will be out next week.

The next deep dive after that will be Chord Energy (CHRD), a position I recently increased but have not written on. Plus I’m chewing on a couple “philosophy” topics that may lead somewhere.

Personal News:

I had visitors over the holidays, and not only one of my daughters. One of my squirrels decided to chat with the reindeer over breakfast.

Being a huge fan of pro football, this is a fun time of year for me. We see how much it is a team game by who wins despite injuries and (in college) desertions. Go Lions!

Member News

Recent material since the last issue included the following.

Items that went to all members:

A Brief Note on some bearish arguments about Alexandria Real Estate (ARE).

My 2024 Portfolio review article.

Items that went to paid members, often including a free preview of much of the article:

A Trade Alert on some changes in energy investments.

Paid members have access to the Focused Investing chat.

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my live, real-time portfolio. If you are an annual paid member and do not have access, please contact me.

There are also a REIT assessment sheet and a Midstreams assessment sheet, each a tab. And if you scroll down on the portfolio tab, you can see some tickers I track and some playing with possible portfolios.

Also:

Paid members can also post items of interest on the Focused Investing chat, which I do often. Check it out and post your own items, please. Comments and questions are always welcome.

There is a search function on the Focused Investing home page, to help look for past articles.

It can be challenging to search the chat (for paid members only) on mobile devices. To do so, you have to get into the chat so my picture is on the top left, and then punch my nose with your finger. You will see a display with a search emoji.

Please click that ♡ button. And please subscribe and share. Thanks!

Hi Paul, Happy New Year! For your amusement, having taken a bunch of profits on some tech stocks like PLTR, PANW, MRVL, and AAPL, I decided (with my cowboy hat firmly on) to dip my toe into some CEFs and BDCs. My method was backwards--to try some that were recommended on SA and then learn more about them. You will agree with the part of my method, I think, in that they are so risky that I limited myself to between 1/2 and 1 percent of my portfolio...the total invested is perhaps 6% of my total. NLY I stayed away from, even I could see that was too risky. One I came across that actually seems decent is FDUS, with a decent dividend coverage and relatively low leverage. Some SA authors seem to think that earning 16% in dividends and having share value decline by 8%, annually, is a good way to proceed. For that net return, I can just buy more PFFA and RIET and enjoy 10% return without worrying too much (not go fishing, no). For comparison, the latter two mentioned are 14% of my personal portfolio, and most of my gains from the tech sales are in other techs or tamer income generators. I'll keep you posted on how the risky assets do. Overall, my portfolio is approximately 40% large cap tech, 40% income generation, and 20% non-tech/foreign.