Generic analysts, and some apparent REIT experts, often make blanket statements about REITs. Examples:

REITs must issue stock to grow

REITs must carry high leverage

REIT prices are vulnerable to the collapse of “real estate”

My examples today make the point that those “experts” do not know REITs and should be ignored.

REITs Are Diverse

Real properties play a role in many segments of the economy, from apartments to restaurants to factories. NAREIT groups (equity) REITs into 13 sectors, and divides some sectors into subsectors.

Broad recessions hurt earnings across and beyond real estate. At various times, specific economic sectors have severe problems. But those are localized.

We saw the value of warehouses collapse through the Great Recession but not across the pandemic. Office real estate has recently seen prices drop, though not as much on average as warehouses did.

Real estate as a whole does not collapse, though values in individual sectors or some geographic regions do. This is not so different from stocks more broadly.

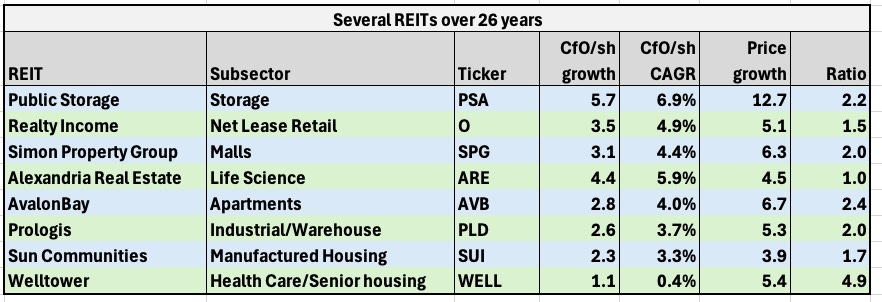

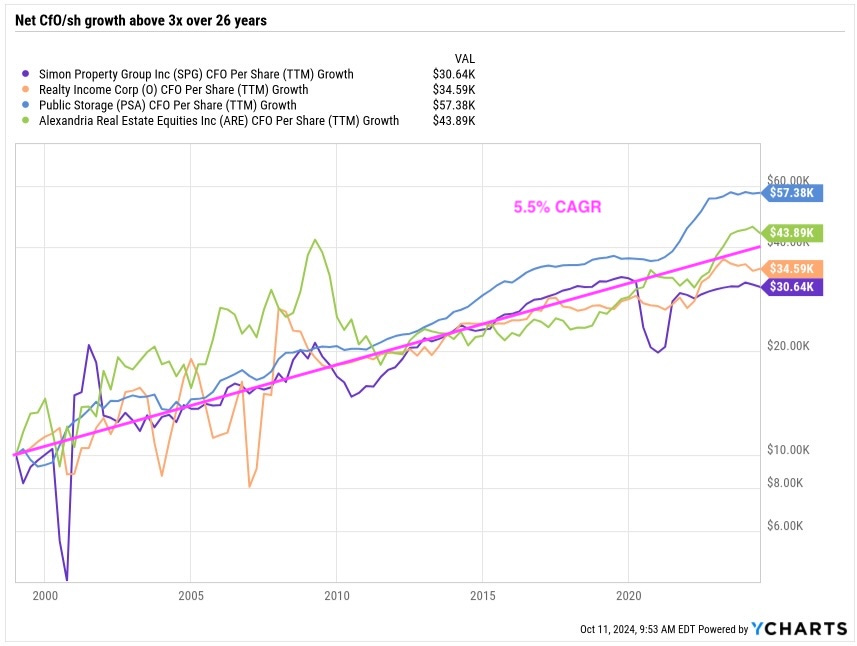

Let’s explore the variations through the lenses of price growth and earnings growth, the latter measured as Cash from Operations (CfO) per share. To do that we will look in more detail at 8 REITs selected to be high-quality representatives of their sectors or subsectors. Here is the list:

In order to have comprehensible plots, we will divide this group into higher and lower growers. The 26-year interval impacts some of the slower ones. A number of REITs, including AvalonBay (AVB) and Prologis (PLD), grew much faster after the GFC.

All eight had significant gains in stock price. This in part reflected declining interest rates and cap rates for much of this century. Here is the first of two charts showing the price action:

We can see that these four REITs certainly have not been in lock step. The market was negative on net lease in the years leading up to the GFC, negative on Malls after 2016, and negative on everything after 2021. Some comments —

Net lease generally, including Realty Income (O), had some years of flat growth of CfO/sh and price after 2005. I have not dug into why.

Alexandria Real Estate (ARE) had huge problems across the GFC. More recently they have suffered from fear of oversupply and work from home, despite the minimal relevance of the latter to the economic performance of their properties.

The price of Simon Property Group (SPG) suffered in the “retail apocalypse” after 2016, magnified substantially by some silly media narratives.

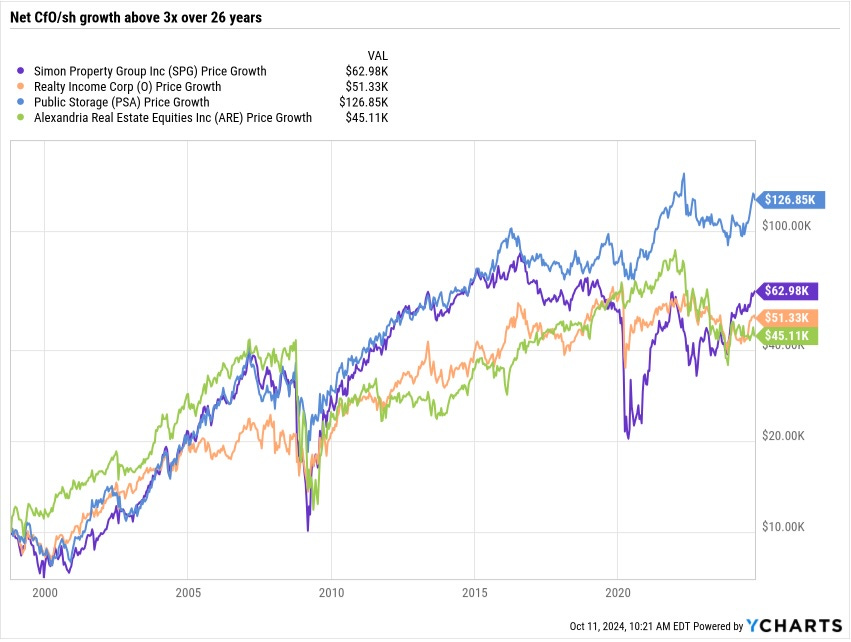

Now consider the four slower growers:

Here again they went their own ways—

Sun Communities (SUI) had financing difficulties (not their fault) in the years before the GFC and then a long climb back up. Again recently financing has become an issue (in part their fault). More below on them.

Prologis experienced the massive collapse of the industrial sector before and during the GFC. Their CfO/sh has only recently come back above its value in 2007, as you can see in the plot to come.

More on the other two below.

Overall, if you look where there were price corrections in the broad markets, any fluctuations there are no larger than all the other noise.

Fundamental parameters

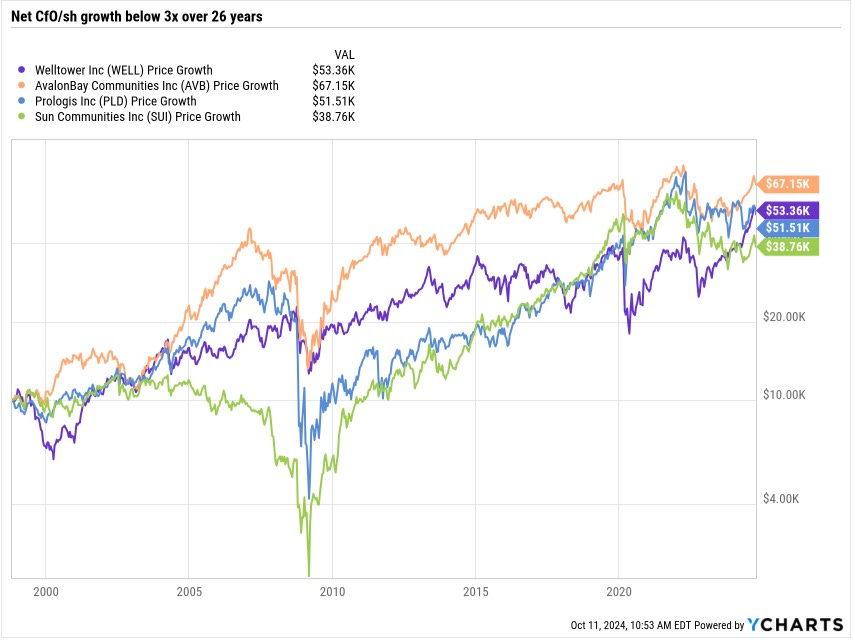

Next we will look at a couple more fundamental parameters. First consider CfO/sh itself. Here it is for the four with higher growth:

To my eyes these are remarkably consistent growers. The noticeable pauses or declines are at the GFC and pandemic. The overall CAGR was 4.4% to 6.9%.

The surge PSA had across 2021 and 2022 reflects an actual surge in rents. Then rents collapsed as housing construction stalled. It is not at all clear when this will change.

In contrast, the recent surge in CfO/sh for ARE reflects what I call SEC compliant cheating. They ramped up capitalized interest until it soaked up nearly all of their interest expense.

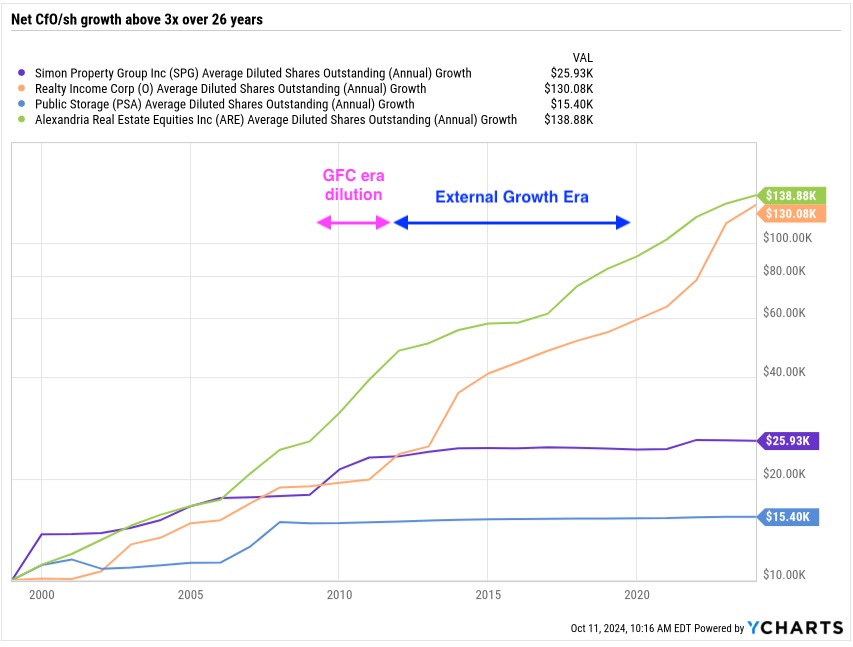

I find it additionally informative to consider how much share issuance corresponded to this growth:

The difference here is remarkable, and shows that it is ignorant to claim that REITs must issue shares to grow.

Three of these grew their share count at a rate of 7% or less through 2012. Some of that was dilution to survive the GFC. Alexandria grew share count faster but also diluted more strongly.

After the GFC, SPG and Public Storage (PSA) issued no shares of common yet still grew CfO/sh at near the 5.5% CAGR shown by the magenta line in the previous plot. Simon did that through development and redevelopment, impressively. I am unsure about PSA, not having found reason to study them in depth.

In contrast, over the past dozen years Realty Income (O) and ARE grew their share count by about 5x and 3x, respectively yet achieved only the same rate of CfO/sh growth. Those two have run inefficient business models, with potential negative long-term consequences.

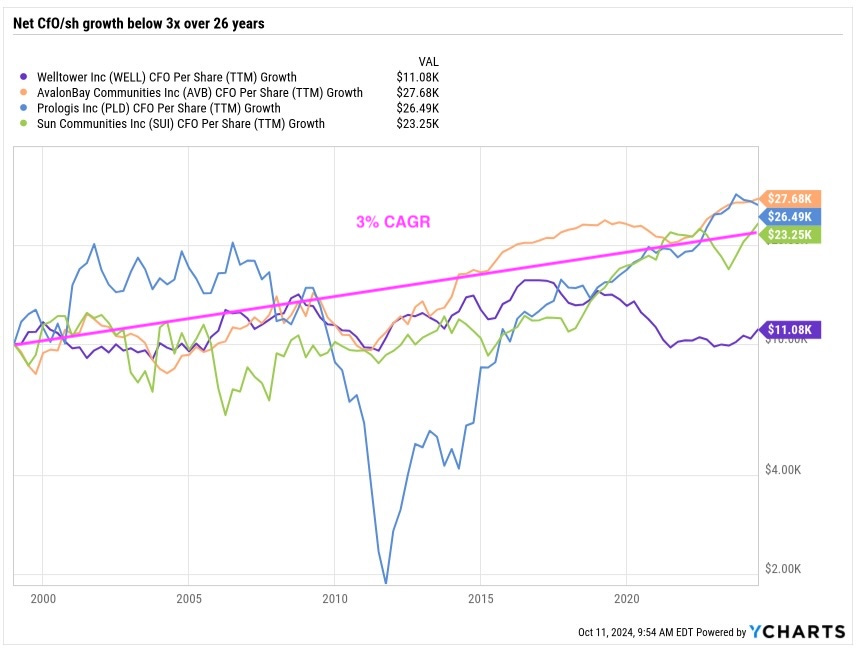

Now consider the four REITs with slower CfO/sh growth:

There are some comments on PLD and SUI above.

AvalonBay (AVB) has been a stellar performer since 2011. But they had an unproductive first decade of this century. Then their growth took off.

Curiously, you can see below that AVB has issued very few shares over the past decade. Their business model has emphasized capital recycling to fund development.

The variation in growth rate for AVB may reflect changes in the premium for doing development. Multifamily has been underbuilding overall since the GFC, despite temporary recent oversupply in some markets. When that changes, which seems far from imminent, the development premium and AVB growth rate may shrink.

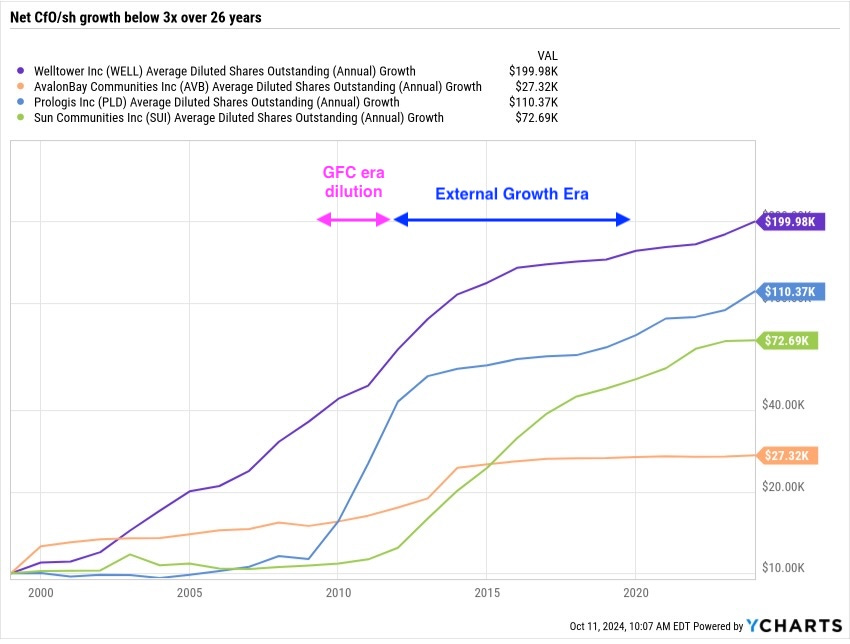

Here is what these REITs did with issuing shares:

Among the blue-chip REITs Welltower (WELL) is the king at issuing shares and growing assets while adding little net shareholder value. You can see this by comparing the past two plots.

In contrast, AvalonBay (AVB) has issued few shares in the past decade but has been one of the fastest growers of CfO/sh amongst blue-chip REITs. Remember this the next time you read some screed about how REITs must issue stock to grow and arguing that WACC matters. Neither is correct. (For more on WACC, see this.)

Since quadrupling their share count as part of recovery from the pandemic era, Prologis (PLD) had nowhere to go but up. They have issued shares at a significant rate on average, but have also grown CfO/sh at a very high rate. They are a complicated company and a lot of that growth involved more than just turning the real estate crank.

The Example of Sun Communities

Sun Communities (SUI) was such a darling of certain analysts for much of the past decade. A couple well-known ones really pounded the table that buying low-yield REITs was the path to high growth and high returns. SUI was one of those REITs.

By now, however, the history supports my perspective that really low yields in REITs may reflect past strong growth but do not predict future strong growth. Compare stock price, CfO/sh, and the dividend yield for SUI:

Sun did grow strongly, doubling their CfO/sh from 2015 through 2022 (while roughly tripling their share count). The market price quadrupled over that interval, but half of that reflected changes in overall market valuations rather than economic performance.

By now their fairytale period has come to an end for both earnings growth and multiple expansion. And the Q3 earnings release and call were real disappointments. SUI management confessed that they had mismanaged expenses during a period of weak revenues.

If you had understood their business and history in, say, 2011, it would have been clear that SUI was poised for a period of outsized economic growth. And the friendly stock markets, though not the only cause, let them add to this growth by issuing stock.

But REITs cannot do this for very long. Their easily achievable growth rates are in the mid single digits.

Look also at the dividend yield. It was at or above 6% around 2012. This is what you want to buy in REITs: yields near or above 6% when growth prospects are strong. But the yield today has dropped to 3%; not high enough for me.

A more recent example is SPG. They were poised to grow strongly even before the pandemic but especially after 2020. Buying SPG in recent years, when the yield was above 6%, produced big gains and nice cumulative dividends.

Takeaways

Such opportunities are few in REITs at the moment. Most REITs are priced reasonably, in my view (for current long Treasury rates). Those should produce high-single-digit total returns, if market earnings multiples stay constant. We are back where we were three years ago, in this respect.

But yields are small, often below 4%. There are only two I care for with yields above 6%. These are Armada Hoffler (AHH) and EPR Properties (EPR).

There is some risk. AHH carries too much leverage. EPR does have larger tenant risk than other net-lease REITs, although the negative narratives around cinemas are quite wrong.

But neither looks poised for a period of outsized growth. One might see some repricing, but big increases driven by big growth look really unlikely to me.

My own current emphasis is on adding diversification and on other portfolio evolution. The hope is to exploit the opportunities served up by the next bear market.

Great article Paul, debunks investing myths. With 4-5 years of REIT experience, I am not inclined to buy many individual REITs at this point. Curious (as you mention) how SA REIT hawkers just keep extolling their virtues regardless of the state of the market. What I WOULD do is put money into REITs in a serious market meltdown, although I'd have to wait for recovery to reap the rewards.

Good discussion, Paul. I agree there is a churn aspect to REIT coverage and some other sectors on SA. Writers with huge followings can make $1,000's per article from premium subs. 15K premium views = about $1,000 in variable earnings. High Yield tickers like SPG with almost 100K followers is sure to get that many from a writer with 40-50K followers. SPG is still getting Strong buy articles this month after doubling since 2022-when I entered at $87ish. The price target at 18X TTM AFFO is $214??? Not adding at current levels, but I hold SPG in several accounts and intend to stay long for income. I agree EPR is undervalued, but have not done independent analysis to come to that opinion. I entered EPR at $32 and have loved the monthly payouts. I don't know if I will ever close out this position as I bought mainly for income. Unless the story changes dramatically-not something I expect. One thing I have learned in 7 years of writing and investing-only buy when there is blood in the streets. Keep em coming. I always learn from your stuff. Cheers, Dave