Sunday morning musings…

Today some thoughts about where REITs go next, informed by a trip through a lot of historical charts for context, with discussion.

Leyla Kunimoto writes excellent articles on real estate investing in private markets. I enjoy learning from her by comparison with the public REITs that get my attention.

Today she included this plot from Hamilton Lane:

The plot covers the years 2009 through 2023. I’m not sure about private market returns, but that represents serious cherry picking for stock market indices. For example, if you look from the market peak in 1999 to today, the total return on the S&P 500 is only 8%.

Looking Ahead

[Throughout the following, hyperlinks are to article on Substack analyzing the various REITs.]

I start here with speculation about the future.

Today more of the highly rated REITs are retaining more earnings and are better positioned to produce higher growth than the historic 3.5%. But they also face a decade of increasing interest rates as they roll their debt, unless rates drop.

On net it seems to me that a good guess is to see a net growth of CfO/sh and dividends at 3.5% and dividend yields near 4%. For unchanging earnings multiples, that would produce a total return CAGR of 7.5% over the next decade. The may seem low, but recall that based on historical statistics, the forward return on the S&P 500 should be no larger than 5% and possibly much less.

The real outcome could be much different, reflecting possible changes in Price to CfO ratios that follow changes in long interest rates. Take your own guess about that. My own view is that current rates make a lot of sense and may not move much.

So where are we? Quality REITs that meet your yield requirements are very likely to keep growing their dividend at a modest rate. The median expectation has to be that they will also grow in price at the same rate, but this may not happen as it is very dependent on factors beyond the control of the REIT or you.

Over the past 6 years, I’ve made good gains buying quality REITs that looked objectively undervalued to me. That seems really hard today. The only one that makes sense to me now is Alexandria Real Estate (ARE).

There do seem to be plenty of overleveraged REITs around, often with some story about how they are underpriced. If you can tell which ones will make you money, more power to you.

Below are charts I looked at while formulating the above conclusions.

The Long Run

We don’t have a good REIT index that goes back to 1999, but we can look at several REITs with solid balance sheets. One may worry about survivor bias, but in my view it is small if you start with such REITs. Those may merge with others, but rarely end up folding and losing their owners a lot of principal.

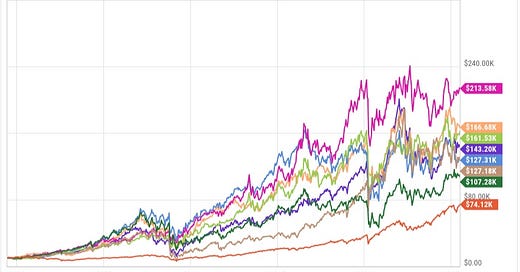

Here is total return for a collection of those and for the S&P 500 (SPY), on a growth of $10k basis:

You see in the bottom curve the 7.4x gain of the SPY for a CAGR of 7.8%. The REITs shown all did better than that, some producing more than twice the return. The median in this group was a 15x gain for a CAGR of 11%.

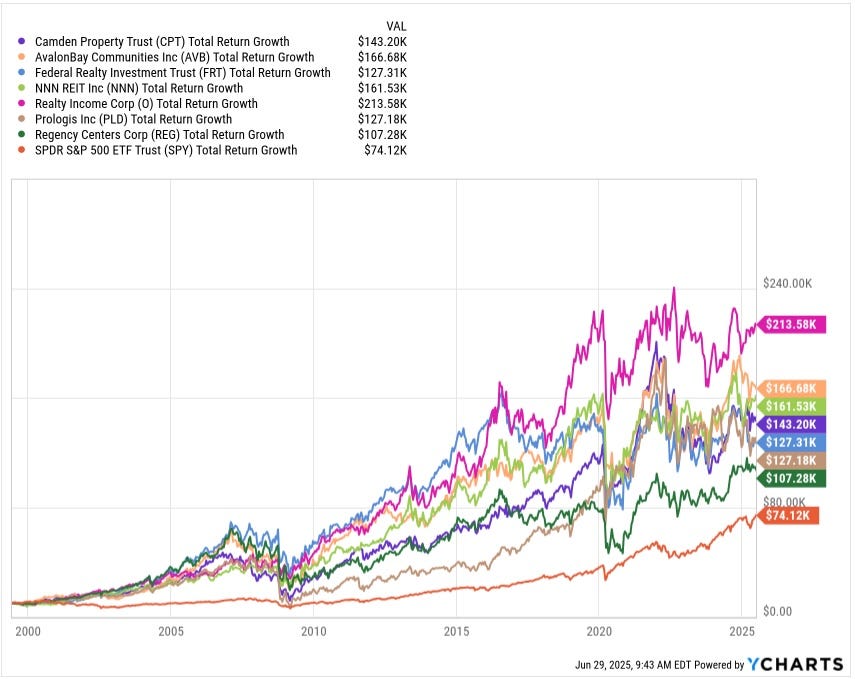

Much of the return for REITs came from dividends. Here is dividend growth on the same basis:

Dividends doubled or tripled over this 26.5 years, for a median CAGR of 3.5%. Two of these, Camden Property Trust (CPT) and Prologis (PLD), got themselves in trouble around the GFC. They both had too much debt, which they subsequently repaired. Still, they still produced significant overall dividend growth.

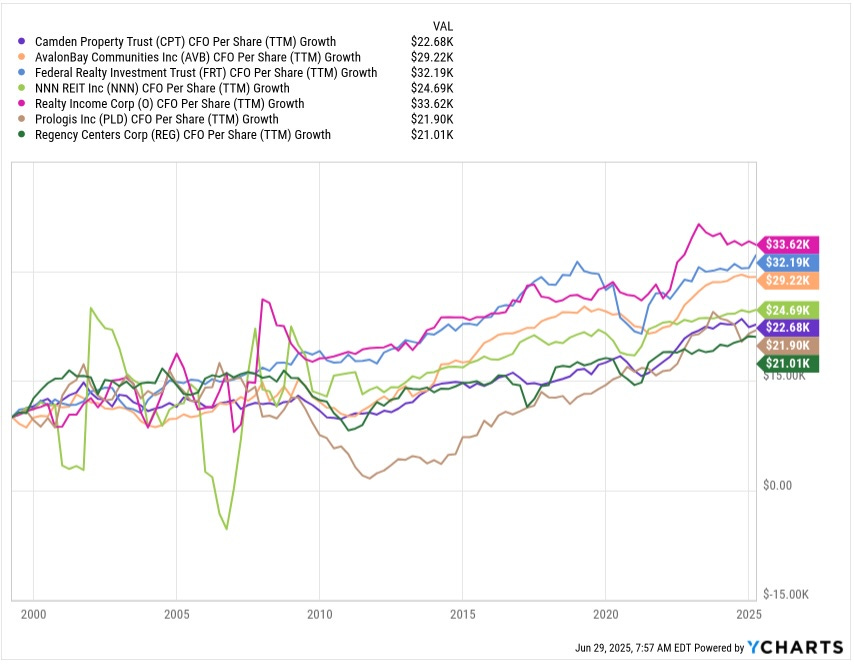

This strong performance was driven by gains in cash earnings, most readily approximated by Cash from Operations (CfO) per share:

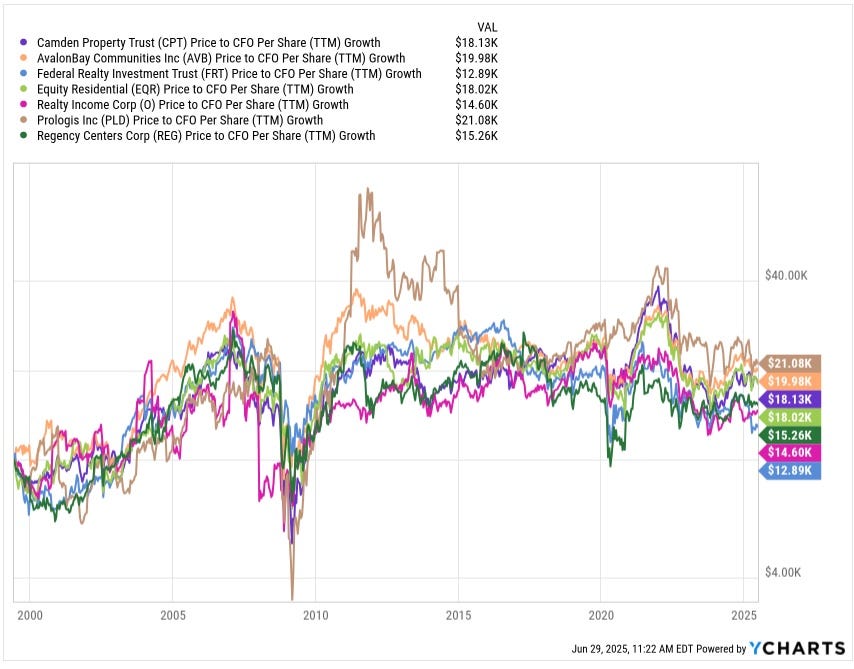

No surprise that the median CAGR is also about 3.5%. If the market multiples (Price to CfO/sh) had stayed constant, we should have seen that much price growth and a total return well below 10%. But Price to CFO has increased on net since 1999:

[Here NNN was replaced with Equity Residential (EQR) to make the plot work.]

Price/CfO is up on net today from about 29% for Federal Realty (FRT) to 210% for Prologis (PLD). It peaked in 2022 up from 100% to 250% before dropping back since. This increase in P/CfO is why REITs total returns since 1999 are above 10% even today.

In mid 1999 the 10-year Treasury rate was near 6%. If it goes up there again, REIT pricing will suffer, which is scary. But you can always find a way to scare yourself. Here I will stick with my best guess that those rates will stay more or less flat.

The Recent Past

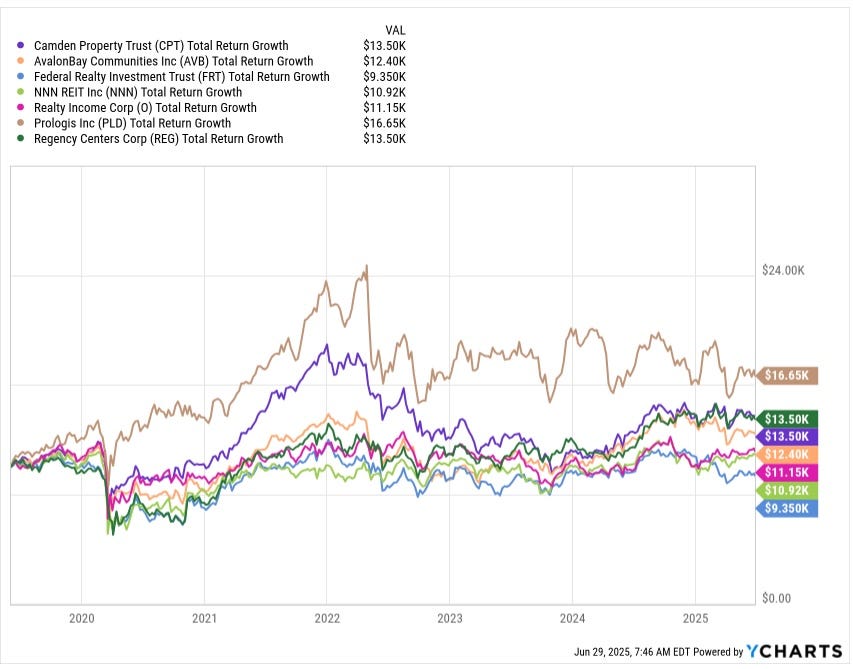

The complaint I see most often about REITs is that their stocks have gone nowhere in recent years. Let’s explore that a bit. Here is total return since mid 2019:

This surely is anemic. The median 1.24x gain is a CAGR of 3.4%. Even Prologis, benefiting massively from the expansion of logistics, only gained 1.66x for a CAGR of 8%, well below what the S&P 500 has done (2.3x).

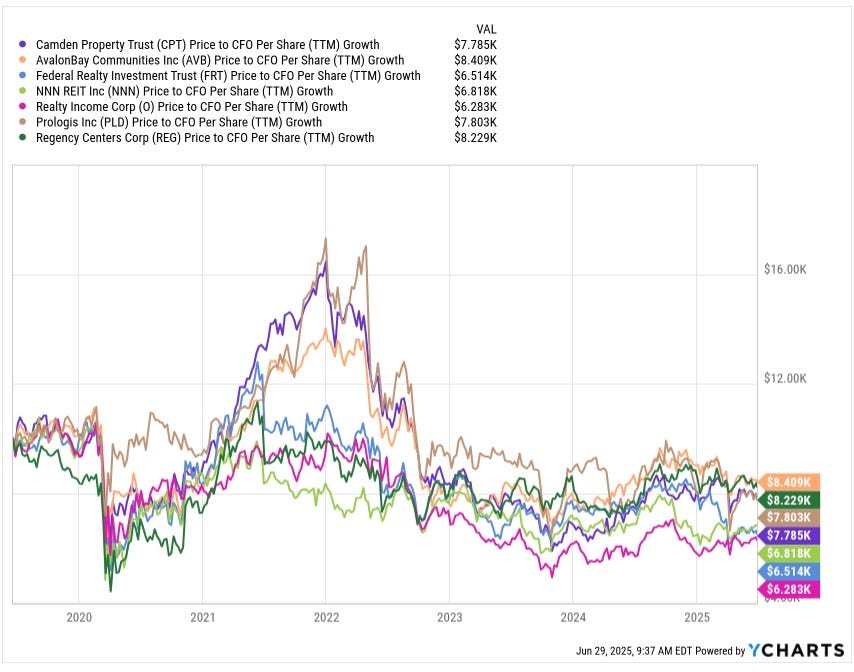

There have been two major headwinds. The big one has been the change in multiples. Here is the change in P/CfO:

The median is down about 20%. This has produced a CAGR of nearly -4% that had to be overcome by earnings growth to just sustain the stock price.

Here a brief comment about the two shopping-center REITs included. Regency Centers (REG) has the lowest total return since mid-1999 but is the second highest since mid 2019. They completely transformed their portfolio across the 2010s. Today Regency, under CEO Lisa Palmer, has a wonderful business model and is well-set to outperform most other REITs going forward.

In contrast, the long-term performance of FRT is mid-range, but it is the worst of the bunch over the past 6 years. In my opinion, for the past decade CEO Donald Wood has not been a good steward of shareholder value. Federal ran debt and the dividend too high in the 2010s and has been paying the consequences since.

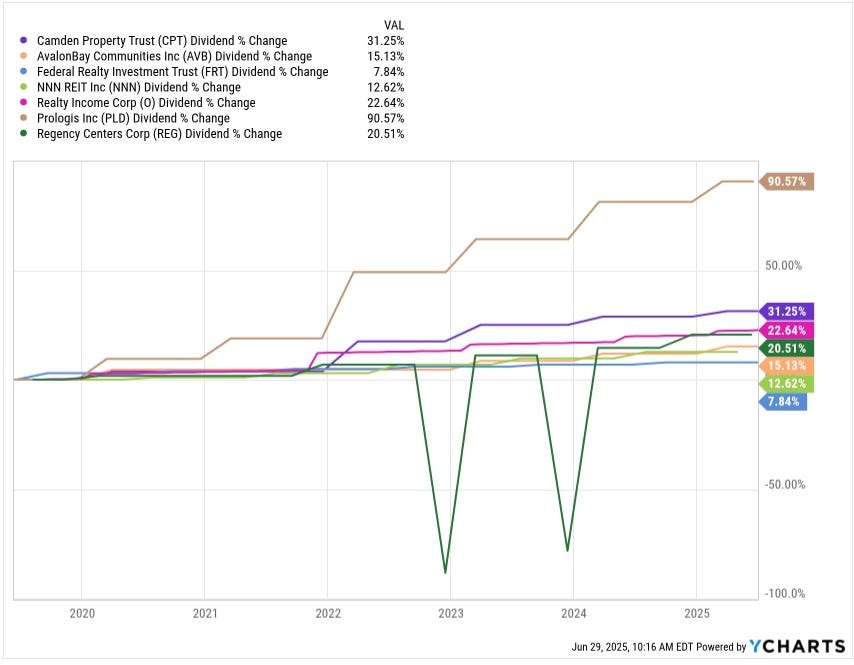

All these REITs have grown their dividends since 2019 (ignore the plotting glitches for REG):

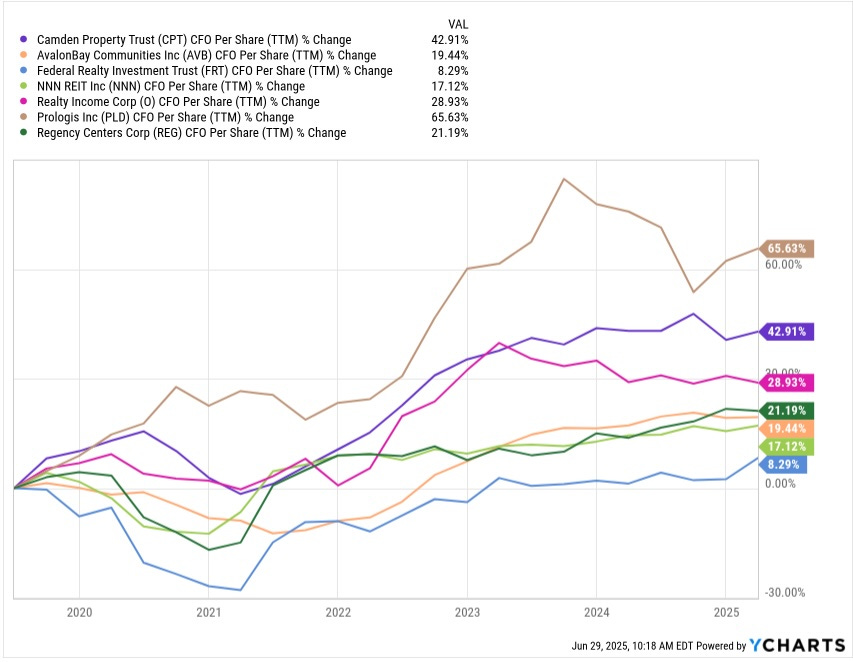

The median total increase has been about 20%, for a CAGR of about 3%. It is no surprise that the growth of CfO/sh has been similar:

The first three years here included the turbulence of the pandemic. Over the past three years, while interest rates were high but operating conditions were stable, the median CAGR of CfO/sh has been 5.4%. Some of that, though, is still the rebound from the pandemic.

Dividend yields have increased with decreasing earnings multiples. The median is now about 4%, with the net-lease REITs NNN REIT (NNN) and Realty Income (O) being higher as usual:

Please click that ♡ button. This helps push Focused Investing up on the Substack feed. Also please restack, and share. Thanks!

A mutual friend today issued a "Trade Alert" in which he is selling all his EPR and buying Kite. Do you have any thoughts on the trade, Paul?

Dividends are REITs’ secret weapon. I'm not a big fan of life sciences REITs like ARE.