A veritable baby; not ready to graduate.

My strong preference is to buy blue-chip companies when Mr. Market hates them. But there is not a lot of that going around today.

Another way to make really big gains is to buy a company that is new or otherwise starting a period of rapid growth. One of my subscribers bought Canadian Natural Resources (CNQ) back when they were investing massive capex to enable their incredible performance since. He tripled his money.

Essential Properties Realty Trust (EPRT) had a stellar business model from the start, presenting it coherently and well. Investing soon after the IPO let you double your money in a few years.

National Storage Affiliates (NSA) had a really unique business model well suited to the environment of the 2010s. Buying soon after the IPO in 2015 let you triple your money by early 2020, and gain even more during ZIRP. But higher interest rates killed their business model and today the price is back where it was in 2020, plus their payout ratio is fairly high.

I missed all these opportunities, although I did get into CNQ and EPRT for some solid gains later. No angst there; I was doing other things with my time when they IPOed.

With this background, it makes sense to be looking at new, small REITs. [Energy companies today are a different story, since assessing their geology is difficult, there is so much advantage to scale in that business, and there is very little worthwhile, virgin real estate.]

Poking around in the NAREIT tabulation, I came across FrontView REIT. They were a private REIT that went public on October 2, 2024.

Who, How, What

Their focus is owning properties with frontage on worthwhile roads, like those shown in the photo above, and leasing them using triple-net leases. They had 323 of them March 31.

The private REIT had debt in the form of Asset Backed Securities that was 55% of Gross Assets. This needed to be paid off. The IPO covered half of it and new, floating-rate debt (a term loan plus about half of their credit revolver capacity) paid off the rest.

So in contrast to many REIT IPOs, theirs did not give them a pile of cash to invest. I see this as a negative.

The IPO did not sell all ownership. Previous owners retained 38% of the ownership in the form of OP Units. Among other aspects, these receive the same dividends as the common stock. Total units including the common are 27.8M.

So it looks to me like on September 30, 2024, the previous owners owned Net Assets of $288M, or 45% of the total. Then by December 31, debt was down to 37% of Net Assets, and the portion owned by the prior owners was down to $172M.

So, on an unrealized basis, those prior owners appear to have taken a 40% haircut in order to get listed. And since property values may be below Gross Asset values in present markets, it may be larger.

What they got in return, as always with IPOs that replace an ongoing business, was new stuckees. If past or present losses do need to be realized, or addressed by issuing stock, they now have three times as many owners to share the burden. And frankly, diluting shareholders by 50% to take that current debt down to zero would put the company in a lot more secure place and give them more ability to grow.

By December 31 they knew that they would be taking back 12 properties from Freddies, TGI Fridays, World Auto, Hooters, On The Border, and JOANN fabrics, representing about 4% of their ABR at the end of the year. Occupancy is just over 96%, already low for this type of REIT.

This is disturbing. It seems that they were burdened by their sponsor with a number of bad properties. One wonders how many shoes may be left to drop.

At least they have only 3 expected single-property nonrenewals in 2025. That rate would be more reasonable if it lasts.

Still that performance is much worse than we are seeing from the blue-chip, net-lease REITs. Many of those have property-level financial reporting by tenants, especially if like Front View they emphasize tenants who are not investment-grade.

Front View discloses no such reporting. To my mind this is a real weakness.

All that said, they seem to be moving quickly and successfully to address those lost tenants. Future quarters will tell the rest of the tale on that.

The Financials

Front View had $4.5M of interest expenses in Q1, 32% of NOI (using TIKR numbers). That seems a bit high but only because all their debt is paying current rates. Other Net Lease REITS will see similar levels if long interest rates stay up for a few more years.

Their G&A expenses were 21% of NOI. This is really high but not really avoidable considering their small size. It does hurt their ability to grow earnings, though.

As of December 31, they had net debt of $276M, and $720M of Gross Assets. This put the Debt Ratio (Debt to Gross Assets) at 38%, a healthy level for a Net Lease REIT.

Then they increased both Gross Assets and Debt at about $40M across Q1, increasing the Debt Ratio to 43%. What’s more, their present guidance will add another $40M of debt during the rest of the year (see below).

Thoughts here: This is pushing it for a tiny REIT. The higher that ratio goes the more their earnings and dividends are threatened by any revenue declines.

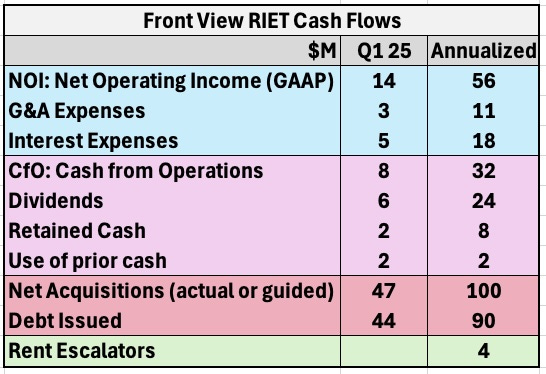

This table summarizes the cash flows:

Such tiny numbers!

If they invest that $12M of retained cash plus escalated rent at 8%, they will grow CfO/sh by about $1M or 3%. That is not terrible these days but won’t get them anywhere worthwhile anytime soon.

Wheel and Deal?

To my ear the language Front View uses around their acquisition is off-key. They say:

Since entering the public markets in October of 2024, we have demonstrated our ability to source accretive acquisitions. The first quarter of 2025 was no exception, and we acquired approximately $49.2 million of properties at an average cap rate of 7.9%, exceeding our pricing guidance by about 40 basis points and having a weighted average lease term of approximately 12 years.

So the first quarter of 2025 was “no exception” to Q4 2024? Strange language, reminding me of my ex-wife’s propensity to generalize one case to infinity.

And then there is the “ability to source accretive acquisitions.” This is a bit tricky if you are issuing stock or selling properties to raise the funds for acquisitions. But that is not what Front View did.

Front View almost entirely issued new debt to support acquisitions. For that case, all you have to do to make the acquisition grow earnings is to have the cap rate be bigger than the interest rate. It is the one case where the spread between those two matters directly.

However, while debt-fueled acquisitions is “accretive,” it is often unwise. It pushes up leverage, which is just what happened here.

At least Front View seems to understand that issuing new stock at the current price would not be a good idea. But the guidance given by Co-CEO Randall Starr for all of 2025 is, at the midpoint, for $30M of dispositions and $130M of acquisitions.

They already added $50M of debt, and as discussed above their retained cash plus escalators will be about $12M. So where is the other $38M going to come from? Most likely more debt, and they mention using their revolver for this.

However, doing that would be a bad idea because they have no good way to pay it down.

We’ve seen other young REITs decide to sell assets in an attempt to support growth. It would not surprise me if soon Front View is presenting themselves like CenterSpace (CSR) does, as great wheeler and dealers in properties.

But that road is a long, slow one. Even if you manage a 200 bps spread between what you buy and what you sell, on selling say 10% you end up increasing NOI by 20 bps.

Value and Takeaways

Today FVR is priced at 10x AFFO (10.8x FFO). For comparison, that price to FFO ratio is 12.4x for NNN REIT (NNN) and 13.3x for Realty Income (O).

A discount of less than 20% seems if anything too small to me for a vastly smaller REIT with

More debt,

Much shorter track record,

Lack of a clearly articulated path to growth, and

Recent significant tenant problems.

Front View seems rather stuck to me. They are very small with little prospect of rapid growth.

Their business model is a very standard net-lease model. It will naturally support AFFO/sh growth of a few percent per year.

Unless the stock market falls in love with them, I see no way for this REIT to launch itself into a period of stellar growth. To my eyes, it is fairly priced for what it is, if you believe in the management. But I have found that I don’t, thanks to their carelessness with debt and also to their inability to present a coherent vision.

The contrast with EPRT when they started is very striking. EPRT had a complete, nuanced, well-thought-out plan that they were able to clearly articulate. Then they executed it.

Instead, these guys remind me of doctoral students I knew who had all the words but could not put together a fully nuanced and coherent story using them. Those ones were not ready to graduate.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

TY Paul.. Keep looking , maybe you can find us a gem. Find it very revealing that owners had to take such a large haircut to go public. I can't seem to find a REIT I'm willing to load up on at current prices other than ARE. Lower investment grade debt around 7% makes me even pickier. I would buy O or NNN or CPT back at April 8th prices . I find this comment more of a warning "Other Net Lease REITS will see similar levels if long interest rates stay up for a few more years. " .. Lastly in reference to your doctoral students where I'm sure you dealt with all kinds of characters, could you tell early on who the stars were going to be? I guessing that perhaps helping the misfits find their way was most gratifying...or maybe not?