This note has some brief remarks on two REITs, Whitestone REIT (WSR) and Centerspace (CSR). It explains why I find neither one appealing at present.

Whitestone is a shopping-center REIT focused on the sunbelt, with a Market Cap near $700M. Centerspace is an apartment REIT focused on the northwestern midwest, with a Market Cap near $1200M.

So both are “small-cap” REITs. As we will see, there are similarities and differences.

Note before beginning: This article is less than 1500 words and covers two REITs. My typical deep dive on a single REIT can be more than three times as long. That level of depth is not needed when the decision is not to invest; please comment if you think something important was missed.

Not Developers

One of the major differences amongst REITs is whether or not they develop properties. There is often a cap-rate advantage of 150 to 200 basis points to be had by doing the development.

In apartments and shopping centers, one finds that the highest-rated and most-successful REITs, long term, are developers. AvalonBay has a 20-plus year growth rate of FFO/sh well above 6%, and a significant part of that is incremental returns from development done well. This in turn explains their premium pricing.

The “done well” does matter, of course. But the REITs bring advantages of scale, long experience, and geographic flexibility.

Some REITs have emphasized redevelopment, which can produce impressive cash-on-cash returns on a single-project basis. But it is tough to do enough of them to really move the needle.

If you don’t do development, then you have to grow earnings from rent increases and from trading effectively within your property sector.

So it would take something really special to get me to invest in a REIT that was not a developer. Let’s see about these two.

Whitestone

Whitestone has fans on Seeking Alpha, notably including Dane Bowler and Jussi Askola. They like the sunbelt location and what they see as the forward growth prospects.

Whitestone had issues with management, fired its CEO, got sued for wrongful termination, and a court dismissed all claims last December. So maybe this is worked out by now.

They also have had issues in monetizing their investments in Pillarstone, another REIT now in bankruptcy. At present they expect to collect about $45M. For future reference, this is about 4% of their current, long-term debt.

Growth

Whitestone shows nice slides bragging about the positive growth of various measures that represent earnings or are relevant to them. Here is what I see from the financial statements:

At first glance, the NOI/sh growth looks promising. It has grown with a 7.3% CAGR and 19% in total for the last 2.5 years.

One just wants to understand why CfO/sh is flat and has not been growing. Overall since the peak at the end of 2022, CfO/sh is down 4.3%. The three reasons this can happen are rising interest expenses, rising G&A costs, or GAAP distortions of NOI.

The first two are a wash, adding up to about 55% throughout. Since this is intended to be a brief exploration, I did not go down the rabbit hole of understanding NOI.

It is true that various legal costs have spent 5.9% of the current CfO over the most recent three quarters. Even if you want to give them credit for that, the normalized CfO would only have grown 1.6% over the six-quarter period period.

Somehow their manipulated numbers show a lot more growth than that. Consider me skeptical of the NOI growth and as a result of the EBITDA growth too. The numbers are not adding up.

Leverage

The above was not really expected, since the main issue for Whitestone is well known to be leverage. They have said they are deleveraging, but their Debt/EBITDA is at about 8x and (down from above 9x at the end of 2021).

They talk about improving leverage by growing EBITDA and applying free cash flow to reduce debt, but so far we’ve seen none of the latter. The long-term debt (including current portion) is essentially unchanged from four years ago.

We’ve seen this movie many times. A REIT says they are deleveraging, but all they really do is stop taking on new debt and try to grow their way to lower leverage.

This may work, depending on what else goes on. Or not.

My preference is to look at Debt-to-Gross-Property, often called the Debt Ratio. Here it is:

Before 2020, it was way up there at private-equity levels. Since then they have worked it down to near 50%. The standard shopping center REIT might be at 40% and my favorite, A-rated Regency Centers (REG), now has it down below 30%.

Since the peak, the Debt Ratio has been coming down at a 4.4% CAGR, almost entirely through the growth of Gross Property. At that rate, it will take three more years to get down to 40%. If they get the bankruptcy proceeds they expect and use them to reduce debt, it will be two years.

Assuming they stay the course.

Whitestone could sell assets and pay down debt to pull leverage down faster. If they sell 10% of the assets they could pull leverage down to just over 40%.

Looking at their interest rate structure, the ratio of CfO to NOI would change little. So CfO/sh would drop about 10% as did NOI. To my mind, this suggests discounting WSR by about 10% relative to typical shopping-center REITs.

Based on current FAD/sh, WSR is priced at about 16x FAD. Notably, REG is also priced at about 16x FAD. This would suggest that WSR is overpriced, today.

So where are we?

Lots of turmoil

Confusing and inconsistent financial information

Valuing for 40% Debt Ratio implies discounting by 10%

Priced at the same FAD multiple as REG

My view is that the promise of the sunbelt is nowhere near strong enough to make it worthwhile to invest in WSR rather than REG.

Centerspace

Centerspace (CSR) is an apartment REIT. They were brought to my attention by “Hunter”, of Lewis Enterprises, on Substack.

Here is where they are geographically:

This is quite unique amongst apartment REITs. So if you value geographic diversification above all else, add them to your basket.

But isn’t the sunbelt certain to grow much more strongly? Hunter had a unique and interesting argument about that.

Yes, a lot of people have moved to the sunbelt in recent years, especially post-2019. And jobs have come too. Even amidst the peaking supply period for sunbelt apartments, rents have held up surprisingly well.

Hunter quotes a Bank of America study showing that mostly the migrants were young people looking for more affordable housing. But as rents keep climbing across the sunbelt, will that continue?

Rents are lower in the Centerspace states, and there are plenty of cities and towns with good jobs. So maybe growth starts to move in that direction.

No opinion here. But as usual, the obvious and accepted story might not be true after all.

Centerspace runs a Debt Ratio of about 40%. This makes Hunter think they are allergic to debt; he must be a private-equity guy.

In their presentation, describing how they make and grow earnings, it is crystal clear that Centerspace sees themselves as superior operators and property traders. They do have a long history, having been in business since 1970 (!).

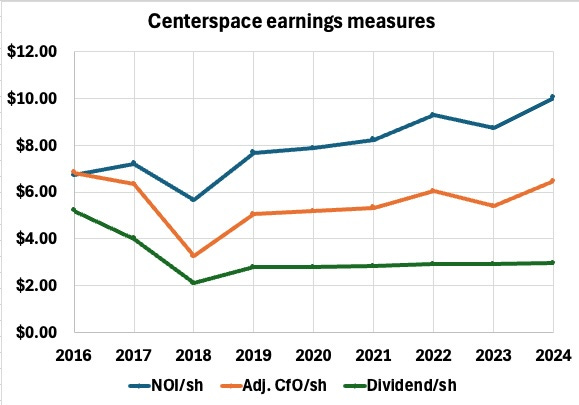

Here are some earnings measures:

The 2018 numbers include only 8 months, because of a change of fiscal year. From 2019 through 2024, with 2024 represented by LTM numbers at H2, the growth rates were like this

NOI/sh: 5.5%

Adjusted CfO/sh: 5%

Dividend: 1.1%

Centerspace pushed down their (common plus preferred) dividend payout ratio from 85% to 53% over the interval. Reducing it should have enabled more growth from retained earnings, and that appears to be what hapapened.

They also issued few shares until 2022, when they diluted shareholders by about 10%. I did not look for the full story there.

But why have they kept the dividend nearly flat since 2019, even as NOI/sh and CfO/sh have grown about 30%? No idea.

Centerspace did announce an annual increase, at the end of 2023, of 8 cents, or 3%. That year was a down year, so the real question is why raises were not larger during the preceeding years.

CSR is priced at 12.7x times my rough estimate for 2024 FAD/sh, which is a very small multiple. The recent NOI/sh growth is nice, but the dividend growth is not.

To me, CSR might be worth 15x, after more research. But that is far from enough upside to keep me interested.

It would be nice to know more about the details, but the bottom line is already clear. There is little point in owning this REIT in a world where there are much more promising options.

w/r to regency, it is very near 52 wk high

and pays paltry 3.8% divy

at what pullback price would u open a position

And adding it a separate comment; I really enjoy your articles and will become a full time subscriber shortly (I don’t dare to do it from a plane on wifi, although that is often where I have the time to read). I want to read your in depth articles on SUN and some of the energy investments, although I am a little scared to read the BSR one :)