One can learn a lot contemplating history.

I wrote most of this last Sunday, in a pensive mood, keeping myself entertained while under the weather. Let’s kick around some charts and see if we can learn a few things.

We will focus on REITs. (The story of my other sector, Energy, is dominantly influenced by sector-specific factors, both technical and political.)

Stocks vs Indexes

We will compare three individual REITs with the S&P 500 index. The REITs will be AvalonBay (AVB), a multifamily REIT, Realty Income (O), a net-lease REIT, and Federal Realty Trust (FRT), a shopping-center REIT.

The reason for choosing those three is that they have been in existence for 30 years. My view is that you will avoid terminal outcomes by choosing geographically diversified REITs with good dividend coverage, low enough leverage, and some track record, like these three had 30 years ago.

Still one wonders whether they are the survivors, and whether some collection of REITs that were sensible then would have reduced the returns seen to date. This is a reasonable question.

From 1988 through last October, over 36 years, there have been 361 REIT IPOs. About half that many REITS exist today, so about half of those that became listed have vanished. Having learned that, very early in my study of REITs, I spent a lot of time a few years ago digging into REITs that vanished.

I expected to find frequent bankruptcies. What I found was mergers.

Mostly the vanishing REITs merged into other companies. There has been ongoing consolidation among REITs and within the broader real estate sector for decades now.

During the difficult periods such as the Great Recession, this no doubt produced significant realized losses for many shareholders, but it also gave them ownership in the merged company, whose stock often doubled or tripled within a few years.

Hoya Capital regularly publishes a summary of recent activity. Here is the current one (including mortgage REITs, a category I ignore):

In contrast to the large number of mergers, there have been few liquidations or bankruptcies. REITs in trouble have often been able to resolve things by diluting shareholders by a few tens of percents, by cutting their dividend perhaps in half, and perhaps by selling some properties. Mergers have been only a part of the solutions.

There have been exceptions, concentrated in three types of REIT. There have been a few mall REITs that went bankrupt, mostly in the wake of the pandemic, where their high costs and high debt rendered them unable to weather the storm amidst the secular shrinking of the mall sector.

Leaving aside the strange case of Sears, which was never a mall REIT as such, those bankruptcies were all Chapter-11 reorganizations, not liquidations. Shareholders got wiped out or nearly so but the companies continued to exist in some form.

A few shopping-center REITs liquidated around the turn of the century, even as many more merged out of existence, amidst a massive wave of consolidation. A lot of very small such REITs went public in the 1990s, only to find that the stock market was less enthused than they had forecast.

And there have been a few office REITs that liquidated. This was often because key shareholders were unsatisfied with the stock price.

Overall the rate of bankruptcies and liquidations has averaged below 2% per decade. To my eyes, survivor bias is not a big issue.

The returns from the S&P 500 are well known to include some “survivor bias,” but most estimates have this as relatively small as well.

Total Return

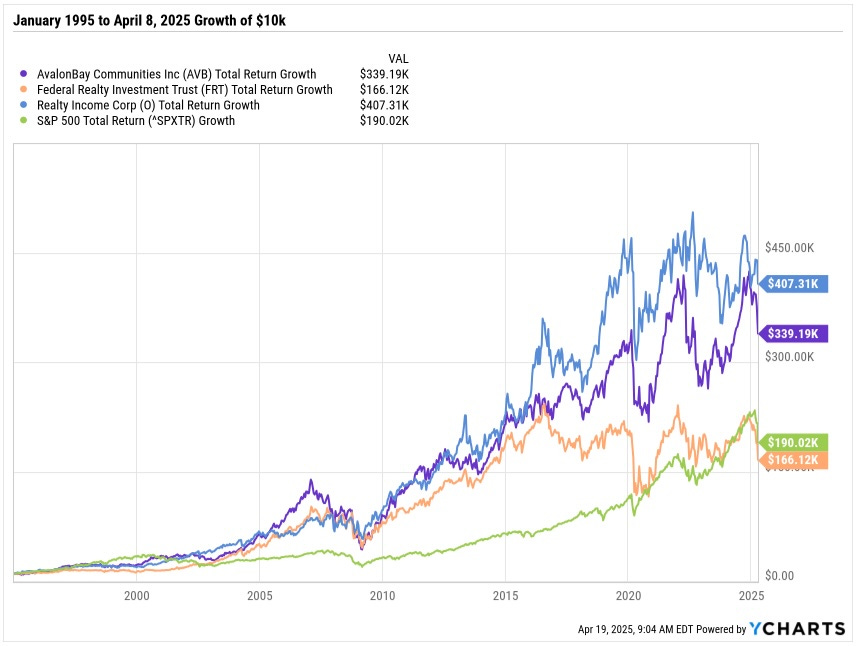

We can start with some long-term comparisons and with total return. Here is a 30-year graph, on a growth of $10k basis:

We see that two of these REITs substantially outperformed the S&P 500 over this interval. And all three did until 2017, when retail entered a difficult period. The main reason for the difference is that the S&P 500 had very small returns across the 2000s.

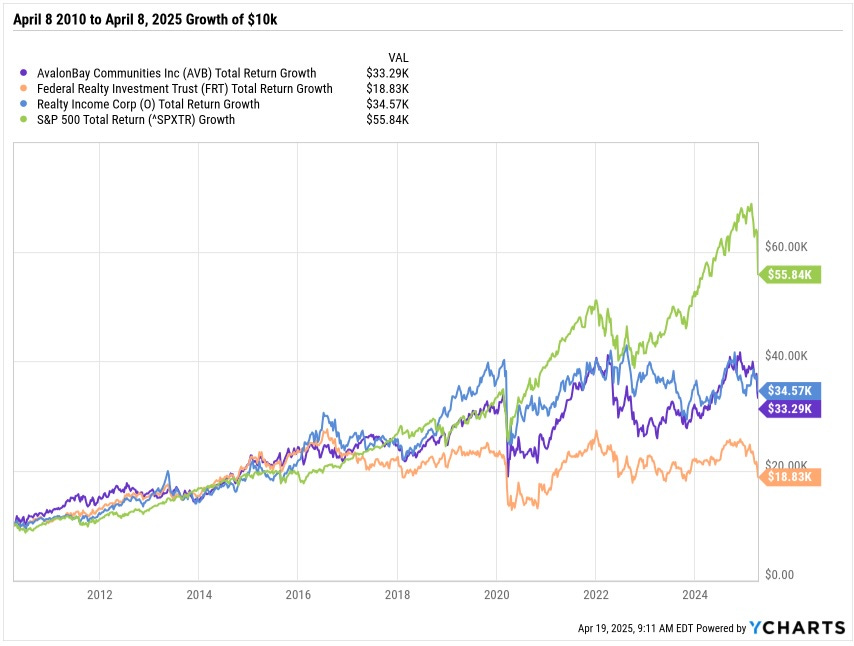

It is interesting to also look at the past 15 years, removing that bad decade for the 500:

We see that the 500 only pulled ahead during the tumultuous years for REIT stock prices starting with 2020.

Looking ahead, should we expect something like a return the the mean? For the S&P 500, the historical statistics suggest that the returns over the next decade will be quite small. But that will still be true if the 500 rises another factor of two over the next 5 years.

A More Fundamental Look

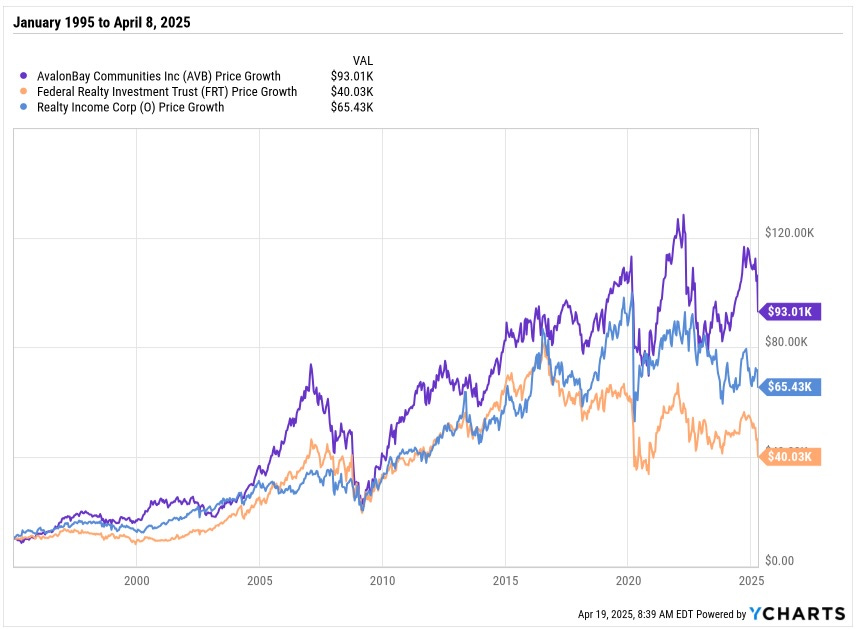

For the REITs one can find more fundamental information to inform one’s thinking. Here is per-share Cash from Operations (CfO), the best easily obtained measure of cash earnings, again on a growth of $10k plot:

Recently, Avalon has masterfully exploited their opportunities, doubling CfO/sh in just over 10 years. And despite the turmoil of the great recession, they have doubled CfO/sh every 10 years.

Realty Income, having reached a size of diminishing returns, has struggled to grow CfO/sh, with the exception of having gotten a big positive impact from their merger with VEREIT in 2021. Federal brought their slow growth on themselves, through emphasizing growth of total assets rather than shareholder value, as I discussed here.

Looking further back, these three all roughly doubled CfO/sh over the 17 years from 1995 through 2012, despite the Great Recession. Their stock prices, in contrast increased by 4x to 6x over that interval:

In case you prefer tabular summaries of main items, here they are shown in a table:

Those larger gains early in the century are highlighted by the difference between 30-year and 15-year growth rates. One can also see that the 30-year price growth exceeds that of CfO/sh for all three REITs. This implies a difference in valuation, our next topic.

Valuation

The best explanation of these trends is the impact of interest rates. Here is the 10-year Treasury rate, which dropped 3x over that period:

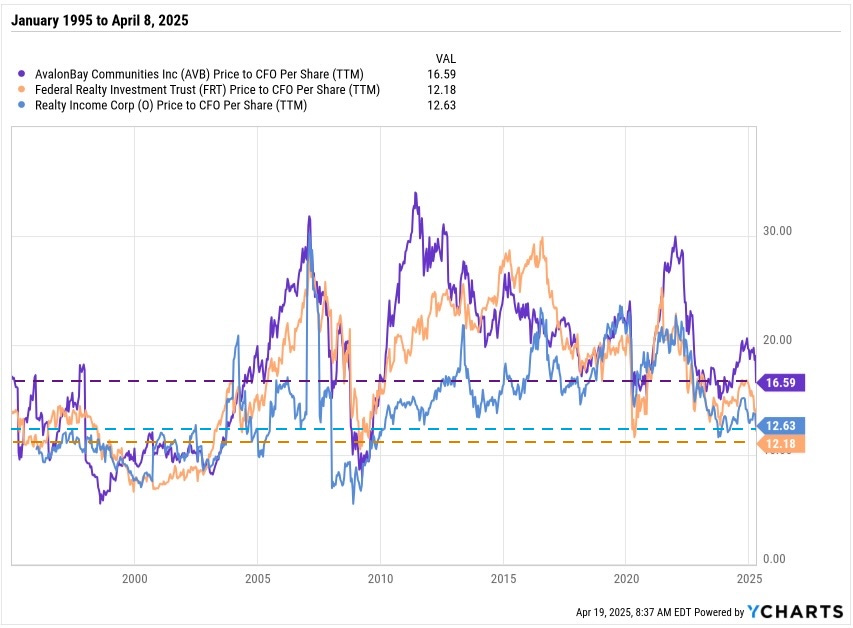

Cap rates in the property markets dropped a lot too from 1995 through 2012. The consequence was that property values and REIT stock valuations (earnings multiples) rose. Here, for our three REITs, is the best easy multiple to look at: Price to per-share CfO:

The horizontal, dashed lines extend recent valuations backward in time. We see that current values are above those of the mid-1990s, but not by a lot. The somewhat higher valuations today make qualitative sense because, for all of them, the acquisition cap rates reported in the 10-Ks of the time, for the late 1990s, were higher than those of today.

And that difference in earnings multiple from 1995 to 2025 might remain, so long as 10-year rates don’t climb back up to the rates near 6% that you can see in the Treasury yield plot. Treasury rates may not climb further.

If you sample prognostications, predictions for rate increases from here are by far the fewest. Staying the same or dropping are much more popular to forecast. An expectation of declining rates makes it so much easier to sell the dream.

So which do you consider most likely? One old saw is that the markets will do whatever causes the most pain to the most investors…

We thus find ourselves at a place of reduced REIT valuations. I first considered the possibility in REITs: Great Gains, Or Not, near the peak in REIT valuations 3 years ago, saying:

REITs have benefited for 30 years from increases in valuation that were not fully justified by their internal economic performance. … Discount rates have relentlessly plunged over that period. They are likely near their bottom.

For now, the tailwind is gone, and so investors who buy REITs at normal prices will be looking at total returns in the high single digits or a bit larger. This will meet the goals of some investors, especially including the aspect of partial decorrelation with stocks broadly.

The problem is that a period with a headwind is almost certain to follow, and to last a decade or two. Across those years, buy and hold REIT investors seem likely to me to see returns in the mid- or even low- single digits. (This problem will not be escaped by investing in most other domestic stocks either.)

So far that was a prescient call. At today’s prices, I am not seeing “the chance of a lifetime” promoted by some. I like high-quality, low-leverage REITs as income plays here. I will like them better if Treasury rates rise and prices fall further.

And a few of those quality REITs do seem undervalued to me, especially if you give credit for growth they will produce. One of those is Regency Centers (REG), which I own.

Where Opportunity Will Be

Enough gloom and doom!

We can get good income but how do we get rich? Or at least make some decent gains?

On of the most famous sayings in investing is “You make your money on the buy.” The broad markets often over-react, especially in niche sectors where standard metrics can mislead.

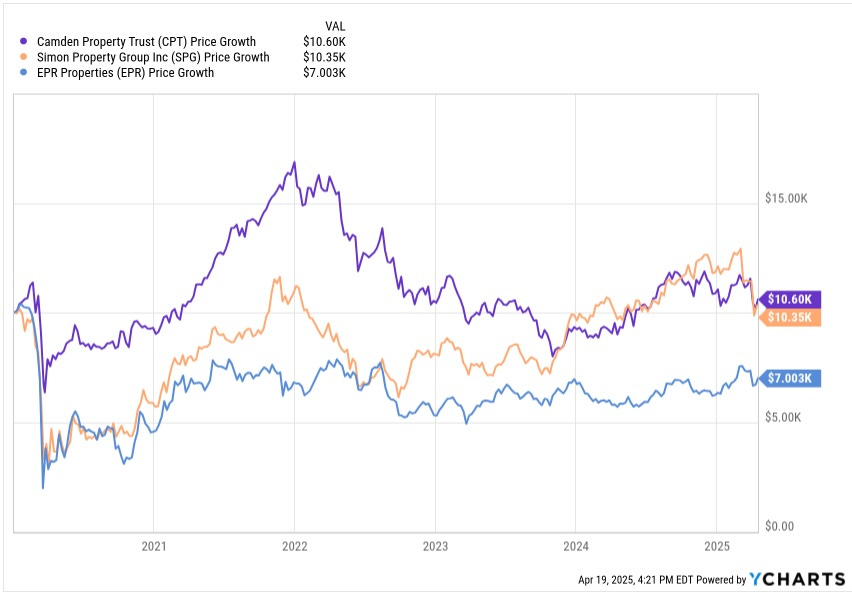

Here are three REITs on which I have made money from this aspect, from early 2020:

The pandemic was tragic in many ways, but did provide great investing opportunities. For much of 2020, great companies including Camden Property Trust (CPT), Simon Property Group (SPG), and EPR Properties (EPR) were ridiculously cheap.

My portfolio was gaining in late 2020, and then increased in value by 50% across 2021. You can see why.

But by the end of 2021 I had sold out of CPT and sold a lot of my SPG. Then interest rates rose and REITs crashed. By the end of 2023 I owned a lot more SPG, was back in CPT, and had increased my holdings of EPR on the dips.

Since mid-2020, the Vangaurd Real Estate ETF (VNQ) has gained 10% in price and another 20% in dividends. My portfolio, whose REIT fraction has varied from about 35% to 55%, is up quite a bit more than that. The additional gains were made on the buys.

The formula, then, is to wait for something (usually the US government) to screw things up and then profit from the resulting mispricings. The Trump administration got off to a great start in that respect, while the petulant child was unrestrained. But now we wait to see how long the grownups retain their current influence.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

I appreciate how your curious intellect thrives on the relentless pursuit--through regular analysis of stocks you own or owned--of practical knowledge needed for success in the market! Well-done! I hope you feel better.

Thanks Paul for the perspective. It's rare to see REITs go bankrupt but from experience some REITs (eg. RMR, GNL, DBRG) are very good at empire building at the expense of the shareholder. I pay attention to leverage and shareholder-friendliness of management.