Investing progress, thoughts on debt for REITs, and a portfolio update.

My investing is focused primarily in REITs and Energy. These are niche markets often considered treacherous by the ignorant, but also prone to mispricing, which provides opportunity.

My goal is to invest only in firms I know well through deep study. Most of my investments have been in quality companies that were undervalued in the markets. Only a small fraction have been in riskier firms with a good potential for stronger upside.

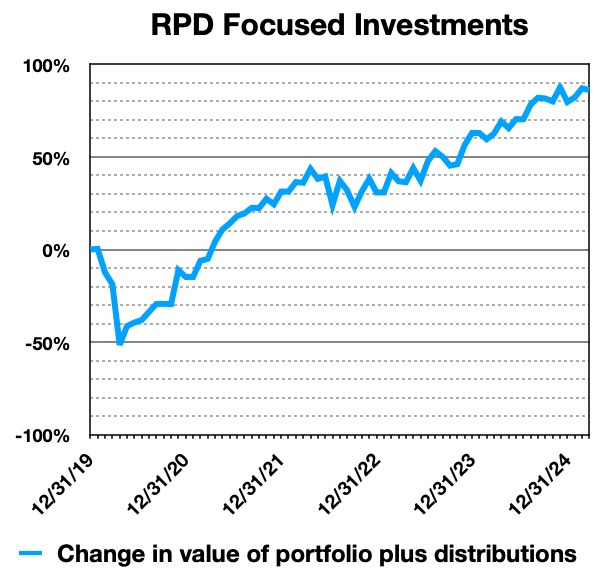

As you can see in the plot above, so far so good. The portfolio market value is up a few percent this year, and is within 1% of its all-time high. More importantly, the very secure dividends would more than cover my spending needs if all paid work stopped.

My annual paid members get direct access to the details of the portfolio. They also get trade alerts, deep dives into companies, and other useful material.

Now for my focus topic this month.

Which REITs Actually Are Recession Resistant?

During 2019 there was lots of noise about a coming recession. And there were lots of articles touting Shopping-Center REITs anchored by grocery stores as a recession-resistant sector.

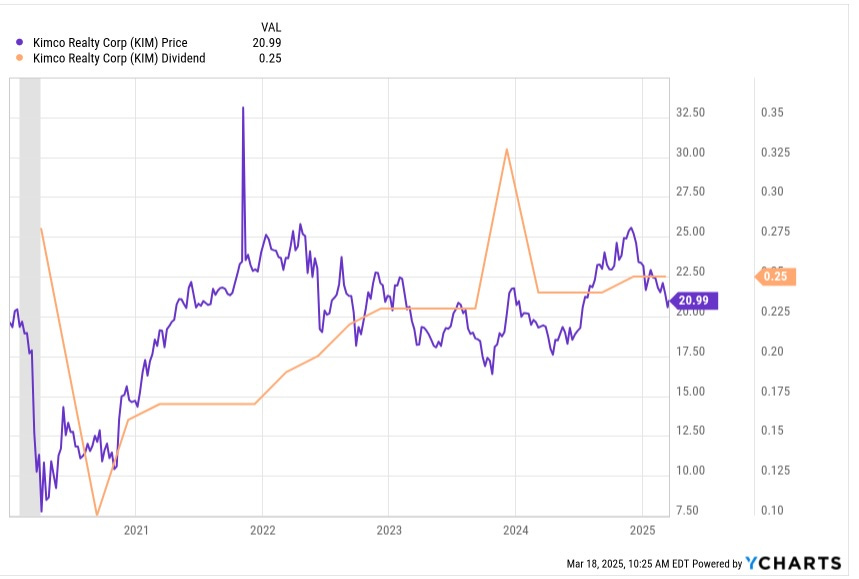

Then the pandemic hit, governments shut down lots of tenants, and both stock prices and dividends went in the tank. Here is Kimco (KIM), one such REIT with a high credit rating:

So much for that recession resistance, eh? The dividend went to zero for a quarter and still is not back up to its 2019 value. The stock price has been flat for five years.

Yes, the pandemic was a special case. But isn’t history a sequence of special cases?

Now compare that plot with what happened with Regency Centers (REG), which I recently covered in depth:

No dividend cut, as advertised. (The downward spike in late 2022 is a YCHARTS glitch.) And on net the price is up 10% compared to late 2019.

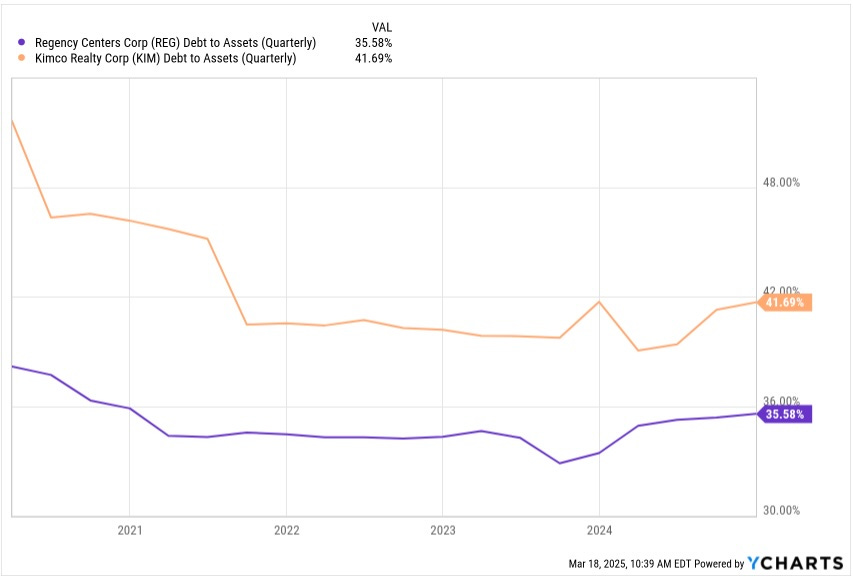

What was the difference? Debt:

Here YCHARTS is using GAAP book assets, so these fractions are overstated by comparison with Debt to Gross Assets, a better measure.

But you can clearly see that KIM had a lot more debt entering 2020, and also that they have worked to bring the Debt Ratio down since.

So why is this? Let’s look.

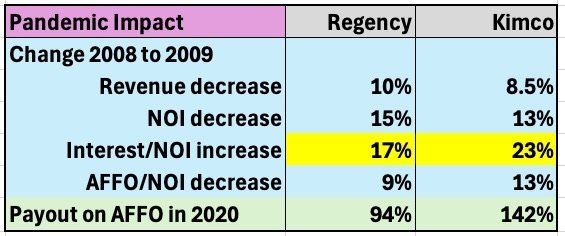

Kimco saw revenues drop 8.5% in 2020. Although the details were unusual, such a drop is not a large one. A 10% revenue drop could happen in any recession, even for properties in a “defensive sector.”

Regency suffered a 10% drop in rental revenues and a 15% drop in NOI in 2020, a bit more than Kimco. But thanks to their lower Debt Ratio, the consequences were different. (This table assumed sustaining capex to be 10% of NOI.)

For Regency, AFFO dropped a lot less than it did for Kimco. The main reason was the impact on interest expense, highlighted in yellow.

Thanks to their low debt and sensible payout ratio, the dividend for Regency only went up from about 74% to 94% of AFFO. Regency skated through.

But the other mistake Kimco was making was to have too high a payout ratio. My estimate is that they were paying just above 100% of AFFO in 2008. The old dividend would have been 142% of the 2020 AFFO. Kimco had to cut.

One other relevant point is that decreases in interest rates do not necessarily improve the sensitivity to revenue loss. A very small bit of simple math shows that what determines the ratio of interest expenses to NOI is the ratio of interest rates to cap rates. That will move less than the interest rates do.

My conclusion: REITs in “defensive sectors” are only defensive for investors if they carry low Debt Ratios. Below 40% is OK for net lease REITs, with their low capex. But higher-capex REITs need more like 30% to have secure dividends. In contrast, any REIT with a Debt Ratio of 50% or more is at high risk of a dividend cut in a recession.

The following contains updates throughout, but much of it is a repeat of my last monthly update.

My Context

My secure income covers 2/3 of my spending budget. At the moment, the other third comes from various paid work.

The secure income includes social security, a pension, and a collection of annuities. Nearly all those sources have escalators of either 2% or inflation.

My dividends from “Go-Fishing” positions — very secure firms likely to grow dividends at least with inflation — also could cover more than a third of my spending. So if work stopped or when it stops, current spending is covered without drawing down the portfolio.

In the meantime I will use those dividends to grow the portfolio and to provide early legacy spending. That will include some early inheritance funds to the kids each year.

The rest of the portfolio pays additional dividends (though not from all positions). These also will help grow the portfolio.

In recent years, my active-investing portfolio has included an income bucket intended to throw off growing dividends, an upside bucket intended to increase portfolio growth, and an illiquid bucket of long-term, private investments made years ago.

Over time the income bucket has evolved to mainly include “Go-Fishing” stocks. These are from firms that only need monitoring once a year, if that.

In response, I have recently added a medium-risk bucket to the portfolio. It will pursue gains from market mispricing of blue-chips or other quality companies. The Quality Gains bucket will better align with the interests of many subscribers, and frankly will be more fun to manage than the Go-Fishing bucket.

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of portfolio market value can be a path to affording larger total dividends.