There is, frankly, a lot to dislike about REITs. Some managements are self-serving. Other managements do not know what they are doing. Some Boards have accepted buyout offers that frankly cheated shareholders, though that is not unique to REITs.

On top of that, long-term REIT investors have suffered strongly since 2021. Here are two of the multifamily REITs, AvalonBay (AVB) and Camden Property (CPT), in addition to the market-cap-weighted VNQ ETF:

There were great opportunities moving out of the pandemic. Then the ZIRP era pushed REITs generally to new highs in 2021. Those highs were up 50% from the lows although less than that from early 2020.

After that, though, skyrocketing interest rates pulled them back below their pre-pandemic pricing. Overall, prices are flat for the past five years. Returns have been those of dividends, at 4% give or take.

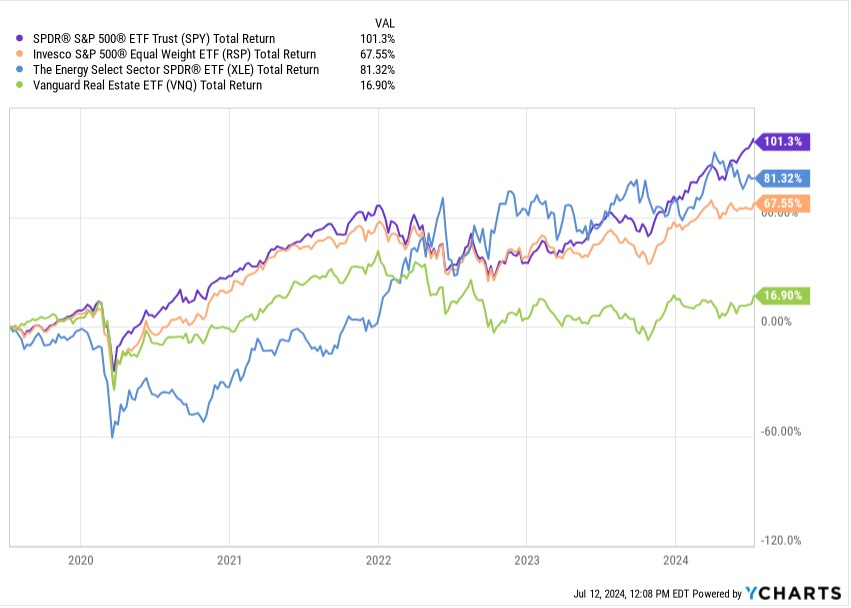

By comparison, over the past 5 years the equal-weight S&P 500 (RSP) is up 55% and of course the cap-weighted index (SPY) is up more than that. Energy investors have done better too, with the Energy Select Sector ETF (XLE) up 40%. That is plus the opportunity to reap significant dividends in that sector too.

On top of all that, REITs generally are doing well and have grown per-share cash earnings over the five years by about 25%. But the markets have given them no credit.

No wonder REIT investors are frustrated. And then some of them read my pieces that offer strong criticisms and find themselves almost ready to throw in the towel and sell at a loss. Please don’t do that; remember Buffet’s Rule Number One.

What is curious is that the trend in REIT pricing makes more sense to me than the trends in the broad indexes. With interest rates up, the value of distant earnings is reduced. [The trend in energy makes more sense, as changes in that industry have increased its value to shareholders.]

The overall earnings multiple for REITs is down about 25% over the past five years. In contrast, the earnings multiple for the RSP is where it was five years ago. My conclusion would be that the markets did something sensible with REITs while the broad market became overvalued.

Still, viewed this way REITs look bad by comparison.

Bad Choices: Consequences for C-Corps and REITs

One significant aspect of REITs adds to their appeal for me. Management is less able to do dumb things that lose massive amounts of shareholder capital.

The REITs of interest to me are tied to real property and also are required to pay out a substantial fraction of their Net Operating Income to shareholders. As a result, there is less scope for management to make massive commitments in stupid ways.

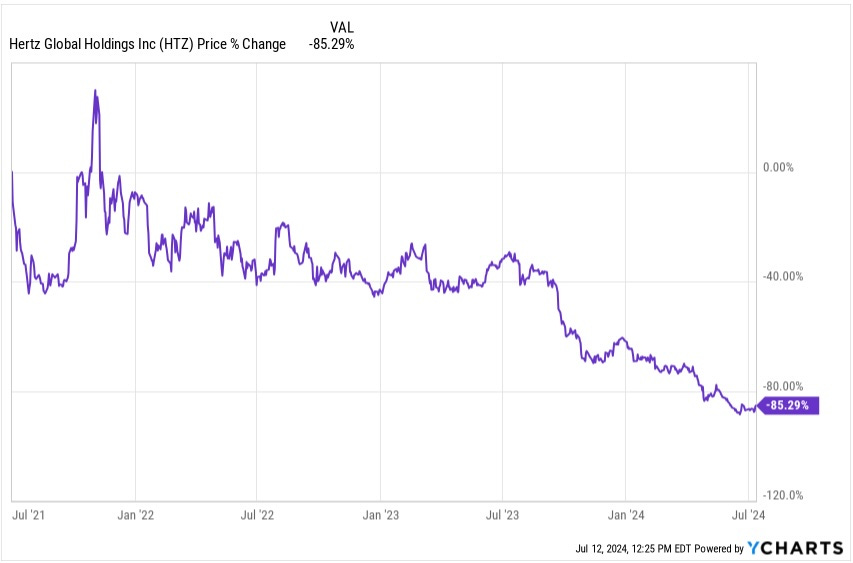

My current poster child for this in the ordinary C-corps is Hertz (HTZ). Their management listened to the media narratives and made a massive investment in EVs for their rental fleet. (They also engaged in massive stock buybacks.)

They learned what anybody with common sense would have told them. Only genuine true believers would want an EV in a strange city for any rental going far enough to need a charge. They reaped what they sowed, and shareholders have paid for it:

This degree of stupidity is rare in REITs, with one exception discussed shortly. You can hear on REIT earnings calls that REIT managements are just as likely to believe foolish narratives as those in other areas. But they are less able to act on those notions in ways that produce huge losses.

The exception is REITs that operate with high leverage. There are REITs with forthcoming annual debt maturities that far exceed their annual cash earnings.

The resulting issue is not interest costs as such. These REITs depend on lenders or credit markets to let them roll the debt. They also depend on earnings staying high enough to avoid violating the debt covenants, which are usually tied to EBITDA or NOI.

The Canadian REITs generally are worse at this than the American ones. Their debt maturities are shorter and they let more debt get close to maturity before dealing with it. On many occasions when the story for some Canadian REIT has seemed appealing, a look at the structure of the debt kept me away.

Such highly leveraged REITs often have great NAV stories, with NAV being Net Asset Value. Subtract the debt from the property value and the per-share remainder will far exceed the current stock price.

The problem is that these REITs are cheap for a reason. Their leverage creates risk and the stock price is discounted in response. You are unlikely to see the price move closer to NAV until the leverage is improved, which is typically a long, slow process.

And if things do not go smoothly with both the business and the debt, then this is what can happen:

Real estate investments using low leverage are much harder to screw up. That is where my REIT holdings are.

Why I Invest

Despite the limitations of REITs, they have been significant contributors to my success. My portfolio has more than tripled in value from its 2020 low, while SPY and RSP have only doubled.

But those gains did not come from buying and holding. My path has been to buy specific REITs when I judge them to be undervalued. This has enabled me to realize significant gains (mainly in 2021) and to generate significant income (in 2022 and 2023).

This can work because REITs are a niche market. Misvaluations are not necessarily well understood or quickly reversed. This often lets one collect good dividends and get paid to wait for a valuation increase.

What is required is a combination of deep knowledge and good judgement. So far I seem to have done well at that.

Recent News (Drawing my attention)

Forthcoming:

The research takes how long it takes, but typically I get through a deep look at one company per week. Soon you will see deep dives on

Pembina Pipeline (PBA), probably this week.

BSR REIT (HOM.U), hopefully next week.

Sun Communities (SUI)

Midstreams:

Enterprise Products Partners (NYSE:EPD) declares $0.525/share quarterly dividend, 1.9% increase from prior dividend of $0.515.

Pembina Pipeline (NYSE:PBA) said last week it agreed to acquire a 50% working interest in Whitecap Resources' (OTCPK:SPGYF) Kaybob complex in Alberta. In turn, Whitecap (OTCPK:SPGYF) will enter into a long-term take-or-pay agreement for Pembina Gas Infrastructure's (PBA) capacity in the Kaybob complex and commit to an area of dedication.

REITs:

The end of this past week saw a big rally in REIT prices. VNQ jumped more than 4% in two days while rate-sensitive SAFE jumped more than 10%. So far this is reminiscent of last December, when everybody though interest rates would soon drop. Well, time will tell.

Alexandria Real Estate (ARE) signed a new 10-year lease comprising 127k SF for its new R&D center at Barnes Canyon Road on the SD Tech by Alexandria campus in the Sorrento Mesa submarket of San Diego. ARE noted that its 1.2 million RSF pipeline of under-construction projects in San Diego is now 94% leased.

W. P. Carey Inc. (NYSE: WPC) today announced that John Park will step down as President of the company effective September 30, 2024. The separate role of President will be eliminated, and the title will be assumed by Jason Fox, the company's Chief Executive Officer.

Personal News:

Two of the three kids have been visiting, with partners. That’s why you see the pontoon boat in the image above. My approach is to rent one when I have visitors. Pricey yes, but far cheaper than ownership.

Member News

This week featured

items that went to all members since June 29:

An article on how REITs should qualify investments.

Items that went to paid members:

The June monthly update

Brief Note on Prologis (PLD)

The Google Sheets (for annual members):

The main attraction on the Google sheet is full disclosure of my portfolio.

There are also a REIT assessment sheet and a Midstreams assessment sheet, each a tab.

Also:

A lot of ongoing random discussions occur on the Focused Investing chat. One can also post items of interest, which I do often. Check it out and post your own items, please.

Annual paid members should have access to the live, real-time portfolio showing all my stock-market investments. (If you don’t have that access, contact me). Comments and questions are welcome.

Great post Paul. The most critical part of this piece is-not buying and holding. I have fallen victim to this sort of "Stockholm Syndrome" in my investing and it has cost me dearly. Congrats on the success of your portfolio. Cheers

I love the pontoon boat. It really does look great.

I am looking forward to getting your thoughts on all three of your "next ups". Those are timely for me, so thank you!!