NYC is back. Time to invest?

SL Green (SLG) is an office REIT focused entirely on NYC and specifically Manhattan. There are two reasons to get interested. First, the Manhattan office market is very low on highly amenitized space and almost none is under construction.

There is coverage every week these days of the collapse in vacancy and acceleration of rents, in particular among quality properties like those SL Green owns. This should lead to higher Net Operating Income (NOI) for SL Green. There is enormous detail about this in their December 2024 Investor Day presentation.

Beyond that they make a good argument that their properties are worth far more than the market is giving them credit for. But they don’t say how much the market price should be discounted to allow for their high leverage.

These things, plus word of debt reduction, motivated an exploration. There is a case to be made that SLG is substantially underpriced. I cover that below so you can make up your own mind.

That said, I won’t be investing and will tell you why.

Who SL Green Is

SL Green owns all or part of 24 properties, all in Manhattan. Of these, 15 properties that are consolidated on their balance sheet, totaling 9.6M rentable square feet (rsf) and nearly 100% owned. They also have 9 unconsolidated properties, totaling 12.2M rsf and just over 50% owned.

They have been upgrading that portfolio over many years now, so that (nearly) all of these buildings have great locations and multiple amenities. The consolidated properties are now 83% occupied and 89% leased, while the unconsolidated ones are 92% occupied and 95% leased.

These percentages are all up 300 bps, give or take, from 12/31/23 to 12/31/24. Those are large increases.

As part of the upgrading, they now have six properties slated for sale that are not of the same quality. This is down from 10 in 2023.

SL Green is also active in other areas. They are using Commercial Mortgage-Backed Securities as a path to take advantage of assets near or in default. They are trying to grow their Assets Under Management, to grow their fees.

Beyond all that, SL Green is active in retail leasing and also in residential conversions of Class B and Class C buildings.

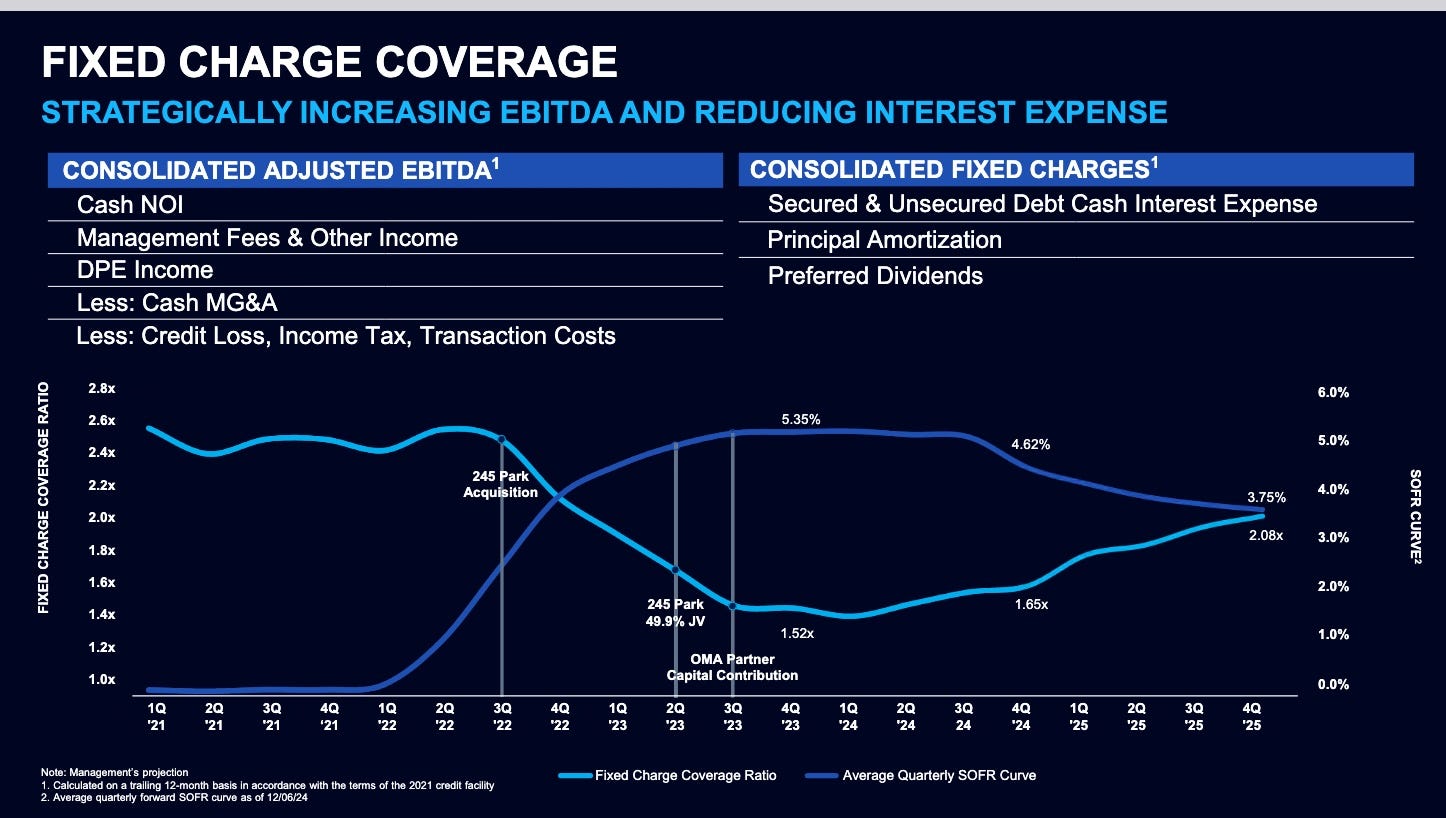

One final point is that SLG has been reducing debt. This has improved their coverage of fixed charges, as is illustrated here:

CFO Dilberto emphasizes that “The real improvement is not driven by rates because we are so insulated. It comes from reduced debt levels, particularly a much lower line of credit balance and improving consolidated EBITDA showing the benefits of our diverse income streams.” Their rates are insulated by being fixed either inherently or via derivatives.

Financials and Stock Price

SL Green projects for Cash NOI from their Manhattan Office properties of $430M in 2025. Here is their summary:

With the price drop YTD, that implied cap rate is up to 8.7%. That is pretty high; will NYC real estate really reprice downward by a third or so? This seems unlikely, so from that NAV perspective one would conclude that SLG is substantially undervalued at today’s price of about $51.

The perspective from cash flows surprised me by ending up similar.

A lot of REITs highlight Funds From Operations (FFO) when discussing growth. But my readers know that FFO has little to do with any ability to pay dividends. And even the usual AFFO can be flawed.

One seeks to fix this with FAD. Here is how SL Green sees FAD:

Note the huge, outlined “second-generation capital,” which is funds associated with replacing tenants. So their FAD drops to 42% of FFO for 2025. For 2024, their FAD was 71% of FFO and 54% of cash NOI.

The SL Green CfO argues that second generation capital is an investment and should not be viewed as a cost. This is a nice, pretty argument. But such capex still represents cash that must be spent and cannot be distributed. (Notably, this is analogous to malls.)

The SLG FAD does highlight something important that is missed by FFO. During periods of increasing occupancy, one has multi-year increases in such capital expenditures. The benefits to revenues come much more slowly than the leasing does.

I discussed the effects in depth for Orion Properties (ONL), after similar costs forced them to cut their dividend. It is also responsible for the inability of Federal Realty Trust (FRT) to implement significant dividend increases despite their exploding FFO.

My numbers for FAD (RPDFAD) are smaller, because I apply the standard definition by also subtracting capitalized interest. They project $58M of this for 2025, reducing FAD by a third.

My 2025 RPDFAD is $1.75/sh, down from $5.40 in 2024. This number is very volatile as that capex fluctuates, despite seeing NOI/sh grow. You can see it as the red line here:

The purple line shows NOI less G&A less GAAP interest costs. The result, an approximation of FFO I call Simple FFO, is relatively smooth.

The next few years seem likely to be a stellar period for pushing occupancy and rents, and thus FFO. But the bottom line seems to be that FAD/sh (and this the dividend) can only increase once the rate of expansion stabilizes.

The average since 2021 of RPDFAD/sh is $3.39. The multiyear average should grow rapidly during this period of active leasing.

If, for example, you assume an 8% CAGR of that FAD/sh for 10 years followed by terminal growth at 2%, and use a 10% discount rate (out of skepticism about the company), they you get a DCF value of in the $120s.

Suppose instead you use the 2025 FAD/sh of $1.75 but grow it at 10% per year for the first decade, and 2% after that. That gives you a DCF of $75.

There is a lot of uncertainty in what the future will be here. But it seems that no matter how you bake the cake, SLG is undervalued by at least 50%.

Beyond that, the great news coming out the Manhattan office environment may well act as a catalyst for the stock price. However, one thing to bear in mind is the risks from their debt.

Not For Me

All that said, it soon became apparent that I will not be investing any time soon. Some of the reasons I will not:

They are seeking “Appropriate leverage for NYC focused real estate owner,” which they seem to see as Loan to Value (Debt Ratio) near 60%. My view is that this is far too high for a public REIT. It risks needing to dilute shareholders and cut dividends.

And indeed, they diluted shareholders 10% in 2024, with the stock price at $79. But this still was a 7.2% yield at my RPDFAD (see below).

They did issue at a local peak in the market, which is good. But it still looks to me like this issuance was dilutive to shareholder value. (They will probably say the reverse because they will argue that some actual costs “don’t count”.)

And likewise they have cut the dividend 20% since 2021.

Now maybe all that is done for this cycle and shareholders won’t get screwed more for a while. But who knows what the impact of the Trump tariffs or other future actions might be. My view is that you can’t count on good times.

SL Green is pivoting toward a “capital lite” model and planning to emphasize asset management going forward. That is still a small segment but I find the finances of asset managers too opaque. My investment dollars are not going there.

They are moving away from Unsecured Debt and toward more property-level mortgage debt in JVs. This does insulate the consolidated corporate books, but also adds risk to the overall enterprise.

Mall REIT Macerich (MAC) ran that model, which drove them near bankruptcy during the pandemic.

This also assures that they will never get an investment-grade credit rating (they are now BB+). They like to say that they have an investment-grade balance sheet but not the rating. I for one am not buying it, for reasons seen above.

It’s Up to You

Invest at your own peril; you might make big gains. Or not.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

Thanks for the writeup. But why is it that stock-based comp is added back to arrive at FAD or RPDFAD. That is a real expense and should treated as such. Is it that you are only seeking out the cash generation ability and there is another metric where that expense is captured?

SLGPRI pays 7.6% but I'll pass. Perhaps not germane to your presentation I am curious about the leasehold on Manhattan. I just assumed, wrongly, it was all fee simple. Is their a lot of land leases on Manhattan? Does SLG own substantive amount of leasehold properties? Would be interesting to see those land leases...