Having recently made the broad case that the future was promising for miners of Platinum Group Metals (PGMs), the next step was to look at specific companies. After some poking around, I chose Anglo American Platinum (AGPY).

We start with a review of the big picture on PGMs.

A PGM Supply Crunch is Coming

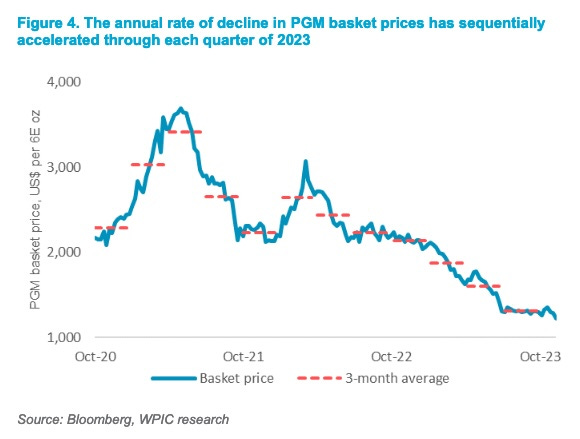

The price of a basket of PGMs (platinum, palladium, rhodium, osmium, iridium, and ruthenium) has dropped more than 3x since mid-2020:

We’ve seen this movie before. Commodity price crashes often render a lot of production uneconomic, and that is the case here too. The cure for low prices is low prices.

Production cutbacks overshoot, and the price has to rise sharply to allocate the available supply and incentivize increased production. We are on that train today, as was discussed in detail in my prior article.

Sure there was a story the EVs will immediately replace all internal-combustion vehicles, eliminating the need for the catalytic convertors that are the main use of Platinum and/or Palladium. If you ever believed that, reconsider your assessment of media narratives and political initiatives driven by questionable ideology.

Depending on how rapidly production is curtailed, existing above-ground stocks of platinum will be exhausted in a few months to a few years. And production is rapidly being curtailed, as I detailed.

Increasing prices will increase profits immediately and provide opportunities for growth by increasing production. Absolutely typical for the bottom of a commodity price cycle.

Investments in financially sound producers of PGMs today have an excellent chance of paying off big within a year, and are very unlikely to produce losses if things move more slowly. That’s my kind of game, but the next question is risk.

The only miners worth thinking about are in South Africa. This is far from a risk-free location but is better than some.

The potential gain has to be large enough to compensate for the risk. And the investor has to be willing to accept it. For me personally, this would limit the size of any position.

Now we turn specifically to ANGPY. The price has dropped more than 3x from the peak in 2022:

They report separately but are mostly owned by the larger Anglo American. The two are in the process of a separation, targeted for completion next year. Here is how they summarized that in the H1 2024 results presentation:

The planned demerger from Anglo American will create a more focused, independent global leader in the PGM industry, with the scale and robust foundations to maximise the potential from our outstanding business, assets, and people.

We start with their mines.

The Anglo American Platinum Mines

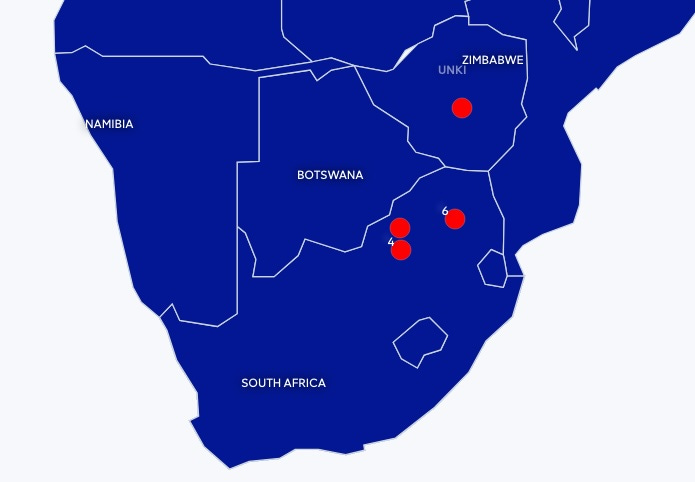

Most of the ANGPY PGM mines are located in South Africa, with the Unki mine being in Zimbabwe. Mines elsewhere have tiny production. They show four of them on a map:

Here are their summaries regarding these mines:

Our flagship mine, Mogalakwena, is one of the highest margin PGM producers in the industry and, as the only large open pit PGM mine globally, is at the centre of a more flexible, competitive and lower risk business.

Amandelbult consists of Tumela and Dishaba, two underground mines located between the towns of Northam and Thanazimbi in Limpopo, South Africa, on the northwestern limb of the great Bushveld mineral complex.

Mototolo/ Der Brochen mine is a PGM mine located in the north-eastern part of South Africa in Burgersfort, Limpopo. It represents one of the largest PGM reserves in South Africa.

Our mechanised PGM mine on the Great Dyke of Zimbabwe has a life span set to extend beyond 2040. It is the first mine in the world to publicly commit to be independently audited by the Initiative for Responsible Mining Assurance’s (IRMA) Standard for Responsible Mining.

ANGPY also is part of a number of JVs.

Mined Production and Costs

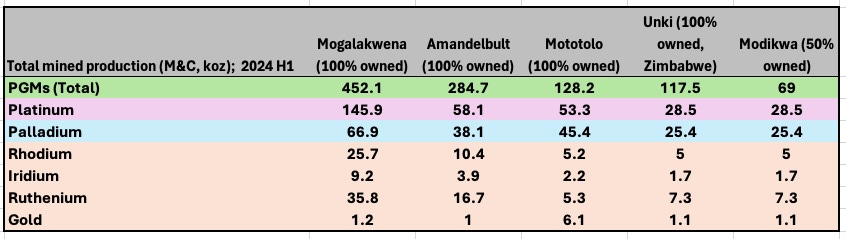

The mined production from these mines, for the first half of 2024, was as follows:

In round numbers, the production in H1 was 1100 Moz, about 60% of the total they sold. In addition, they purchased 600 Moz of concentrate from others.

They guide to midpoints of 3.5 Moz for 2024 and 3.2 Moz for both 2025 and 2026. So they are dropping production by about 10% starting next year.

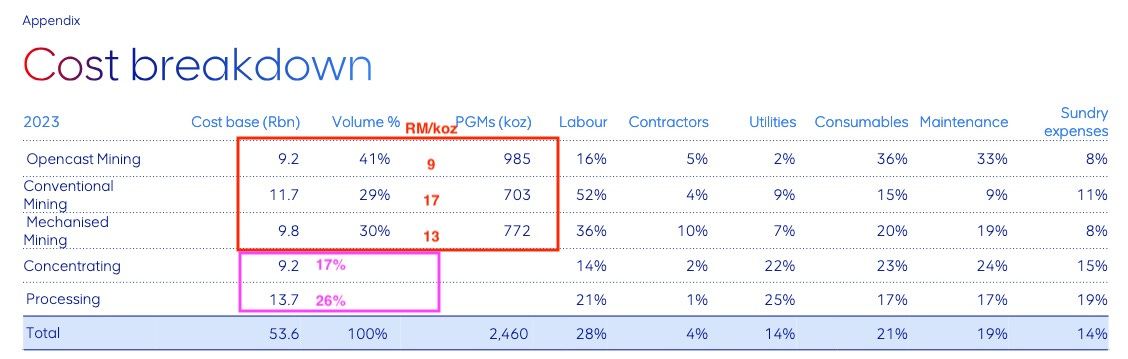

It is informative to look at the relative costs by type of mine.

Opencast mining is also known as open pit. Conventional (underground) mining is labour-intensive, though of course it involves a lot of machines. When there is much more automation the mining is labeled “mechanized.”

Here is their breakdown for 2023, of mining costs. [The additional costs (p. 42) associated with Purchase of Concentrate (POC) were about 80% of these.]

The red box highlights the overall cost and production. The red text gives the cost per ounce. We see that conventional mining is nearly twice as expensive as open pit. The primary reason for this is that it is labour intensive. Mechanized mining closes half the difference.

This did not change a lot in H1 2024, but may change quite a bit in H2 in response to their cost-reduction initiatives.

Nearly half the total cost is incurred after the mining (purple box). Concentrating is a complex process involving large machines that like to break.

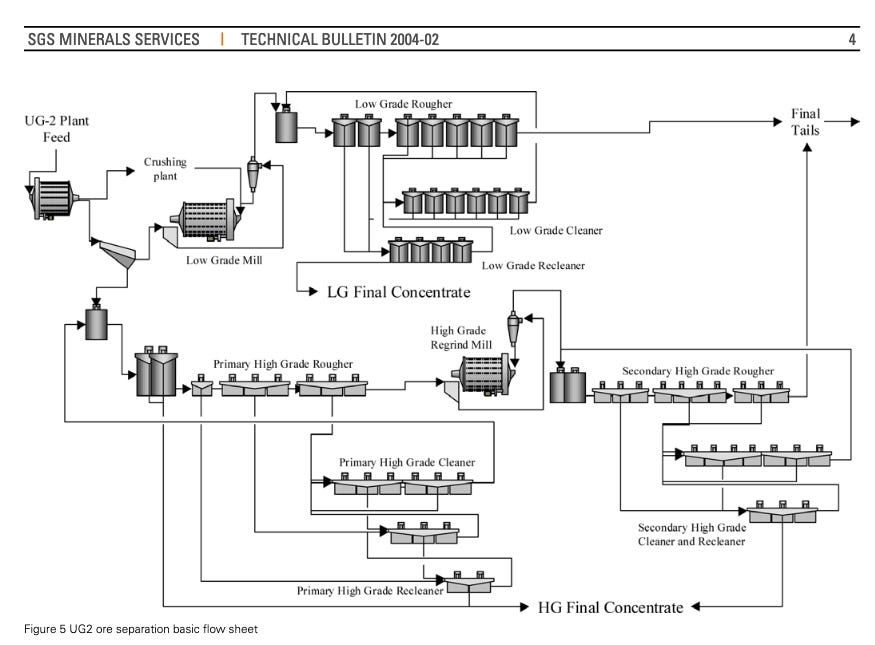

Concentrating also has to be customized for the specific minerals each mine produced. Here is a schematic from Impala Platinum (IMPUY) for one of their mines.

Processing involves a lot of further steps and methods. These subject the concentrate to mechanical, chemical, and thermal processes in order to end up with useable metals.

Next we look at how this all has translated into financial performance and at what the future may hold.