Are any shopping-center REITs worth buying today? As usual, that depends. Here I share a look at Brixmor Property Group (BRX).

By Market Cap, Brixmor is the fourth largest shopping-center REIT, after Kimco (KIM), Regency Centers (REG), and Federal Realty (FRT). My recent deep study of Regency, which included some comparisons to Federal, is here.

Brixmor owns 360 shopping centers and has a total of 5,000 tenants. They focus dominantly on open-air centers anchored by grocery stores. Like most such REITs, Brixmor has spent the last decade plus moving their portfolio into neighborhoods with higher population density and higher average household income.

They boast higher rates of change of same-property NOI and in-place ABR, and higher new lease spreads than their “peers”. [Here NOI = Net Operating Income and ABR = Annual Base Rent.] From their footnotes these apparently include REG, FRT, KIM, and Kilroy (KRG).

Of course same-property NOIm in-place ABR, and new lease spreads are the areas where their business model is strongest. We will compare total NOI growth below.

Overall, Brixmor is benefiting from the same tailwinds as the rest of their sector: underbuilding of retail space and healthy retail overall. There are as usual some tenant bankruptcies, but the anticipated revenues deemed uncollectable for the year are expected to be no larger than 75 basis points of revenues, a decent number.

The Brixmor debt maturity ladder is excellent, with most of the debt spread over the next 7 years and some of it further out than that. The ratio of Debt to Gross Assets is about 50% for Brixmor. In contrast, Regency is near 30% and the other two are near 40%. This makes Brixmor cash earnings significantly more vulnerable to declines in revenues.

Regency, Federal, and Kimco are the only such REITs with credit ratings of BBB+ or A-. Brixmor is rated only BBB by Fitch and S&P and Baa3 (like BBB-) by Moody’s.

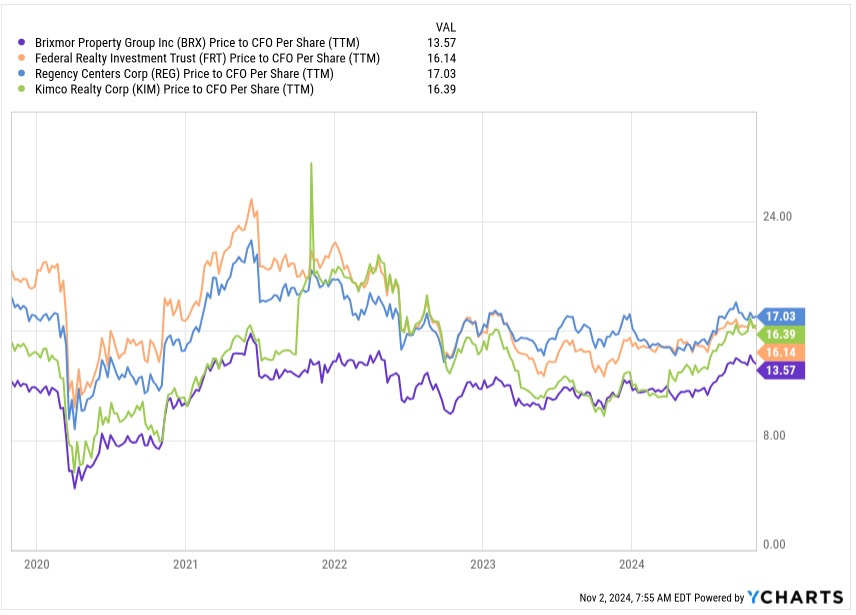

And Brixmor is valued less highly than those others. Here is Price to CfO/sh (Cash from Operations per share) for all four:

REG is valued at a ratio of 17x. FRT is valued at 16.1x. My previous conclusion was that REG is fairly valued and that FRT is worth somewhat less since they are still a bit hamstrung by debt taken on during the pandemic.

KIM has been all over the place, but at the moment is valued above FRT. I’ve never been a fan of KIM, at least by comparison, and certainly would not pay that much.

In contrast to those three, BRX is valued at 13.6x CfO/sh. Superficially this suggests that it might have more upside. I’m looking to diversify my REIT holdings; perhaps this is a candidate.

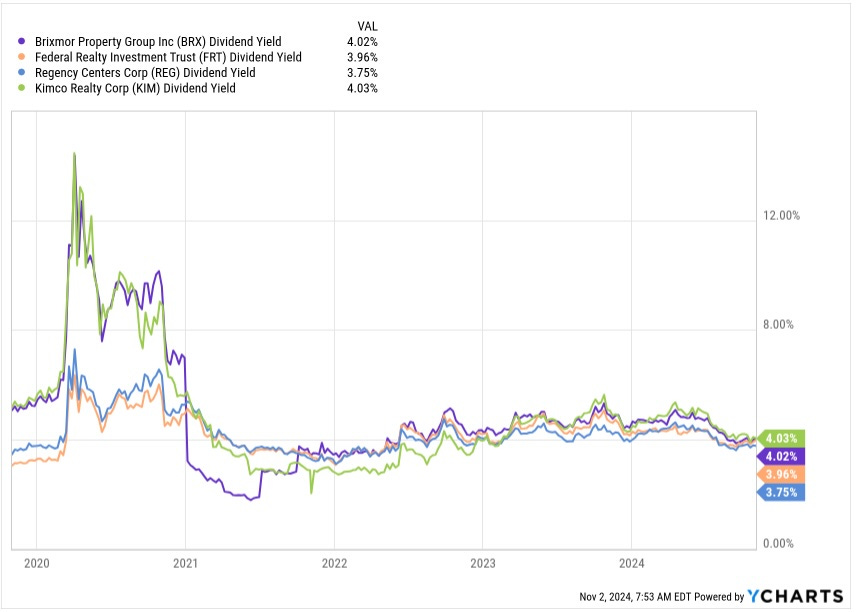

But then you look at the dividend. The comparative dividend yield is quite surprising, with BRX comparable to REG and KIM:

So BRX is priced at a lower multiple, which usually suggests a higher dividend. But their dividend yield is in the ballpark of the others. This is not really making sense.

Let’s look further.