W.P. Carey today is a Net Lease REIT, relatively normal in structure. They are diversified geographically but focused by tenant industry.

They got to where they are today in a complex way. But that is all in the past now; our goal is to we look forward.

Before we get into details, WPC has these attributes:

A dominant focus on industrial properties, including comparable amounts of warehouse space and manufacturing space.

A substantial focus on retail properties.

An international scope, with about a third of their properties in Europe.

A focus on relatively large properties, averaging about 150,000 square feet.

A 12 year Weighted Average Lease Term

Stronger lease escalators than is typical for such REITs

A BBB+ or equivalent credit rating

A 4.4 year Weighted Average Debt Maturity, on the short end for such REITs.

Critics can point to their very short debt maturities by comparison with, say, NNN REIT.

The impact of the lease escalators is often overstated by analysts, though. Only a third of them are uncapped CPI and they have remarked that tenants are not going for that anymore.

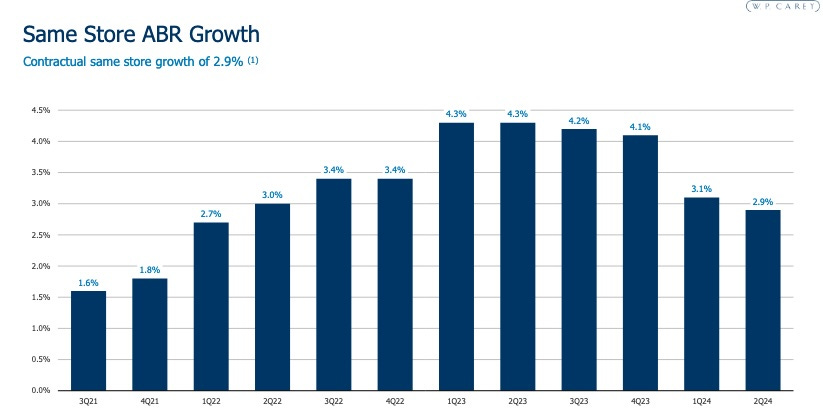

Still WPC does get superior rent escalation. You can see that since 2021 they have done better than most such REITs, including for example Realty Income (O) and Agree Realty (ADC) having escalators of 1% to 1.5%.

Let’s proceed to look at the very recent history.

Execution

Our focus here is not on the past transformations of WPC. There have been a lot of them, covered by me in previous writings.

We will not try to dig through all the details from last fall either. But to set the context here are a few summary items:

WPC announced in September their decision to actively shed all their office properties.

Some of these were spun off into a new (liquidating) REIT, providing some cash and also taking over a disproportionate fraction of the total debt.

The rest have all been sold, with only one sale remaining to close, in Q4 this year.

Their largest previous tenant, U-Haul, exercised their (idiosynchratic) end-of-lease right to buy back their properties. This too closed in Q1, reducing WPC revenues but providing cash.

They settled all outstanding forward equity sales in Q3 last year, netting just over $380M.

They will eventually reap a few hundred million dollars from their investments in cold-storage REIT Lineage, following the recent Lineage IPO. But this is looking like it will pay off over a few years, so we ignore it here.

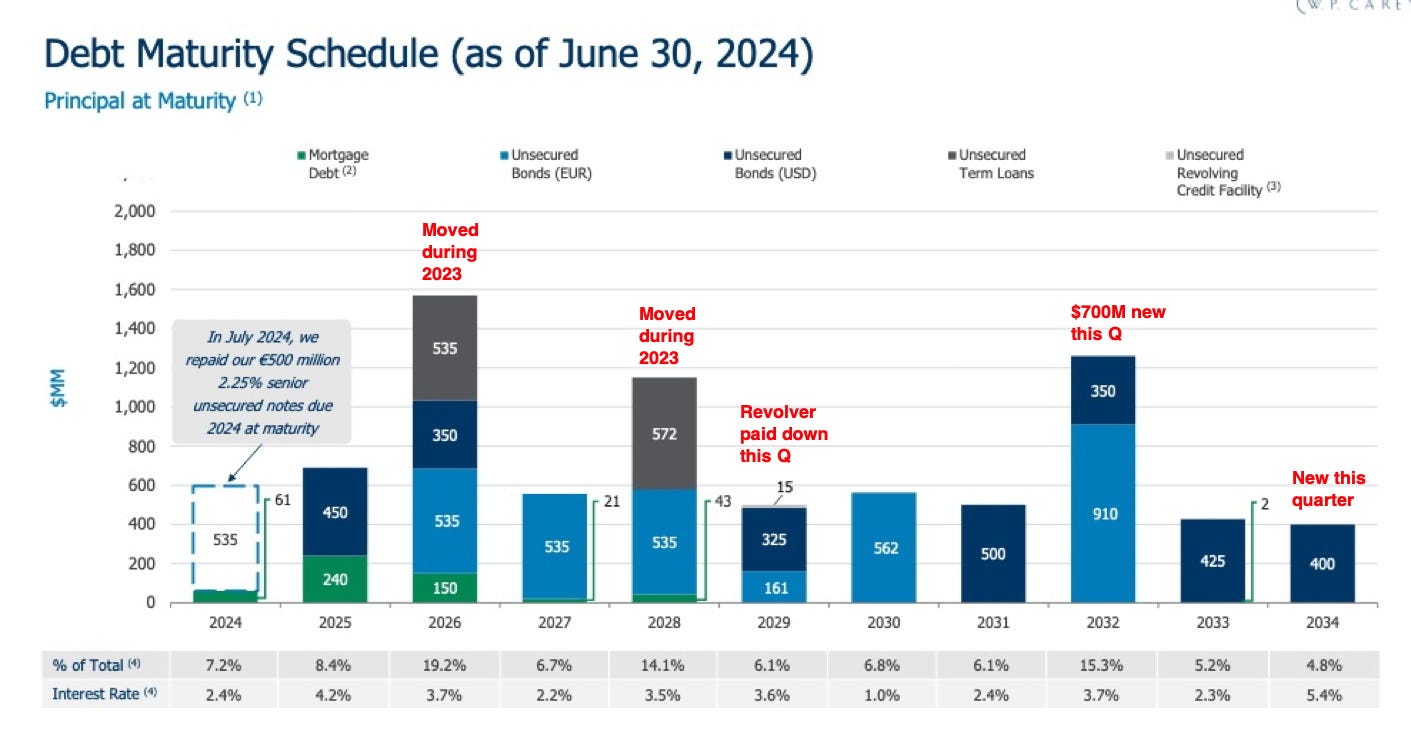

In total, WPC raised nearly $2B in cash. They used some of it to improve their (remaining) debt ladder, as you can see here:

On net by July 1, 2024, they have reduced total liabilities by about $800M (10%) and have moved new maturities out about 10 years. They also moved the term loans downstream, as is always expected.

My main disappointment about their debt management is that they did not exploit the ZIRP era to place some low-rate, 30-year debt. A number of other REITs did just that.

Where WPC is Now

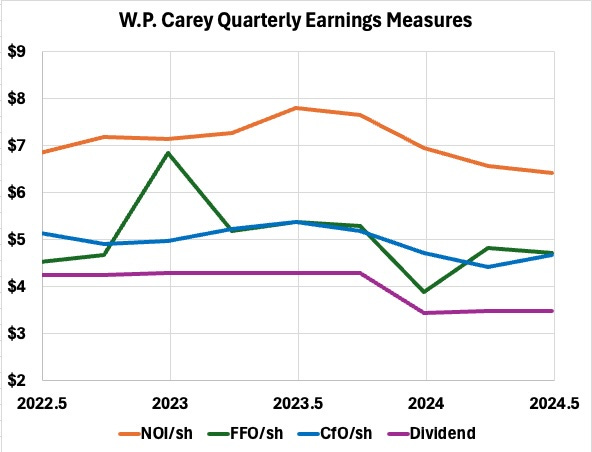

The Q2 2024 Financials reflect all the revenues remaining after the spinoff. The interest costs have since decreased (about $13M) from the debt paydown in July. We can see the impact of their transition in the quarterly earnings measures:

The main story is always found in NOI/sh. You can see that it dropped from near $8 a year ago to about $6.50 in Q2.

Here as usual, the CfO/sh (adjusted to remove changes in working capital), based on actual cash flows, tells a more consistent and sensible story than NAREIT FFO/sh, whose definition was impacted by politics.

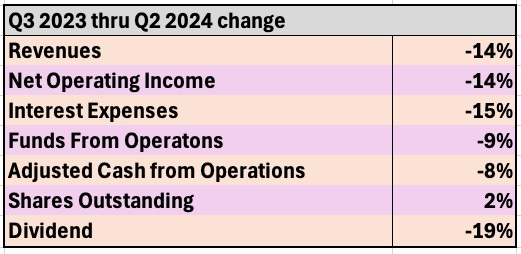

It is useful to look across the period from Q3 2023, before any dispositions, through Q2 2024, after they were substantially complete. Here are the net changes in these parameters plus Revenues, Interest Expenses, and Shares Outstanding:

The result of the 2% dilution, from settling previous forward equity sales, is to decrease all earnings measures but the dividend by another 2%. The larger relative decrease in the dividend reflects their decision to simultaneously decrease the payout ratio.

That decrease of payout ratio has been needed since their REIT IPO a decade ago. It secures an ability to grow AFFO/sh modestly in all markets, without issuing new stock.

Since WPC revenues are not seasonal, we can use Q2 as a starting point for their future from here.

Near-Term Prospects

At the end of Q2, WPC had $1,229M of cash. After then paying off the $535M loan in July, they had $695M left in cash and had reduced interest expenses by $13M.

Their debt is in place. Suppose they invest that remaining cash at present-day initial cash cap rates of 7.7%. This would produce $53M of new NOI.

In combination, the new NOI and reduced interest costs would boost CfO by 6%. By comparison with the drop in CfO seen above, the net cost of exiting office looks like 2% of CfO.

We know that office, and especially single-tenant office, is a treacherous sector today. Buildings that lose tenants are costly to re-tenant and can become substantial if not total losses.

That 2% of current CfO is about 10% of the CfO from their previous office properties. Escaping the risks there, at that price, looks to me like it was a good move.

After that, WPC should be able to invest perhaps 15% of CfO as retained earnings at an ROE of at least 7%, producing about a 1% increase in CfO per year. Rent bumps should boost NOI by about 3%, which would boost their annual growth to 4% less net winds.

Headwinds may include rolling more debt at higher rates and tenant problems. Tailwinds will include finally monetizing the Lineage investments.

A notional growth rate of CfO/sh of 4% is a good place to start in thinking about the future. Lots of solid REITs are in that ballpark. For Carey, if inflation is larger, that (nominal) growth will be too.

Worries

Recent quarters included an unexpected development that I see as grounds for concern. This was the bankruptcy of their third largest tenant, Hellweg.

Hellweg is a retail chain focused on do-it-yourself home-improvement. Think Home Depot. They are a top-10 tenant, who had 2.2% of total Annual Base Rent, now down to 2.0% for Q2. But that is not the end of the story.

Hellweg got themselves in trouble when a decline in sales left them unable to cover their rent. Debt is likely part of the picture, but the full story there is unclear for this private firm. I did find evidence of a debt-funded expansion a few years back.

Germany is not in a state of economic collapse, and instead is slowly recovering from a recession in 2023 (per the European Commission). The only thing in recent years that would create big problems for a company would be too much floating-rate debt.

My perspective is that a retail firm should structure itself to be able to survive recessions, even deep ones. Hellweg clearly did not. Yet WPC also clearly did not know this.

Quoting Brooks Gordon, Head of Asset Management, in the Q4 2023 call, “the situation with Hellweg … was really a very late in the year development. They now are on our watch list.” NOW?

Me to WPC: So you only put tenants on your watch list when they reach the point of default? What is wrong with your tenant monitoring? How are you fixing it?

No information.

What Gordon did say is “From a coverage basis, they're coming off a very slow period, but we would expect this to be kind of in the 1.25 coverage range, that's before they execute on what we think is a robust turnaround plan.” That seems to me to be quite poor coverage, especially after a 15% decrease in rent.

The contrast with Essential Properties Realty Trust (EPRT) is remarkable. EPRT reports that they have “Unit-level coverage of 3.9x with ~99% of ABR required to report unit-level P&Ls.” Clearly WPC is not getting unit-level financials.

That foreshadows my concern. Amongst the WPC tenants, and especially in those European markets where debt got really cheap for a long time, how many other Hellwegs are there?

Hellweg ended up with a permanent, 15% reduction in their rent. That reduces overall WPC revenues by a third of a percent and CfO by about 0.5%.

WPC reports that they have 346 tenants. If 10% of them each were to produce a loss half that large (0.25% of CfO), this would wipe out more than half the annual growth.

So this issue does not look severe. It would not push WPC to a default of their own. But it does threaten the growth story.

Foolishness

Two subtopics here.

Negative cash flows:

Let me start with my personal perspective on real estate investments. It is usually foolish to make an investment that is cash-flow negative at the start.

Lou Haddad, CEO of Armada Hoffler (AHH) for decades, agrees. From the AHH Q1 2024 call: “we've seen some real estate companies play the game of looking at year four or five as far as stabilization and saying that they're making a spread. That's just not a game we've played for 40 years and are not going to start now.”

Making real-estate investments with initial negative cash flows disrespects Murphy. Something can go wrong that puts you cash flow negative even if you start positive. And starting negative just invites him to make you pay for your foolishness.

Companies develop problems on their own. The Fed and other macro influences create problems.

It seems clear to me that present cash flows are relatively certain and future changes in cash flows are provisional, even if your leases have escalators. So one should set value by treating escalators as a contribution to growth, not as cash flows that are in the bag.

What we’ve seen by CEO Jason Fox in the last two earnings calls is claims that the average cap rate, over the length of their new leases, is 9% and that he thinks this is meaningful and actionable. A specific example from the Q1 call:

Our investments year-to-date had a weighted average going in cash cap rate of approximately 7.4%, providing initial accretion and average yields around 9%, reflecting rent growth over the life of the leases.

It became clear on the Q2 call that Fox believes that the spread from those averaged cap rates to interest rates is a meaningful basis for investing.

That 9% average yield is for example a GAAP straightlining of the rent payments for a 15-year lease with an escalator near 2.7%. But there is a fundamental problem with straight-line rent; it does not account for discounting of value with time.

On the one hand, that only evaluates to a difference in Net Present Value (NPV) of a few percent to 10 percent. On the other hand, the NPV difference may not be the main thing.

If Carey begins to do transactions that are cash-flow negative, this will subtract from CfO/sh and AFFO/sh. It will reduce their hard-won ability to grow the dividend. And it will leave them more exposed to the vagaries of the future, whether tenant defaults, interest rate increases, or other headwinds.

Understating Debt Ratio:

Other foolishness includes the description by Carey of their leverage. CFO Toni Sanzone said, in the Q3 2023 call: “We are maintaining our leverage targets of low to mid-40s on debt-to-gross assets.”

Now my sense is that for most Net Lease REITs the ratio of Debt to Gross Property runs near 40% (with exceptions that are lower). But WPC is actually above 50% by that measure.

You can see in a footnote in their investor presentation that Carey defines Gross Assets as Total Assets on the Balance Sheet plus depreciation. It includes significant quantities of Good Will (good grief!), Other Intangibles, Investments in Securities, and Accounts Receivable.

In contrast, Realty Income (O) shows Long-Term Debt as $20M and Gross Property at $50M, for a nice clean 40% ratio. This difference in details that matter and how then are disclosed disturbs me, a lot.

Why the sleight of hand from Carey? They carry more leverage, which is more risky. They should explain why but instead it seems that they hide it.

On net this again may not be something that can push them over the edge. But it makes the dividend more exposed to bad times.

Valuation

As with most Net Lease REITs, because of minimal recurring capex and capitalized interest, AFFO (Adjusted FFO, which they report) is not terribly different from both CfO and FAD. FFO is often close to these, but jumps around more as usual.

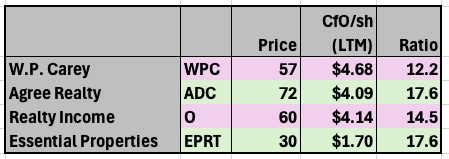

The annualized CfO/sh based on Q2 is $4.68, which is a good current number. At their current price of about $57, WPC stock is priced at a 12.2x multiple of CfO/sh. Here is a comparison:

[Note that EPRT has an unusual amount of straight-line rent for this type of REIT, P/AFFO and P/FAD for them will be higher than the more-easily found P/CfO.]

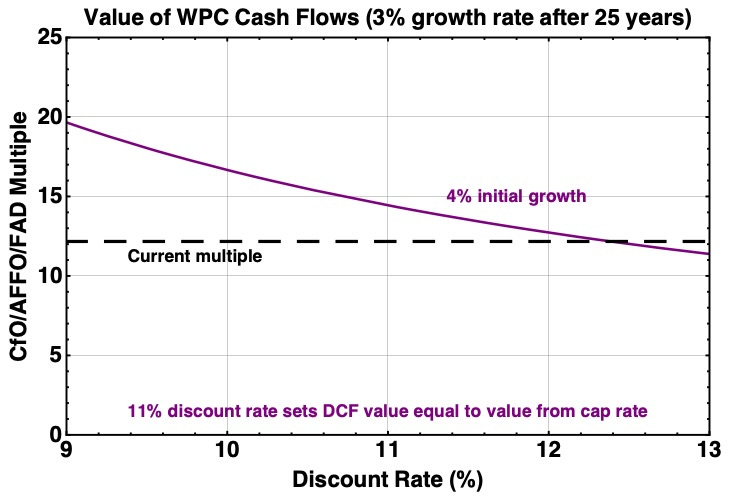

One way to set a discount rate is to demand that the value of the REIT based on current cap rates matches the value based on discounted future AFFO/sh. Here that implies a discount rate of about 11%. (Net Lease REITs have higher cap-rate properties, which implies a higher discount rate by comparison to other REIT sectors.)

The resulting multiple plot becomes:

This suggests that WPC should be valued near where Realty Income (O) is. This would be a 19% increase in price.

That works for me. I see both those REITs as flawed but capable of growing, probably.

Many analysts see upside for the entire net lease sector. Economically, that ought to happen when cap rates come down, presumably after interest rates come down.

The market might give credit for the interest rates before cap rates respond, which did after all happen on the way down. If you want to play that, then WPC does seem to me a promising way to get another 20% beyond what you get from the sector overall.

Takeaways

Summing up, this is how I see W.P. Carey at the moment:

They have executed their spinoff and other recent transactions very well.

They should end up with roughly a 2% net loss of CfO, AFFO, and FAD as an outcome of the office spinoff and other developments. To my mind shedding that risk was worth more than that loss.

Their failure to see the Hellweg problems coming is very concerning. We, and apparently they, have no way to know how many bombshells remain to fall as the hangover from ZIRP continues. But the potential damage is more about limiting growth than creating existential risk for W.P. Carey.

My view is that they tempt Murphy more than a blue-chip REIT should, in two ways:

Their leverage, measured apples-to-apples, is the highest amongst the investment-grade Net Lease REITs. This implies greater risk to the dividend.

They seem to think that investing at negative cash flows is fine, if one has confidence that those cash flows will become positive over time and on net.

They seem undervalued to me by about 20%, if one is willing to tolerate the risks.

As a result, their dividend yield (above 6%) is the highest among non-experiential Net-Lease REITs.

I expect to keep holding my small position for now, hoping to collect the dividend and get that upside. Over the next few quarters, growth of AFFO and the dividend seems likely to emerge. In turn, this seems likely to improve relative pricing.

That said, I look forward to eventually being rid of this gang.

This is a great write up, with the final sentence a real fresh eye opener!! I appreciate your honesty.

100% Agree! Hopefully, just a matter of time.