Born into slavery. Fought their way to independence just in time to suffer in the Troubles. Rose from distress only to face further uncertainties. This is the tale of Western Midstream (WES).

Western Midstream is focused primarily on gathering and processing of natural gas. They also have extensive operations of two other types: gathering and processing liquids (crude oil and natural-gas liquids or NGLs); and gathering and disposing of produced water.

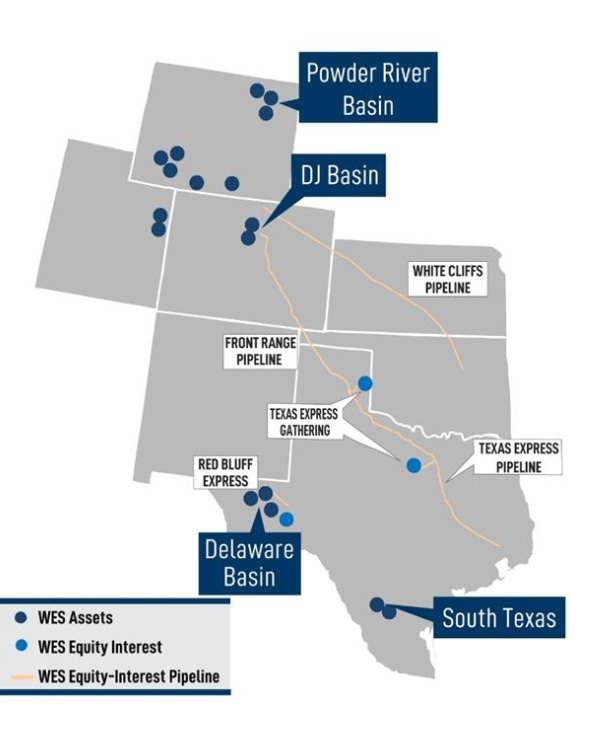

They own interests in several pipelines but do not operate any of them. That is left mainly to the big boys, who have several times their enterprise value. Here is a high-level map of their assets.

They don’t have any export terminals or any of the other facilities that one sometimes sees. That makes them a simple story, in some respects.

While WES is active in the mountain states whose total production is comparatively low, most of their investments and revenue sources are in the Delaware Basin, a part of the Permian in West Texas.

The Gathering Business

WES has very little exposure to commodity prices. They get their revenues from fee-based contracts, and revenues from over 2/3 of their volumes are guaranteed through either Minimum Volume Commitments or Cost-of-Service Protection.

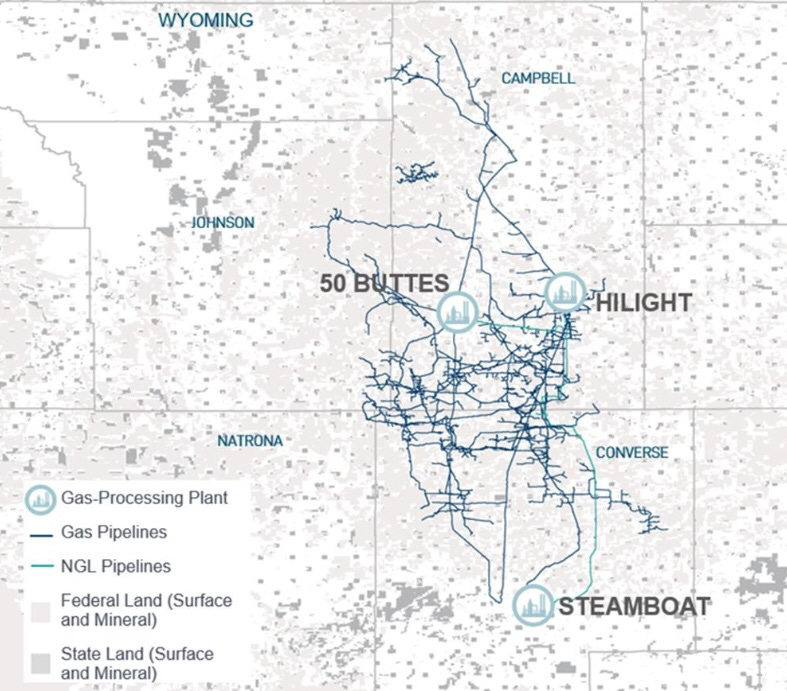

This next map illustrates the gathering network they operate in the Powder River Basin in Wyoming, which is small enough to be portrayed simply. They have oodles of small gathering pipelines that extend to individual wells.

They also have three gas-processing plants in that basin whose output is both natural gas and NGLs. The processed gas and NGLs each travel further in their own pipelines.

In contrast to the the big midstreams and some others, WES has no fractionation plants, to separate the NGLs into purity products. They sell their NGLs to someone who does. In other basins WES gathers oil and produced water as mentioned above.

There are couple aspects worth noting about gathering systems. Any operating well needs access to gathering for whatever it produces. But modern horizontal, fracked wells produce an initial high-volume spike of output followed by a lower-volume tail that lasts many years.

So the gathering systems for a specific well are in place for a very long time. Typical contracts are based on fees for volumes, so the revenue to the midstream peaks early and then fades. The contract addresses conditions under which service can end.

The result is that to sustain production from any basin requires the continual drilling of new wells. This in turn requires new gathering pipelines.

So any midstream doing gathering has to invest capex to serve these new wells. It may not be “maintenance capex” as such, and it does produce a return on equity. But it is necessary and that return may not do more than offset the decreased revenues from declining wells.

The implication from this is that increasing EBITDA for WES has to come from two sources. These are expansion of production by their producing counterparties and the addition of assets by M&A.

Both of these aspects contribute to their projection of an 11% increase of EBITDA for 2024 vs 2023.

Context from the History

There was a time when most Master Limited Partnerships (MLPs) in midstream energy were captives of a specific upstream oil & gas company. For Western Midstream, that was Andarko.

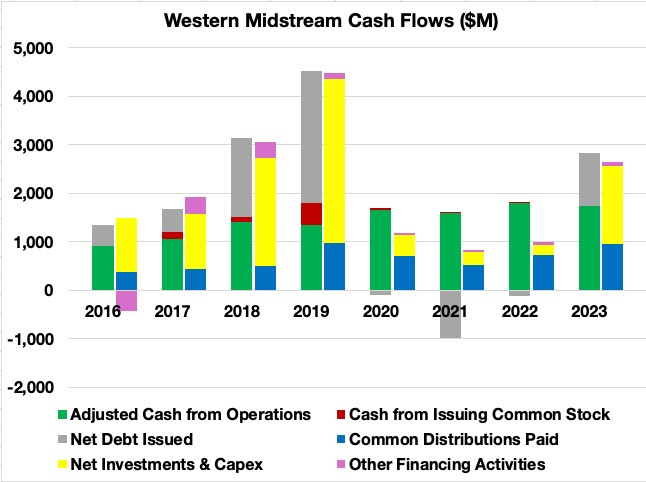

Andarko had the power to give assets to Western and make them pay for the assets (subject to some constraints, not worth digging into here). You can see the pattern in the cash flows through 2019:

Here the left stacked bar for each year shows sources of cash while the right stacked bar shows uses of cash. You can see that the net investments, shaded yellow, were always larger than the green bars showing Adj. Cash from Operations (taking out working-capital variations), labeled CfO below. The difference is standard Free Cash Flow (FCF), which was negative throughout that period.

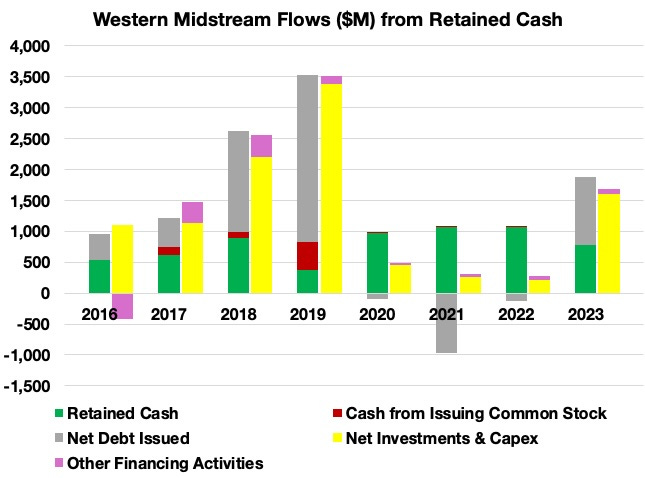

This set the FCF fanatics to howling that the company was having to borrow to pay its distributions, which is a really dumb way to look at it. A much more accurate description of the business focuses on Retained Cash, approximately the CfO less distributions here, as maintenance is included in operating costs:

What you see is that through 2019 the new investments were paid for by retained cash, new debt, and a bit of issuance of common units. And through 2018, the ratio of Debt to Gross Assets stayed below 50%. EBITDA and CfO were increasing strongly, with minimal issuance of new units, and the dividend was quickly rising.

Slavery can be lucrative.

Gaining Independence

Gaining independence can cost.

Across 2019, Occidental Petroleum (OXY) bought out Andarko. They then tried to sell Western Midstream, before giving up on that and granting them independence instead.

That cost WES dearly. They had to buy their independence. (Again, lots of details not worth our time by now.)

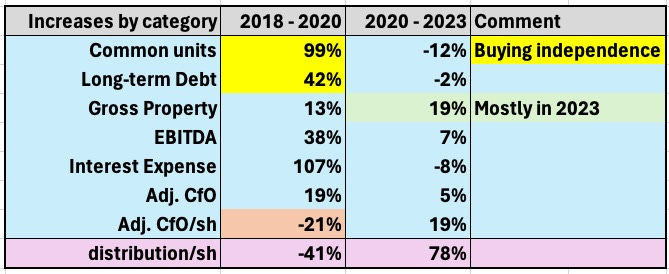

What we see across 2019 and 2020, making this happen, was:

The share count doubled, the long-term debt increased substantially (shaded yellow), and the interest costs more than doubled. This reduced the CfO/sh more than 20%. After 2020 the numbers improved, but slowly.

Amidst the enormous uncertainty caused by the Troubles of 2020, the board eliminated the distribution for one quarter and then brought it back at half its former level. It came back to nearly even in 2023 at 89% of the 2019 value. And now that is about to be blown out of the water.

CEO Michael Ure provided a great summary of the past four years in the Q4 earnings call. Here it is, at some length:

In early 2020, we had more than 450 million units outstanding, net leverage of approximately 4.6x, and we faced a monumental task .… When the pandemic hit, WES was downgraded below investment grade, and we immediately took significant steps to materially reduce leverage and improve the health of the balance sheet.

Our shift to free cash flow generation has led to strong results, including repurchasing 15% of our unaffected unit count and reducing our expected year-end net leverage by more than one and a half turns since the end of 2019, when taking into account the non-core asset divestitures and 2024 financial guidance we announced yesterday.

We also regained our investment-grade credit rating, and our ability to meaningfully improve the balance sheet put us in a position to debt finance the [recent] Meritage midstream acquisition and transform our Powder River Basin footprint in the second half of 2023. Additionally, we have returned to growth mode, sanctioning Mentone Train III in 2022 and the North Loving plant in 2023, both of which were underwritten by long-term contracts backed by minimum volume commitments, and further demonstrates our commitment to capital discipline.

These actions, coupled with the recent non-core asset divestitures, have ultimately resulted in our ability to accelerate the return of capital to our unitholders and position us to recommend a 52% increase to the base distribution. At $0.875 per unit quarterly [or $3.50 per unit annually], our target 2024 base distribution represents a 41% increase relative to our pre-pandemic distribution level…

If you look at the cash flow plots above again, you can see that recent years all featured retained cash larger than investments until 2023. Last year is when they debt financed that major acquisition (for them) of Meritage Midstream. They raised a comparable amount of funds by selling non-core assets at a good price.

Here lately WES has been exuding some sense of completion. They are building two processing plants in the Delaware Basin: Mentone III and North Loving. Their present view is that these will accommodate foreseeable future growth.

This leaves them without significant internal projects for growth (a sharp contrast with the big boys). It is also reminiscent of Crestwood Equity Partners shortly before they got swallowed up by Energy Transfer (ET) last year.

WES also does mention M&A frequently, so action there would not surprise, either acquiring other small midstreams or being acquired.

Two Views of Now

For 2024, guidance implies over $1900M of CfO and nearly $800M of capex. Indications from their recent earnings call are that capex will drop to the $200M - $300M level after 2024. There will then be funds left over to drive incremental shareholder returns and/or M&A activity.

Assuming that their producers do grow production at some rate, WES will see an increase in EBITDA. Below we assume that to be 5%.

So if you think of WES as stable, and they may turn out to be, and if that dividend increase is adopted by the board, they are paying a remarkable 10% yield that should grow faster than inflation.

However, to my mind that $3.50 distribution, not yet declared by the Board, may be delayed awhile.

Recent rumors have it that OXY wants to sell their stake in WES, in order to help them deleverage. At the moment, that stake is worth about $6.5B.

And while WES has now been independent for 4 years, and seeking to broaden their group of counterparties, during 2023 they still got 59% of revenues from OXY. Plus, OXY still controls the General Partner, but not the WES Board. The Board has 3 OXY employees and 5 non-employees.

My analogy for this is that WES may be independent, but still is constrained to generate about half their revenues as the equivalent of a tenant farmer. An important and positive way to look at that is that WES and OXY operate like partners in getting production from the associated assets.

So does WES really want an unrelated owner of 48% of their units in a position to throw their weight around?

The alternative is for WES to buy out OXY, as for example Crestwood bought out their GP. It seems certain to me that they are thinking hard about it.

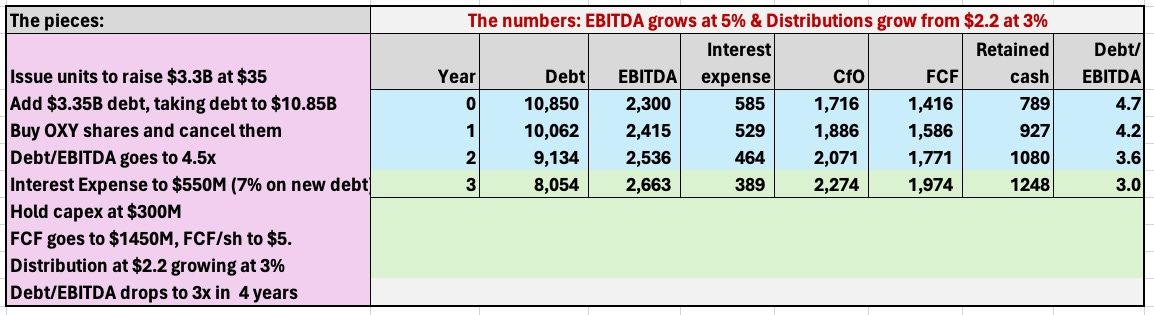

I did a bunch of scenarios about this possibility. The basic idea for the process is that WES has to add debt to do this and then the question is how fast they can get back near 3.0x EBITDA. I assumed EBITDA grows at 5%.

The model I settled on has WES diluting non-OXY shareholders by 50% and taking on equivalent debt to raise the funds to buy out OXY. Here is one model, assuming that the distribution remains at $2.20 and grows at a 3% rate:

On these assumptions it takes 3 years to get back to 3.0x. If distributions were outright eliminated it would take two. If they were put at $3.50 it would take four years.

Note that the overall share count would drop 25% and CfO/sh would correspondingly increase. This would eventually lead to significantly increased distributions.

This is all very contingent, including on how flexible OXY might be. But perhaps the most important conversations will be with the ratings agencies.

The size of the distribution might end up being constrained by those conversations. We see firms bump up debt for some reason and then work it back down without losing a rating. We see others lose the rating and get it back.

My personal preference would be for WES to find a way to buy out OXY. It would reduce forward uncertainty. Plus, my preference is to hold shares of firms without dominant shareholders, when possible.

That said, I do not mind owing WES at a $2.20 distribution, and just hope the distribution does not get smaller than that. I would ride out a period with reduced distributions if it did get them fully free. Stronger ultimate returns would clearly follow and it would not take long.

Risks

Of course the WES 10-K has a lot of discussion of hypothetical risks. I think one can call out a few specifics.

WES has a third of their production in the DJ Basin in Colorado and 13% spread across several smaller areas of operation. The rest is in the Delaware Basin, where the gas will mostly be associated gas from oil production.

These different areas will differ in costs of production, and could see curtailments in volumes transported if prices of either oil or gas got bad enough. Still it is heartening to see no apparent issues on the gas side at the low prices of 2023. That may be helped because today an oil-focused producer like OXY has no choice but to have the gas transported away.

It appears that Colorado is done for now with politically motivated actions against production in the DJ Basin. But that could eventually change and could end up impacting WES.

To my mind the likely story here is what it is everywhere. WES should be fine, from a balance-sheet perspective.

But although the CEO argued on the recent earnings call that this is not true, that new dividend seems to eat up more than all the FCF for 2024 (as the analyst said). The likely downside here is small dividend growth in response to headwinds, when they develop.

It would take some pretty negative economic developments to lead them to have to cut the dividend. But that could happen.

However, it is pretty hard to see this company imploding. Very low leverage. Solid counterparties filling their pipes with essential commodities. So long as they maintain the current conservative approach, it seems to me that WES will be fine.

Valuation

For me these MLP midstreams are income positions and not upside positions. My hope is not to trade them, ever.

I got into WES at a dividend yield above 8%. Today’s forward yield of about 10% in the market is a 13% yield on cost for me. Not that I really care; the income is what matters.

Still, it is worth looking at a couple metrics related to valuation to see whether anything is obvious. To do so, I used the compilation by Michael Boyd’s Energy Investing Authority on Seeking Alpha.

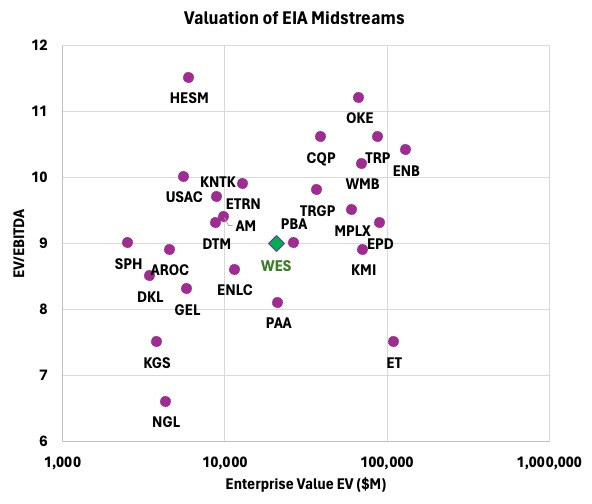

One often sees energy companies discussed in terms of EV/EBITDA, with EV being the Enterprise Value. Looking at Michael’s coverage universe you see this:

WES is pretty much right in the middle, with an EV of $20B and a ratio of 9.0. If you push WES down even 5%, it starts to drop below midstreams that should in my view be valued less highly.

And if you push WES up 10% the opposite becomes true. One can also note that several of the midstreams that are valued more highly are pipeline-heavy and not gathering-heavy. This makes sense to me.

So by this measure WES seems reasonably valued within the midstream sector. One can argue that the entire sector is undervalued by perhaps 25%, but that will not be our topic today.

Similarly, for Distributable Cash Flow or DCF WES has a DCF yield of 14%, which is right in the middle of the group. So if and when that $3.50 distribution is confirmed, WES might go up in price a bit further but it is hard to see much more than 10%.

So own WES for the tax-deferred income. But don’t expect a lot of upside.

Hello Paul, thank you for the article. I appreciate solid midstream coverage. This industry strikes me as one of the most undervalued areas of the market with stable cashflows despite the recent run up.

In the article, you assume that WES grows at a 5% rate going forward which does not seem unreasonable to me. However, I curious how you arrived at this number

Well-explained, Paul. Thanks. It's been a winner. Do you think there would be much change in the volumes and/or pricing with OXY if they were to buy them out? I don't think so but what are your thoughts?