What to think of South Bow six months after they spun out of TC Energy?

Last October 1, TC Energy spun off its oil pipelines business into a new company named South Bow (SOBO). Six months later, and with one quarter of 2025 financials in the books, we can begin to see what South Bow will be based on more than vapor.

South Bow both seems and is a simple company. They own a few crude-oil pipelines:

[This and the other images from South Bow are from their current investor presentation.]

The main one is the Keystone pipeline, providing the most direct route from western Canada to the Gulf.

Key to the story is that 90% of their capacity is committed on long-term (8 year weighted average) contracts. These even guarantee payment during downtime like their recent “Milepost 171 incident.”

The remaining 10% of capacity can be sold on a spot basis. At the moment, though, it is enabling them to meet their volume commitments even with reduced flow in the wake of that incident.

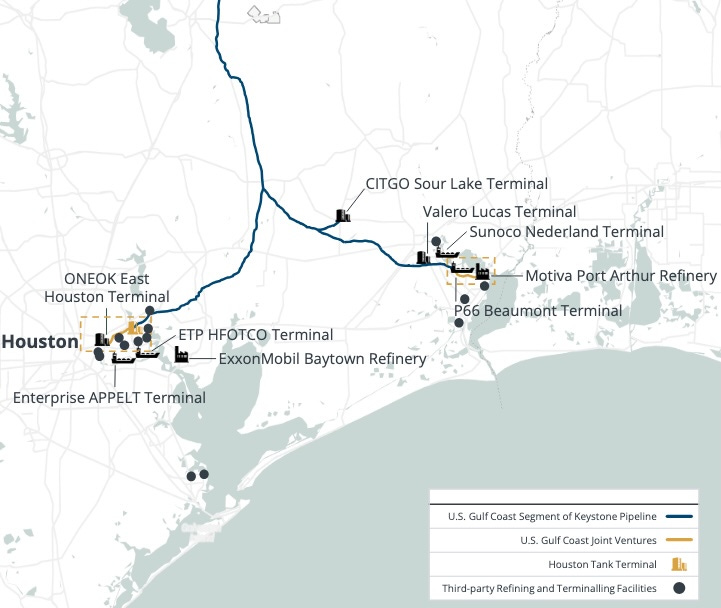

It is worth mentioning a couple regions in more detail. The first is the US Gulf Coast:

Those two orange lines are joint venture pipelines that provide connectivity to multiple refineries, terminals, and marine export facilities.

The second region with more detail is northern Alberta. They have two pipelines there to transport oil from oil sands producers to terminals near Fort McMurray and Edmonton:

In addition, South Bow has the Blackrod Connection project under construction. It will deliver oil from the Blackrod Steam Assisted Gravity Drainage oil sands project to the their Grand Rapids Pipeline.

The Blackrod project also includes a natural-gas lateral, about which almost nothing else is said in the Sedar filings. So I have taken the impact to be negligible.

That is their only current growth project, slated to begin operations in early 2026 and to produce about $30M of EBITDA. This will increase the current $1B of EBITDA by 3%.

The nice thing about South Bow is that the story is quite simple, externally as well as internally. The internal story is above.

Externally, they provide transport for crude oil out of the Western Canada Sedimentary Basin (WCSB), one of the premier hydrocarbon basins in the world. Over time, egress from the WCSB is tightly constrained.

This year, there is a bit of excess capacity thanks to the recent startup of the Trans Mountain Pipeline expansion. But projections have increased production returning the egress capacity to a shortage next year.

It would take enduring political changes to see a massive increase in egress capacity to the US. And if that happened, we would see it coming for years. The result is that the South Bow pipelines will stay in high demand even far beyond their current contracts, which have 8 years remaining.

The question that remains is how the numbers work. And now we have a very clean quarter that lets us take a look.