A strong growth model meets a collapsing market and higher interest rates: who wins?

When I dug into Rexford Industrial (REXR), I found surprises. Typically surprises about REITs are negative, but there were some positives here, detailed below.

Rexford owns industrial properties in the “Inland Empire” in Southern California. We will get into details later, but start with their dividend growth at an 18% CAGR over the past 5 years, with no cut during the pandemic.

This is an unusual dividend growth rate for a REIT. We will work on understanding it below but would expect the stock price to reflect the earnings growth that enabled the dividend growth. Nope:

You can see that the CAGR of the stock price since 2016 has been about 9%, far smaller than the dividend growth. Raise your hand if you bought in 2016 and sold in late 2021. Liar.

You can also see that the dividend yield was 2% or less from 2018 until late 2023. For retired income investors, does the 18% growth rate make up for starting at 2%?

Nope. The cumulative income from a 2% Yield on Cost growing at 18% takes 11 years to catch up to the cumulative income from a fixed 5% Yield.

So I had zero interest in REXR. The yield was too low to provide good cumulative income and pricing at 50 times CfO/sh was just crazy. [CfO is Cash from Operations.]

But today the yield is about 5% and P/CfO is 15x. That is appealing if one knows nothing else. So let’s learn some things and see if REXR still appeals.

Vacancy and Collapse

The problem with industrial historically is that there is no moat. The properties are easy to build and so the sector is prone to cycles of oversupply and undersupply.

This came home to roost in the Great Recession, leading many REITs to cut dividends and dilute shareholders to survive. Today’s industry leader, Prologis (PLD), cut the dividend in half and doubled their share count. They also saw their stock price drop 80%.

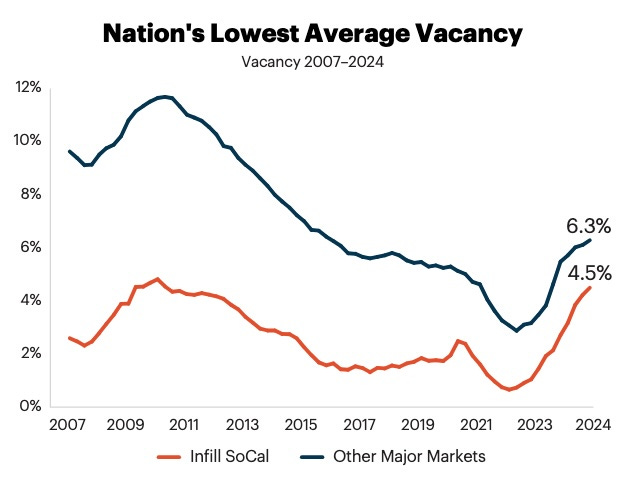

So my reference point for the sector was that it would be worth a look when we saw a collapse due to oversupply, with massive drawdowns in stock prices. While we have seen a rise in vacancies, and stock price declines, it has not seemed like a collapse. This graphic, though, led me to question my previous interpretation:

Nationally the vacancy rate crested in 2010 at nearly 12%. That is significant but for a collapse to result, the property owner must be carrying rather large debt. Well, a lot of them were, including the listed REITs of that era.

The recent increases in vacancy seem to be leveling off. But one worries that a trade war might turn that around.

Anyone who owns warehouses must be concerned. The ports of Los Angeles and Long Beach together import about 20M TEUs per year. [A TEU is a standard container, which stands on 160 square feet.]

Google’s AI says that the ballpark for shipping container usage is 10 trips per year. That would imply that the space needed to handle the SoCal imports is near 300Msf.

This is a sixth of the industrial space in the Inland Empire:

According to Google’s AI, shipping from China occupies about half of the volume into SoCal. And I’ve seen coverage stating that recently 60% of Chinese shipments since April 2 had been canceled or placed on hold.

From the rough numbers just given, that shortfall in Chinese imports would open up about 100M sf. This could be significant for firms focused on warehousing. But it is only about 5% of the space in the Inland Empire, and so would be unlikely to drive a collapse.

What are the implications for Rexford?