Kite Realty Group seems comparatively undervalued; is it?

My attention was drawn recently to Kite Realty Group (KRG). I decided to take a look and document my views.

Kite holds 180 properties and focuses on grocery-anchored shopping centers. At $4.8B, they are a mid-cap REIT.

They brag about having 69% of their properties in Sun Belt Markets and 61% of their Annal Base Rent from community and neighborhood centers. One can note that neither of these numbers represents a truly dominant contribution.

The big immediate issue for Kite is tenant bankruptcies. On the Q2 call, CfO Heath Fear said:

… when you look at the watch list and our relative exposure to the tenants on everyone's list, we feel pretty good that whatever is happening next year will likely fit into our general bad debt bucket of, call it, 75 to 100 basis points of total revenue. So we're not looking out to next year, thinking there's something that's going to be putting pressure on our AFFO, except for, obviously, what we discussed, which was the elevated leasing spend.

There was no mention of tenant issues in the Q3 call. Then on the Q4 earnings call they revealed that several tenant bankruptcies had occurred and they now had 25 bankrupt anchor boxes.

In the event, the total impact for 2025 is nearly 200 bps, about twice the 100 bps they plan for. My issue is that those bankrupt tenants included Big Lots, Party City, and JoAnn, all well-known basket cases for some years.

This sequence of events makes me feel like I’ve been played and I don’t like that.

To help fund growth, Kite has recently entered into a Joint Venture with an investment firm from Singapore. The JV acquired a $785M mixed-use asset. Kite will get fees for operating it.

This kind of thing has become very common in recent years. Still, it is preferable to own the properties directly.

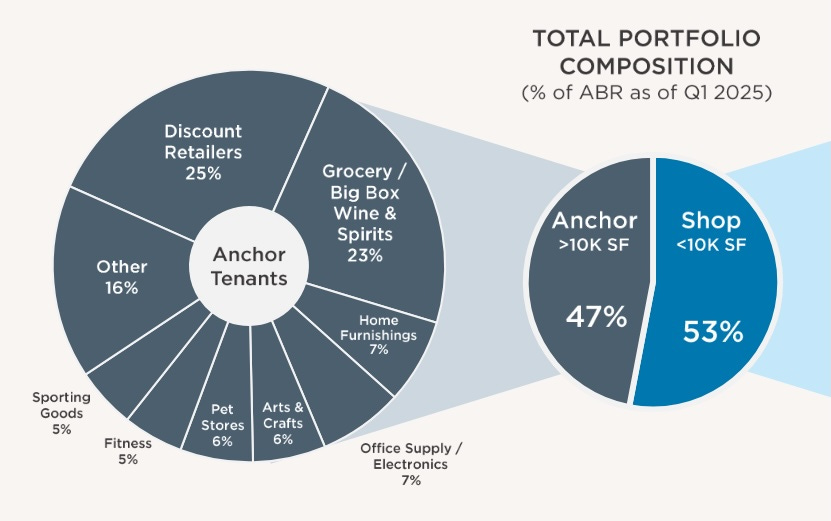

Kite has a liberal interpretation of what an “anchor” is, based only on square feet. Out of 180 such properties with expiring leases, they have executed 72 leases in the last 5 quarters and still have 38 available spaces. Here is their overall mix:

In these years of very strong retail leasing, it is common for such REITs to have a large fraction of properties that are SNO (signed, not occupied). Those bankrupt boxes will add to the total, as well.

Kite projects an increase to NOI of $26M as such properties are occupied during the next 18 months. But it costs money to prepare for occupancy, and this does not show up in headline numbers. For Kite, that SNO fraction is 2.6%, not small.

Some details from the 2025 Q1 10-Q:

Other short-term liquidity needs include expenditures for tenant improvements, external leasing commissions, and recurring capital expenditures. During the three months ended March 31, 2025, we incurred $6.3 million for recurring capital expenditures on operating properties and $31.3 million for tenant improvements and external leasing commissions, which includes costs to re-lease anchor space at our operating properties related to tenants open and operating as of March 31, 2025 (excluding development and redevelopment properties). We currently anticipate incurring approximately $130 million of additional major tenant improvement costs related to executed leases for tenants not yet open at a number of our operating properties over the next 12 to 24 months.

That cost will be about 14% of total NOI over 2025 and 2026. We will come back to the implications below.

Their 2025 guidance is for same-property NOI growth of 1.75% at the midpoint. This is low in today’s leasing environment but reflects the total impact of about 200 bps from anchor bankruptcies.

Kite has been pushing to larger fixed rent bumps since 2022, and today nearly all of them are at 3% or more. I think Federal Realty Trust led the way in having this as an emphasis; today it is common.

Their blended total leasing spreads are solid, running near 13% for several years now. In my view, this mainly reflects a response to the inflation of recent years.

What distinguishes leading shopping-center REIT Regency Centers (REG), which I own, from others is very active development. Regency always has several active projects going on.

Kite does do development, but at the level of about one active project at any time. Their annual funding of the current one will run $35M on average for each of 2025 and 2026.

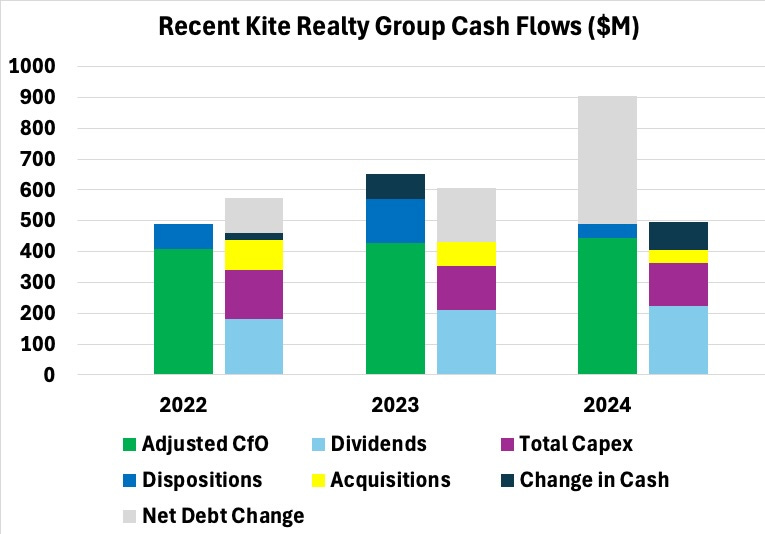

This is about 20% of total capex, with much of the remainder going for those retenanting costs. I failed to find a precise breakdown, and so have lumped all capex together in the cash flows plot.

The Kite cash flows look like this:

As usual, each pair of bars has sources of cash on the left and uses on the right. A few things are worth noting here:

Kite has not issued stock over these years and in fact has a long history of issuing almost no stock.

Capital recycling is modest for Kite. By comparison, Regency does more dispositions and acquires more property.

Overall, Kite looks really solid in their uses of funds.

I estimated FAD as Adjusted CfO less all capex plus a correction for growth capex. (Capitalized interest is negligible here.) Having done that, the payout ratio on FAD becomes about 2/3. This is among the lowest I’ve seen, implying a very safe dividend.

Here is how I see the story in very rounded numbers:

NOI is $600M;

CfO is $400M;

FAD is $300M;

Dividends are $200M;

Growth capex is $50M; and

Acquisitions are $50M.

NOI growth is $25M — $19M from escalators and $6M from reinvestment — or 4.2%; less headwinds. Headwinds for 2025 are 2% ($12M), nearly all tenant improvements and related capex. At least half of that relates to the “surprise” bankruptcies.

That leaves net NOI growth of 2.2%, close to guidance.

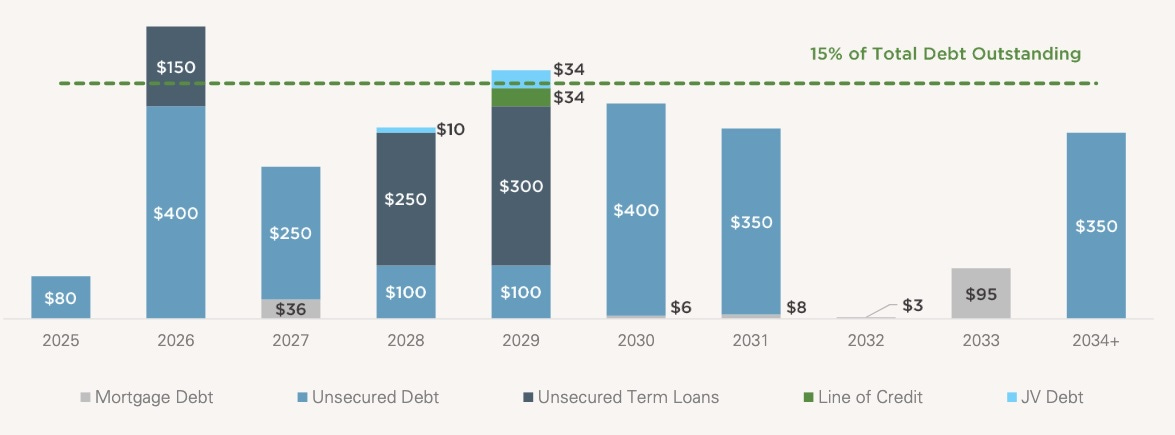

NOI headwinds for future years look like the standard $6M bad debt plus $3M to $6M of increased interest costs as their debt rolls. Here is the debt story:

Kite has driven down their Net Debt to Adjusted EBITDA from 7x in 2016 to 4.7x today. They hold BBB or equivalent credit ratings from all three agencies.

Their Net Debt to Gross Assets ratio is in the mid-30s. Their debt is nicely laddered:

Their liquidity of $1.6B exceeds annual maturities by a very comfortable margin. Overall their balance sheet is in the top group for this type of REIT. So why only BBB? Likely the history.

The combination of rolling debt and bad credit takes us to NOI growth rates of 2% to 3%. The larger burst they got in 2024 seems unlikely to be repeated except in occasional years.

As to dividends, a comparison since 2019 provides some perspective:

[FRT: Federal Realty Trust; KIM: Kimco; BRX: Brixmor]

We see how Regency (green) has really distinguished themselves. We also see how the dividend recovery for Kite (red) was slower than that for peers.

There are advantages to this. Kite has raised the dividend more than 10% most years since 2020 and clearly from the above would have the financial capacity to do this a few years more.

This is reminiscent of Simon Property Group (SPG) and Equity Lifestyle (ELS) after the Great Recession. Both cut the dividend a lot and then spent the next decade growing it rapidly.

Today Kite has the option to grow theirs rapidly, although eventually it will have to come down to the rate of NOI growth. If I were them, facing some difficult years for growing NOI, I would put the dividend growth rate where I expect long-term NOI growth to be. Perhaps 4% or 5%.

Dividend yields today run 4% for REG, 4.4% for BRX, 4.6% for FRT, 4.8% for KIM, and 4.8% for KRG. Regency has more ability to grow earnings but Kite still has more headroom to push the dividend up.

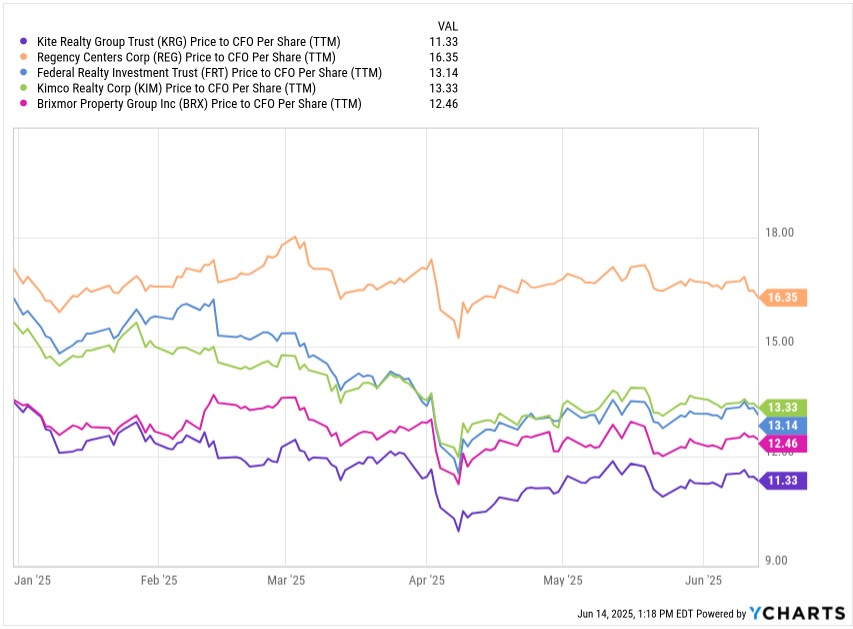

Looking at valuation, using the ratio of Price to CfO for a first cut, we see that KRG is the lowest valued among the top group of shopping-center REITs. Notably, the ratio for KRG diverged from that for Brixmor (BRX) in the wake of the Q4 earnings releases that included news of the aforementioned bankruptcies.

But it appears to me that Mr. Market did not over-react, for once. The NOI/sh growth projected by Brixmor was twice that projected by Kite, thanks to those bankruptcies.

The difference in the ratio today is just over one turn from Kite to Brixmor. I find it hard to view that as unreasonable, considering Kite’s retenanting costs. Regency is valued a lot more highly, but no wonder.

I looked at valuation in the spirit of the discussion here and in a similar way to my look at Regency here, with the addition of varying the discount rate for distant earnings after 10 years. The difference is that Kite will have slower growth. This will be in the near term as discussed above, and also in the longer term unless they change their business model (which might happen).

After 10 years of growth using a discount rate inferred from the current cap rate, I compared long-term discount rates of 5.4%, corresponding to today’s cap rates and 7%, corresponding to a cap rate of 10%. For the first case KRG has about 55% upside to fair value, while for the second it has 25%.

So the ballpark estimate is that KRG has 40% upside to fair value (without any assumption of changing interest rates). This is in the ballpark of what I see for REG.

Takeaways

Like so many companies and many REITs, Kite appears to me to overhype their status and prospects. But in a lot of ways they are actually quite solid.

If one views those bankruptcies as just bad luck, which seems likely to me, then KRG would seem to be underpriced by about 15% compared to peers and 40% overall. They all will see costs of rolling their debt, so long as interest rates stay high.

There are plusses and minuses here. The dividend yield for KRG is 80 bps higher. But their likely growth is smaller and they have a poorer track record.

I don’t see immediate catalysts for repricing in this sector, though. It seems likely to me for the market to take awhile to recognize the strong performance.

I personally am not so impressed by Kite that it seems worthwhile to me to replace my current investment in Regency. But I would not object to doing so either.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

Thanks for sharing your take on KRG. I opened a small position (about 1/4) when tariff fears send prices down. This is my only exposure to retail REIT. I wonder if it makes sense to continue buying to a full position at market weaknesses.

Very helpful! Thank you!