Orion Office (ONL) has become something of a battleground REIT. Here we probe what the possibilities and value are.

Orion was spun out of Realty Income (O) in November 2021, shortly after Realty absorbed VEREIT. Substantially all the office properties were included.

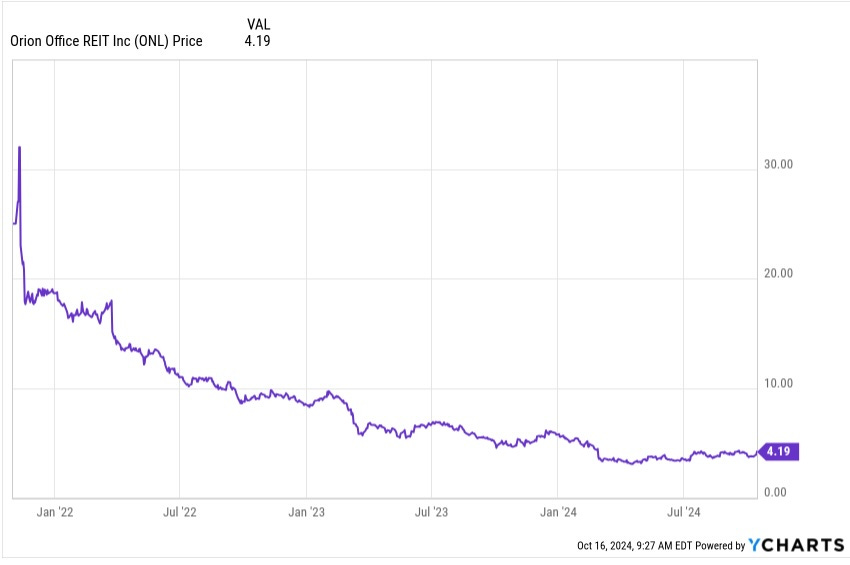

This was single-tenant office, the most expensive and treacherous type of net-lease real estate. It seemed that the future might be liquidation. The stock price since would leave that unsurprising:

The management team at Orion is a large part of the VEREIT team. I think they are more interested in running and growing a REIT than in liquidating one.

A couple weeks ago there was a bullish article on ONL, placed on Seeking Alpha by Brad Thomas.

Brad highlighted the very low payout ratio and very low leverage ratio. This was enough to peak my interest.

He also noted the current price of 3.84x AFFO. That is incredibly cheap unless the REIT really is headed for bankruptcy. So is this a classic cigar butt investment?

Simpleminded use of the so-called Graham formula says that this price is assuming AFFO/sh shrinkage at a rate above 4.5%. Unfortunately AFFO/sh has actually been shrinking at above 15% per year.

The Graham formula would price that below zero. But if they are not headed for bankruptcy, then there is finite value there.

Seeking Alpha author Trapping Value seems to think that they are headed for bankruptcy, or something close to it. He argues that in 2025 Funds Available for Distribution (FAD) will no longer cover the dividend.

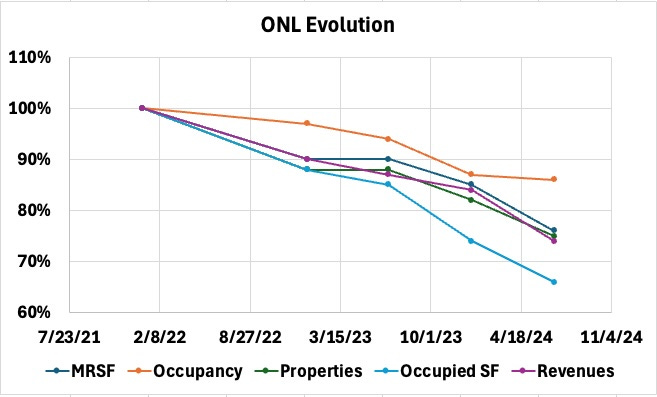

And various measures have been crashing hard for ONL:

I will argue below that bankruptcy actually seems unlikely and that the dividend should continue to be covered for at least several years.

Their Big Mortgage

Their primary debt is a $355.0 million fixed rate mortgage loan collateralized by 19 of their 69 properties and maturing in early 2027. The negative article mentioned raises some question around the potential conversion of those obligations from non-recourse to recourse. But that author often values drama above perspective, so one must check the real story.

Now I am not a real-estate lawyer, but as I read the Loan Agreement and Guaranty these are standard “bad-boy” recourse provisions, that apply in the event of fraud or other bad behavior by ONL.

In contrast, IF the properties turn out to be uneconomic, then the loans will be non-recourse to ONL. This makes life simple. They either succeed with those properties or hand over up to 19 sets of keys.

They also have a revolver, with $170M drawn on it. I expect that to absorb a lot of whatever FAD is surplus to dividends.

Property Transactions to Date

ONL began in late 2021 with 10.5 million LSF (Leaseable Square Feet) of space. Working through the filings, they have sold or are selling about 3 MLSF (26 properties) to date.

They have new or renewal leases on about 1.5 MLSF. So they are running about a 33% success rate at keeping the properties owned and leased.

One can blame the early dispositions on the weaker properties in the initial portfolio. But, looking at the filings, I don’t buy this as a large factor.

The filings show that few of the disposed properties were vacant on the spinoff date. New properties become vacant and get dealt with each year.

Bearish authors also can focus on occupancy, which stands below 80%. But in my view that misleads.

ONL puts a current property list in their quarterly 8-K. If you take the time to peruse that, you find 75 properties listed. Of these, 9 (12%) are vacant while 5 (7%) have an occupancy below 95%.

These 14 properties may well be on the way to disposition, although Orion may save some of them. And there will be a lot more, as is discussed shortly. So far, this may or may not imply bankruptcy. So keep going.

The portfolio quality is probably increasing with time. Traditional office as a fraction of square footage is already down several percentage points, to 67%.

For comparison, their preferred areas of Flex/Industrial and Governmental Office are at 21% and 10%, respectively. They also aspire to add lab spaces. But a future where these are dominant is, in my view, oversold in their investor presentation and in the bullish article cited above.

They now have 6 MLSF to be released or disposed of in near-term years. The leases on most of those expire at a fairly uniform rate of about 0.9 MLSF for each of the five years through 2028. (Not much had closed yet in 2024 as of June 30.)

We can model how this goes.