The momentum investors have long since left the room on NNN REIT (NNN). Good riddance.

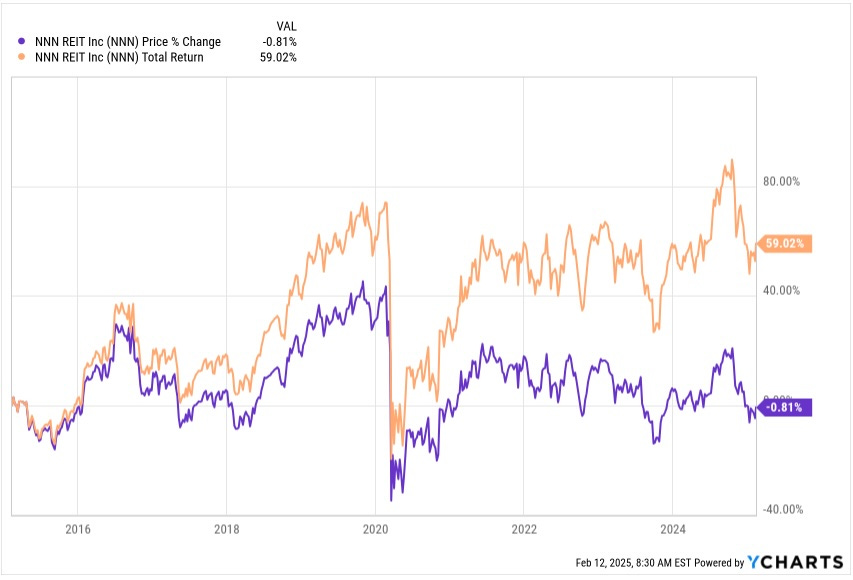

The price of NNN stock has done nothing for a decade. Even total return corresponds to a CAGR of less than 5%:

More recently, the price dropped more than 10% in November after NNN revealed that they would reclaim all their properties from two significant tenants, accounting for about 200 bps of their rental revenues.

This caused some value investors to also run out of the room, stimulated by worry porn articles like this one full of foreboding, which stated “this could lead to material issues for NNN.”

Other value investors, including yours truly, bought more. Now that we have the annual results with another quarter of data, what is new and what does this suggest about the value of NNN?

Seeking More Meaning

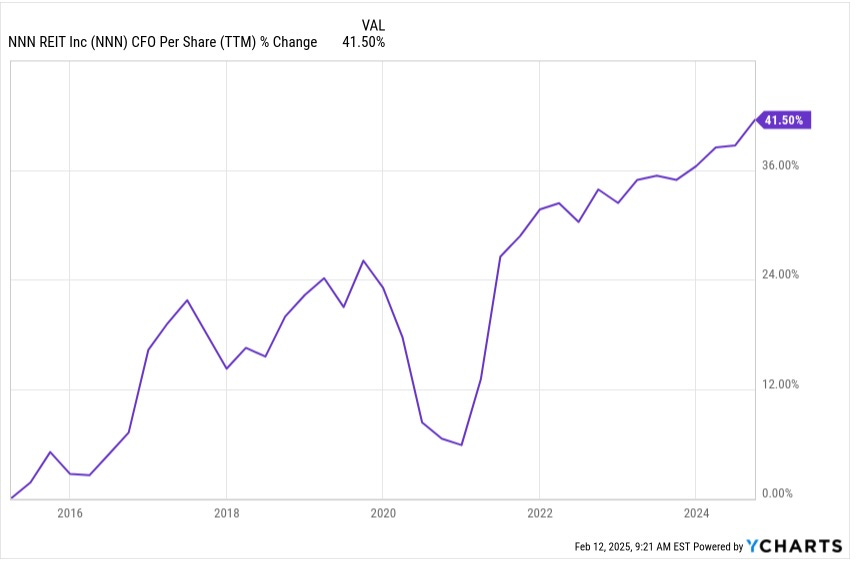

The above plots are cute entertainment, but that is about it. More meaning is found in the changes in cash earnings per share, reasonably measured for NNN by CfO/sh. [Here CfO is Cash from Operations, taken straight in YCHARTS plots but better evaluated without changes in working capital.]

Here is CfO per share, which has increased steadily except during the pandemic:

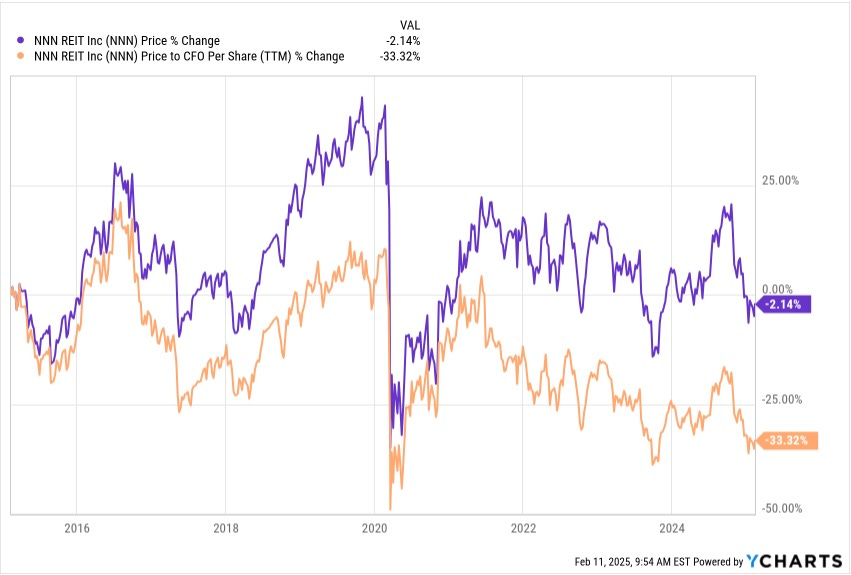

And here are price again and the ratio of price to CfO/sh:

The P/CfO ratio for NNN has decreased by a third, from 17.5x to 11.5x, over the past decade. But this ratio should go down when interest rates and (hence) cap rates increase, so the decrease is not necessarily unreasonable. We will revisit this connection much later.

Tenants and Occupancy

The approach of NNN to tenants has these elements:

Seek “middle-market” tenants — those with quality financials but too small to gain access to the broad bond markets. Still they are not small firms — the top 20 tenants of NNN operate an average of 1,533 stores each.

Help these tenants grow by doing repeat business with them. NNN owns an average of nearly 70 properties each with their top 20 tenants.

Minimize the purchase of properties on the open market.

Emphasize strong retail real-estate locations, enabling strong tenant performance and strong re-leasing when needed.

Make sure, from property-level data, that the location can easily support the rent.

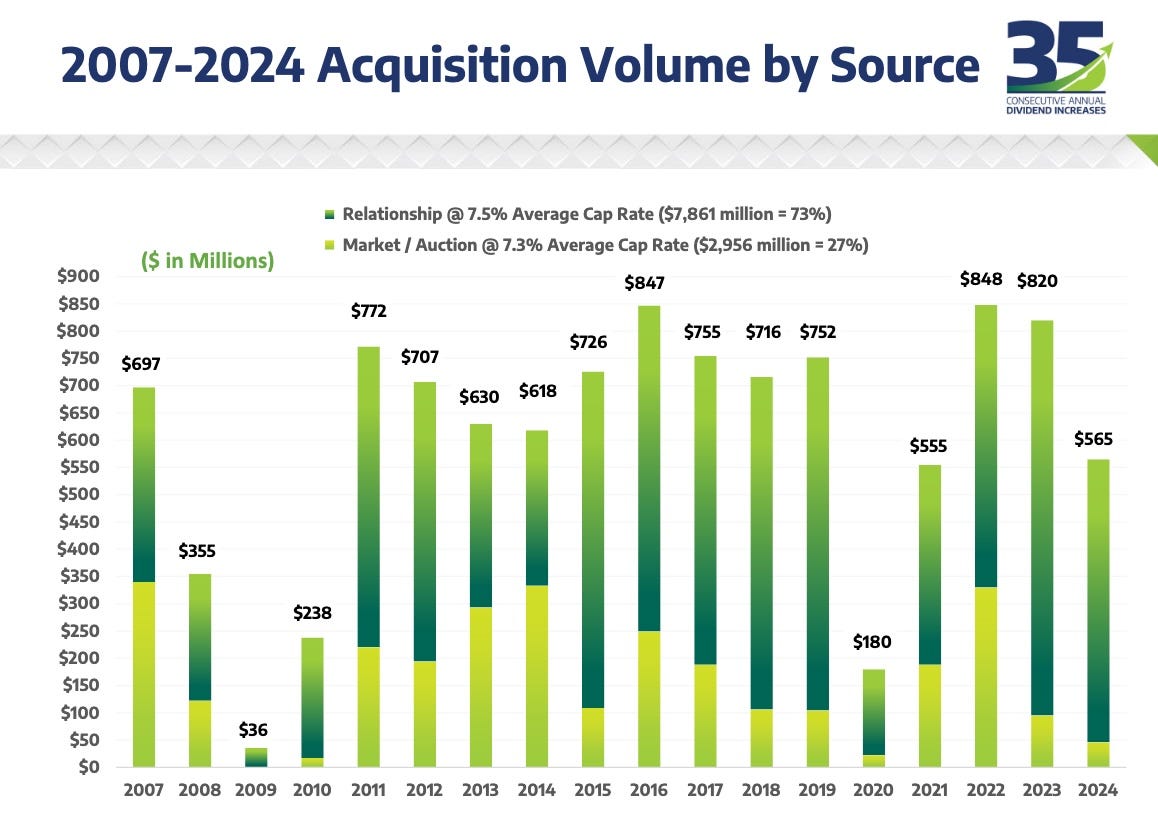

You can see here that a substantial majority of their acquisitions has been with relationship tenants:

NNN boasts that quite a few of their tenants have become investment grade after the relationship began. My friend (3-time REIT CEO) Chris Volk thinks they should sell such properties, whose market value has just increased with no change in objective value. But NNN tends to hang onto them.

Sidebar: The Meaning of “Higher Quality”

There is an ongoing debate about whether and in what sense investment-grade properties are “higher quality” and thus less likely to default. To my mind this has aspects of a religious disagreement, as I have not seen anyone involved change their mind.

The REIT managements all argue strenuously that their property type is the best. Do you suppose they might be taking their books?

A relevant comparison may be between NNN and Realty Income (O), with the latter having until very recently emphasized investment grade properties. An important measure is occupancy, since a property is only occupied if there is a tenant in place, operating and paying rent. Also, it takes a year or so to replace tenants of this type.

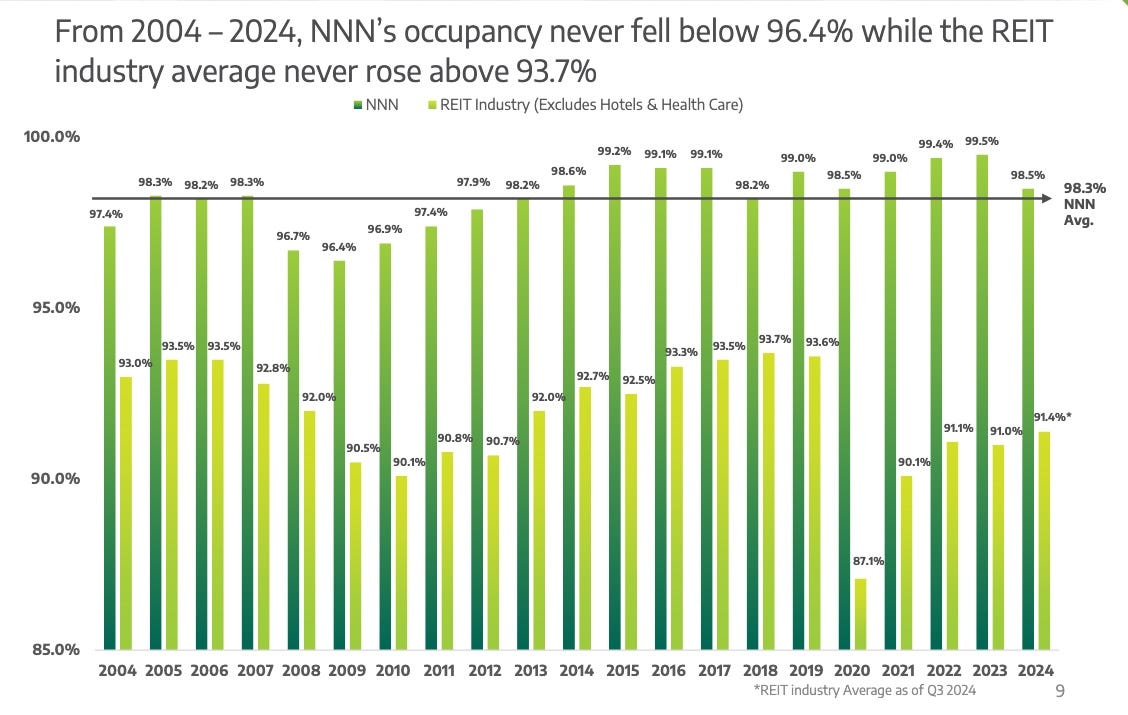

Since 2004 occupancy at NNN has averaged 98.3%. For O the number is about 98.0%.

Or one can compare the low in occupancy during the Great Recession. This was 96.4% for NNN and 96.6% for O.

Such huge differences! Not. One cannot make a case from data that the middle-market tenants selected by NNN are less reliable rent payers. As to “higher quality” — that’s a religious question.

Back to the Main Story

There are two pieces to the occupancy story. Here is that historical occupancy for NNN:

Since it takes about a year to retenant, one can see that typically about 2% of their properties go vacant each year. Today, that is about 70 properties per year.

Most of these properties are re-leased to a new tenant. The rent typically comes in lower for several reasons:

NNN tries hard not to pay anything for tenant improvements, preferring to get lower rent at no incremental cost and let the tenant make any needed investments.

NNN wants the tenant to easily be able to cover the rent. Getting “low” rents is a long-term theme in their presentations.

A potential new tenant likely has several other options.

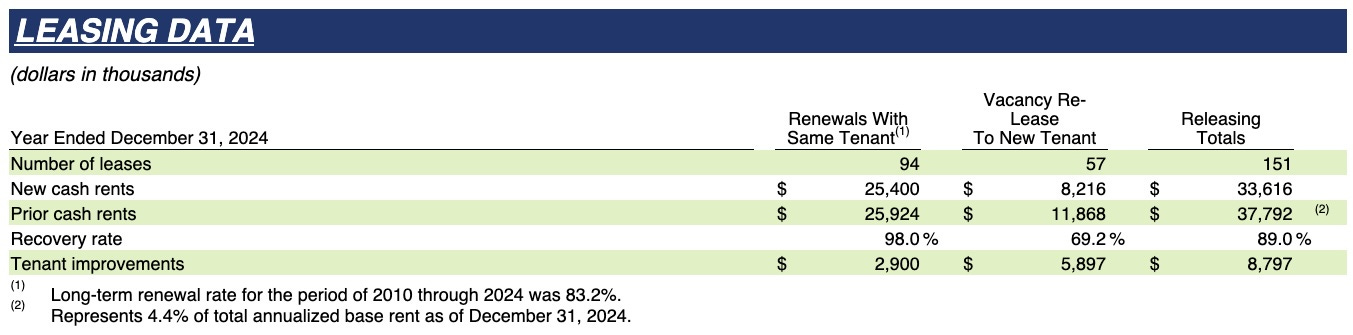

The recovery rate for existing tenants ran 98% in 2024, and is generally in the ballpark of 100%. Replacement rents have historically averaged 70% recovery rates, and 2024 was at that level:

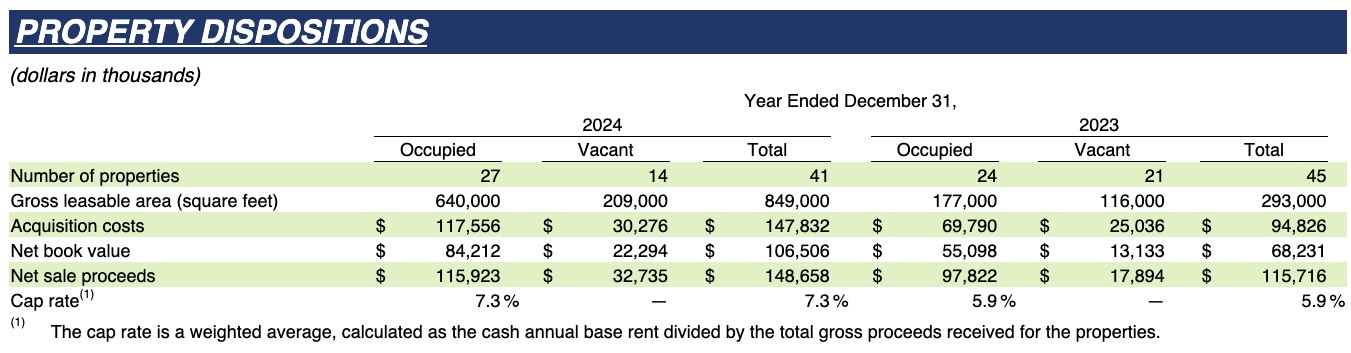

The other part of vacancies is properties that are sold vacant. There were 14 of these, shown here:

Worth mentioning is that NNN typically sells about 3% of their properties each year, of which only a third are vacant. Since they have property-level financials from 82% of their properties, they are able to prune weak performers.

Between the last two tables, you can see that across 2024 they dealt with 192 properties, just over 5% of their total, as follows:

94 (49%) were renewed with the same tenant

57 (30%) were re-leased with a new tenant

27 (14%) were sold occupied

14 (7%) were sold vacant

Meanwhile they acquired 75 properties, for a net increase of 34 properties, which is about 1%. This is fewer new properties than they have often added; we discuss the reasons below.

[It is worth noting that '“historical” trends reflect what happened during a period of low inflation. The story would change in the future if there is sustained, significant inflation.]

Bad Cock and Fishes

Well, that’s what the transcription of the earnings call said. It was referring to two tenants who have broken their leases — Babcock Furniture and the Frisch’s restaurant chain.

Taking the simple case first, during the fourth quarter Babcock liquidated and NNN took possession of 32 properties. These had $5.2M of Annual Base Rent (ABR), 0.6% of the total ABR.

Per the earnings release, “As of December 31, 2024, NNN had sold six of these properties … and re-leased five of these properties.” So there is work to do but these properties were handled at a rate of about 1 per week. The NNN CfO Kevin Habicht explained on the Q4 earnings call how the proceeds are, in new ABR, equivalent to 113% of prior rent, so far.

Frisch’s, a Midwest big boy hamburger concept, is a more complex story. They stopped paying rent but did not declare bankruptcy, so NNN had to evict them. NNN owned 64 Frisch's properties at the beginning of the fourth quarter. This represented 1.5% of ABR.

Per the earnings release, by year end “NNN had taken back possession of 33 of those properties of which 28 properties have been re-leased to another restaurant operator with rent commencing May 1, 2025.” That is much faster than the usual 9 to 12 months.

To get the deal done, NNN lowered the base rent to about half the previous value and got percentage rent of 7% of sales above a threshold. Based on the history of those locations, for which NNN has property-level data, the total rent recovery should equal or exceed the average of 70% discussed above.

In combination, quoting Habicht again (edited for length and clarity):

Bigger picture and really the key point of the combined vacancies, and consistent with these early resolutions I just reviewed, we remain optimistic to, a) get them leased or sold more quickly than usual; and b) hopefully improve upon our typical vacant property rent recovery of 70% versus prior rent, with no tenant improvements. … most importantly, when the dust settles on all this in say, 2026, we believe per share results should be impacted by less than 1%.

This does not look material to me. That 1% is about what they usually budget for credit losses, though typically the final number has been lower.

Two is a small number

One huge flaw in normal human thinking is overgeneralization. Seeing a couple bad things happen, one is emotionally inclined to expect that bad things will continue and may get worse.

The reality is that defaults are rare events (see the Moody’s default reports, for example). There are reasons today that default risks have increased, but they are still rare events.

Yet we often see investors and authors turn a few rare events into a causal story that predicts the future. Rationally, this makes no sense. But emotionally, it appeals.

The level of distress today is far less than it was during the Great Recession. Our expectation should be that tenant failures for NNN will be fewer than they were then. But since defaults are mainly statistical, there could be a brief surge at any time.

Another flaw in human reasoning is that past events alter current probabilities. Getting three heads in a row while coin flipping does not change the odds of a next heads. But NNN decreased their reserve for credit losses, looking backward at recent history.

Habicht says about 2025: “we've got enough baked in for credit loss for this year. We don't really have any other tenants in the immediate horizon that it feels like we have real exposure to in terms of credit loss.” So NNN guided for smaller new credit loss than usual.

This reflects normal, flawed human reasoning. They should have left the credit loss reserve the same. But it is small anyway. This is not a material issue.

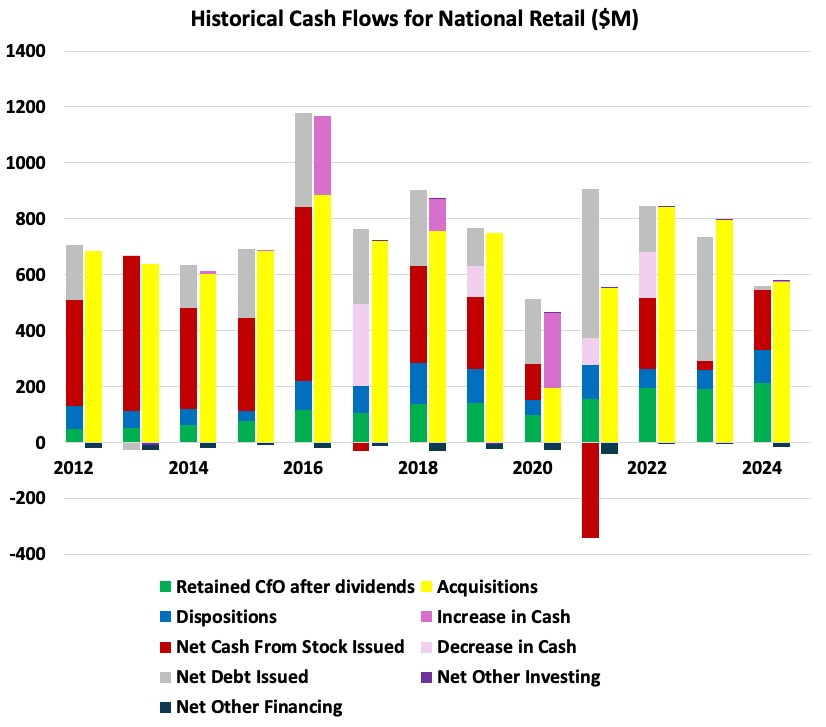

Cash Flows and Growth

To really see what NNN has done and to assess their near-term growth potential, it is very helpful to look at cash flows: