One subscriber told me he made enough on EPR Properties (EPR), based on my analysis, to cover his subscription for his lifetime.

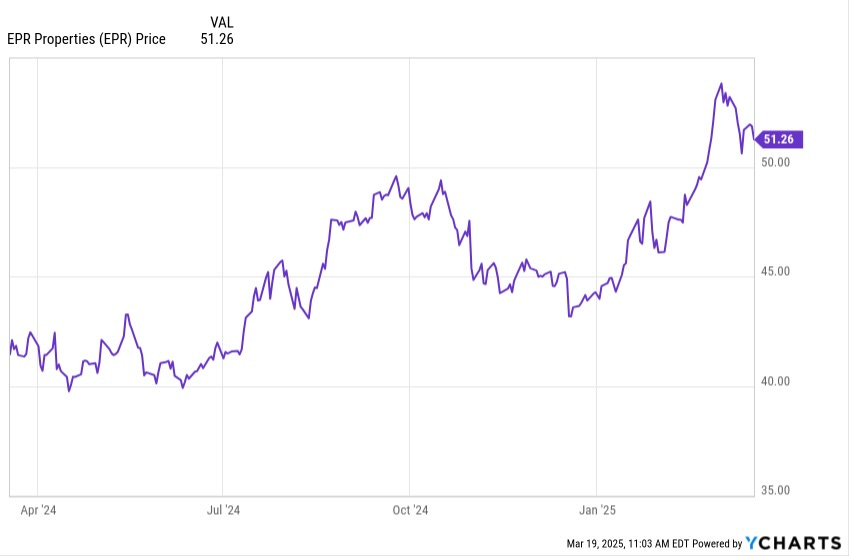

In fact, a lot of my subscribers have been selling down their holdings of EPR this year, as have I. My own holdings are down by more than half. As the price has rocketed up well above $50, it became a sensible place to raise capital for other investments.

My purpose today is to update my long-term view of EPR, seeking perspective from their long history. This will help us understand what may matter today.

Who EPR Is

EPR is an “Experiential Net Lease REIT.” They lease properties on a triple-net leases, under which tenants must pay for all maintenance, taxes, and insurance.

The common focus is that these properties are places people have experiences, ranging from cinemas to hot springs to karting. One common emphasis is that they are selected in “drive-to” locations, which provides significant recession resistance.

On the one hand, such properties are lucrative for a landlord. They sport higher cap rates than properties of other types. On the other hand, those high cap rates reflect real risk.

In addition, EPR has very high tenant concentration. Three tenants (two cinema chains and Top Golf) account for about 40% of rent, and the next three for another 15%.

What’s more, three of those six tenants are cinema companies. There is historical context for that, since EPR was formed by spinning cinemas out of AMC Entertainment.

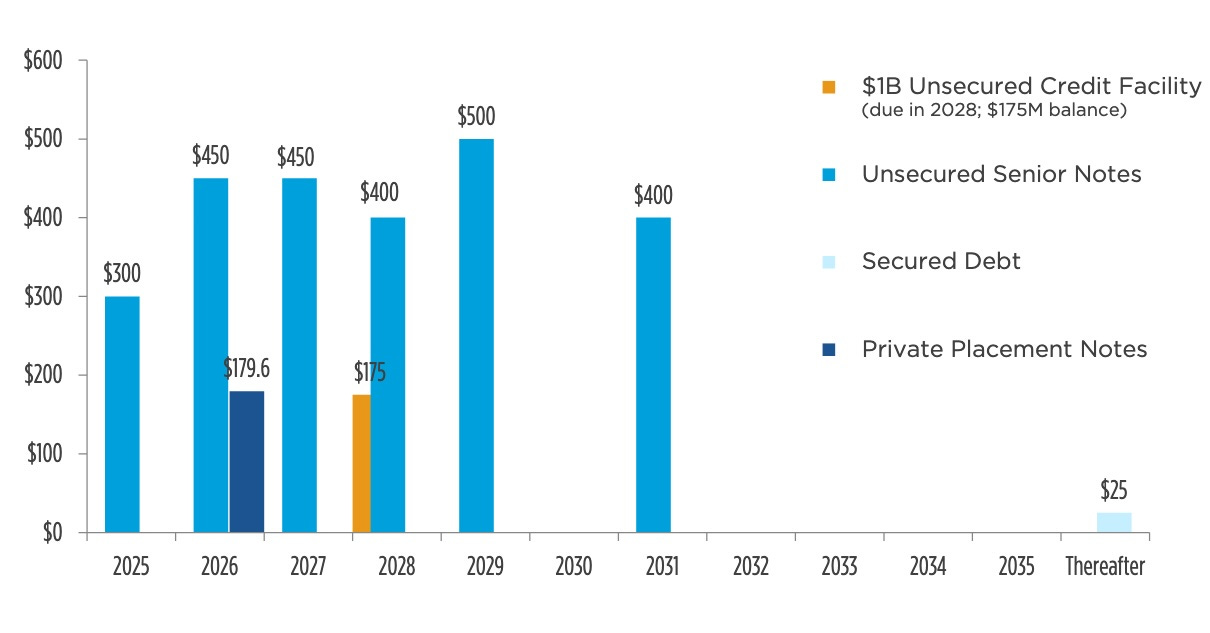

These issues have limited EPR to credit ratings of BBB- or equivalent by the three big agencies. This is despite the reality that they maintain a truly excellent level of debt and debt structure:

This is protected by a $825M of availability on their credit revolver. Their ratio of long-term debt to gross assets (including loans) is 41%. This is safe for a net-lease REIT with its low costs.

Economic and Market History

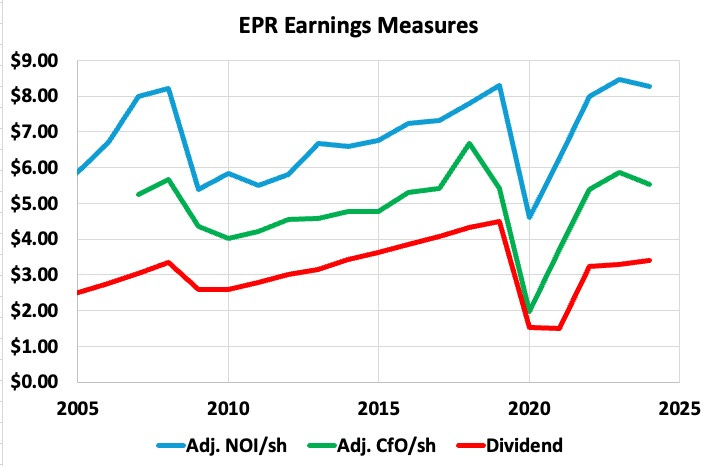

Take a long look at market price, not necessarily sensible, and per share Cash from Operations (CfO), which for this REIT captures cash earnings with good accuracy:

One sees three peaks in CfO/sh. The first was followed by the Great Recession. The stock price had moved up enormously, more than 4x from 2000 through 2007, while CfO/sh only doubled.

The price crashed hard then rebounded rapidly. It got back to 3x the value from 2000 and moved strongly up from there, as CfO/sh grew.

The second peak of CfO/sh was in 2019, before the pandemic. EPR had problems with their charter school portfolio and sold it off, just before governments shut down their properties during 2020. Ouch.

The stock price had grown to 6x its value from 2000 but then crashed down to about 2x that value. CfO/sh peaked again in 2023, thanks to deferred rent from the pandemic.

The current TTM value of CfO/sh is representative of ongoing operations, and is back to what they produced in roughly 2017. But the stock price is down 20% from its 2017 level. We consider later whether this valuation change makes sense.

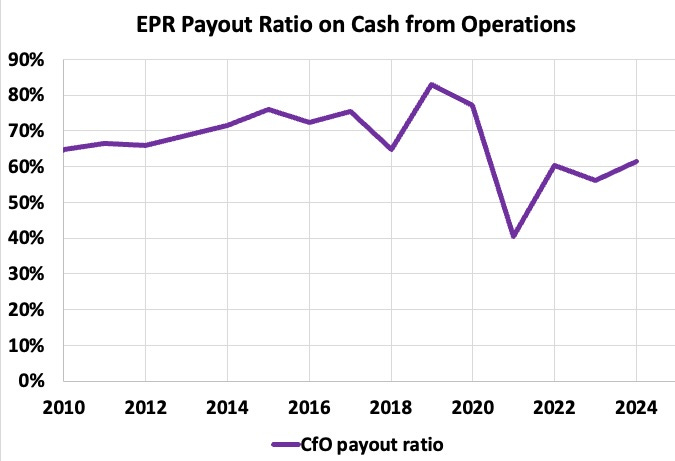

One certainly can complain that the EPR stock price is flat on net over the past 20 years, and people do. But that also misses the point, as the market has demanded a high and remarkably consistent dividend yield near 6%:

The resulting total return over the past 25 years has been 9.1%, producing a cumulative growth of 3.7x. This is near what NNN REIT (NNN) did. For comparison, Federal Realty Trust (FRT) did 5.2x and AvalonBay (AVB) did 6.4x. [I own EPR and NNN].

EPR outgrew the S&P 500 (SPY) by 6x for the decade starting with 2000 and was only slightly ahead for the decade starting with 2010. Since early 2020 the SPY has doubled while EPR is flat (in total return).

Since May 1, 2020 EPR total return has grown by 2.4x vs 2.1x for the SPY. This is an important comparison, because at that date EPR was clearly very underpriced and forward growth of the S&P 500 to the present level was much less certain. That was a great moment to buy EPR.

Overall, since early 2000 the total return of EPR is 3x larger than that of the SPY. That is in no way a forward prediction. But what I find interesting is that this outcome occurred despite the challenges discussed above.

The SPY can always have a flat decade, like it did across the 2000s. Many expect this now. If it happens, EPR could outperform again, even if they just muddle along,

Listening to the Cash Flows

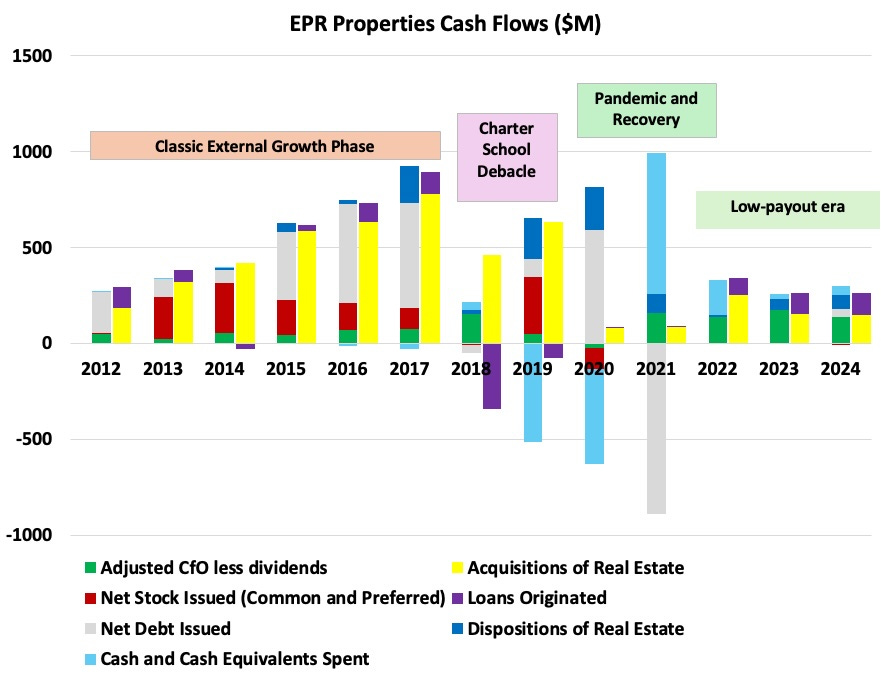

The cash flows show us what business model a REIT is using to grow earnings. Here is a view for EPR since the Great Recession:

As usual, the left stacked bar of each pair shows sources of cash while the right one shows uses of cash. The four main periods are labeled.

Through 2017, share issuance (red) and new debt (gray) drove acquisitions (yellow), producing growth. This required favorable stock prices, and the market cooperated.

But EPR’s venture into charter schools imploded when other sources of capital became interested and were willing to outbid EPR. They disposed of those in 2018 and 2019. (The graphic shows net acquisitions.)

But they did not get to invest the accumulated cash (downgoing light blue bars) before the pandemic. We will leave aside details of that era.

Since 2021, acquisitions and loans originated (purple) have been covered by retained earnings (green), dispositions (dark blue), and spending down cash (light blue). Cash on hand is now down to typical, historical, small levels.

(A word on the loans. EPR loans to own, often funding construction of properties that they expect to end up owning after that.)

On net, EPR has reinvested only about half the $530M in cash with which they ended 2019. My estimate is that the difference is what they lost across the pandemic, about 4% of gross investments on net.

Looking at today, there is an obvious visual difference in the pattern and magnitude of cash flows since the pandemic. These years there is no issuance of stock and little of debt.

EPR used the pandemic to reset their business model (and they even were communicative about it). During the gogo 2010s they ran an increasing payout ratio in the 70s. This did not leave them with a lot of cash to invest.

They used the pandemic as an opportunity to reset that payout ratio to down near 60%. You can see the resulting, larger green bars in the cash flows; they had more retained cash to invest.

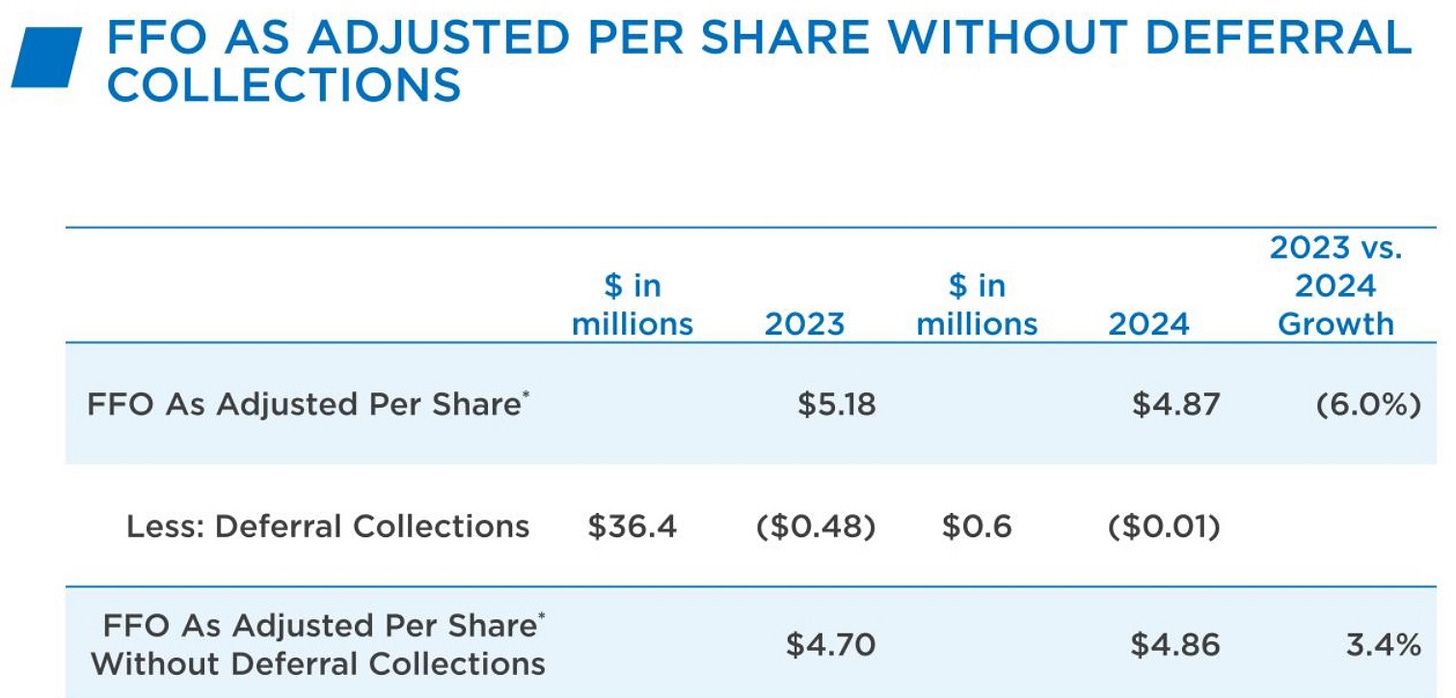

If they can reinvest 30% of CfO (there is always friction), at an 8% ROE, that will grow CfO at 2.4% per year. Add rent increases and you get between 3% and 4% growth. After removing impacts of pandemic rent deferrals, that is what they managed last year:

For most REITs today such growth is reduced by increases in interest expense. EPR had their debt maturity ladder depleted for 2023 and 2024, so they have so far avoided this.

But going forward there will be a headwind near 1% of CfO per year, unless interest rates come down. Also, at some point EPR will have work to do to restore as good a maturity ladder as they once had.

Per-share Net Operating Income or NOI has grown over time. It is impacted by all the turmoil discussed above, combined with accounting treatments of various details. I spent a fair bit of time trying to see if there was a story worth telling there, and concluded that there really is not.

The Tenants

Experience providers rarely attract a large fraction of the US population. A small fraction goes to movies, goes skiing, or frequents amusement parks. And so on.

So it makes me sigh in the many cases when some commenter says that they don’t go to, say, amusement parks, the implication being that this makes them worthless investments. What matters is viable businesses that can attract enough people over time.

As to cinemas, the number of wide-release films from major studios (the film slate) has been impacted first by the pandemic and then later by the Hollywood strikes. This has provided a natural experiment, proving that this number is the primary factor driving box office.

You can find hard data related to this at boxofficemojo. I have spent time with it, and agree with the case to this effect made by EPR.

The film slate is returning to its normal from the late teens. Box office will too. And the collection of high-performance theatres owned by EPR will outperform.

The other major tenant has been TopGolf (at about 15%). Their reputation has suffered thanks to years of rapid expansion since Callaway foolishly bought them. (Callaway now is turning them loose.)

But the properties EPR owns are from before the split. EPR reports that “In 2025, we anticipate TopGolf will self-fund at least 4 refreshes at EPR properties.”

The rent coverage by their tenants has always run on the low side for a net-lease REIT. But it has been stable, except across the pandemic. Here are the current numbers:

The theatre coverage has dropped a bit as the impact of the writers’ strike worked its way through the film slate. It should be coming back up now.

All that said, there is risk in having high concentrations of tenants or tenant industries. EPR seems stuck with that.

They tried to diversify into childhood education during the 2010s. That led to their charter-school debacle, and to the decision in late 2019 to slowly exit their childhood education portfolio. That decision was driven by their analysis of the potential for growth in those businesses.

More recently, they tried to diversify into RV parks, which they also tried to operate. More recently they have said “We are disappointed with the performance of our [RV parks]. The volatility of performance and expense pressures, including significant increases in insurance, are all part of the normal course of business for our tenants. However, they are not for us.”

EPR faces challenges in diversifying their tenant industries and from occasional tenant problems. This seems unlikely to change, and is why they should pay a higher dividend than otherwise similar REITs do.

Where We Are

EPR is an extremely well-managed company. Their balance-sheet is excellent, and their management of it has been outstanding. They have handled issues with tenants well, too.

But they face various risks reflecting their tenant industries and concentration. That comes along with the high cap rates they get for their leased properties.

Looking back 25 years, they have grown well when they could, by whatever method worked. But then some kind of difficult period has knocked them back and they have had to reset.

Despite these challenges, EPR has produced a high-single-digit total returns, as solid REITs tend to do. And there have been stellar investment opportunities, occurring when the market over-reacted to difficult times.

This has happened in 2000, 2009, and 2020. Good but less stellar opportunities have come in 2018 and 2023. It will happen again.

Because EPR has minimal sustaining capital expenditures, running 2% to 3% of CfO, and a third that level of capitalized interest, it is sufficient to approximate per-share Funds Available for Distribution, or FAD, by CfO/sh.

Looking back, EPR has not grown CfO/sh on net since 2007, with the difficulties having eaten up the gains. BUT this new model with more retained cash should drive more sustainable growth.

One can match the value of the cash flows to Net Asset Value, for today’s typical 8.5% cap rate. That gets a fair value of 10x CfO/sh, or $57.

To go further, we should account for the tendency of CfO/sh to crash. A first decade, with CfO/sh growth of 3% and that same discount rate of 10% provides an NPV of $40.

If you then drop CfO/sh by 25% and let it grow from there, the second decade provides an increment of $8 to NPV. Repeating that for the third decade gives a $2 increment.

From this perspective, $50 represents fair value for EPR. During good times the market may enthusiastically push the price higher, and it will rise as earnings go up. But still, EPR looks fully valued today, more or less.

Even so, I am happy to hold a few percent of my portfolio in EPR and collect the dividends. And there is a good chance the total return will outperform the broad markets over the next decade. But I also might sell some of my EPR at any time to fund superior opportunities.

Please click that ♡ button. And please subscribe, restack, and share. Thanks!

I’ve been selling calls at $55 and $60 against my EPR after it hit $50. I’m okay if it gets called away at those levels. Thanks for reaffirming fair value.

Outstanding company. I still have 80% of my position after trimming above $52. I may trim some more today if we see more blue light specials.