BSR REIT (HOM.U) is a Canadian REIT that owns a collection of multifamily properties. These are mostly in Texas.

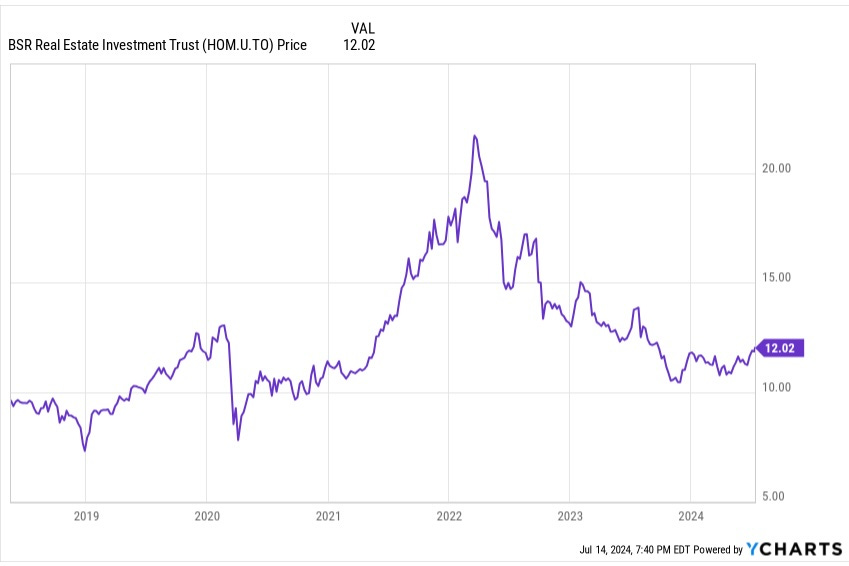

Being Canadian, BSR reports a Net Asset Value (per share), or NAV. They report NAV of US$17.20 as of March 31, 2024. With a recent stock price just over $12, they would seem to have about 40% upside to “fair value”.

Plus there is a current dividend yield near 4%. Between this and the upside to NAV, HOM.U has become a popular value stock among REIT investors.

The question to be asked is whether this really makes sense. There are a few things to think about.

[Below I will refer to both the stock with ticker HOM.U and to the company as BSR, to maximize ease of comprehension.]

Properties and History

BSR owns 31 properties with less than 9,000 total units. This is a really small number. In contrast, Mid-America Apartments (MAA) owns more than 100,000 units.

The average rent for BSR is about $1,500. MAA is about 10% larger.

MAA predominantly and BSR entirely own garden-style properties. BSR describes their properties as “middle market, high-quality housing”. Average income of new 2024 residents is $75k. For MAA it is about $85k in the markets where BSR operates.

MAA characterizes their properties as a mix of B+, A-, A, and A+. BSR does not say but their description and rent suggests B+ as a likely level.

There is a narrative out there that Class B rents are less threatened by the current period of oversupply, with newbuilds concentrated in Class A apartments. However, I’ve also seen coverage claiming that the data show the reverse, with tenants taking the opportunity to upgrade. No strong claim here; just don’t believe any simple story.

After their IPO in 2018 BSR went through three years of massive capital recycling. They sold 39 properties with a 31-year average age and added 22 properties with a 6-year average age.

For owned properties this is part of the apartment REIT game. Maintain and redevelop the properties to push rent and then sell them opportunistically as they age. This can produce reasonable internal rates of return.

Then you use the proceeds to buy or develop newer properties. BSR does do some development and redevelopment, having about 3% of their investment-property capital in such activities. This is about the same fraction as MAA.

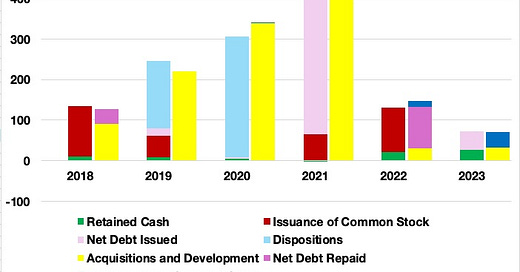

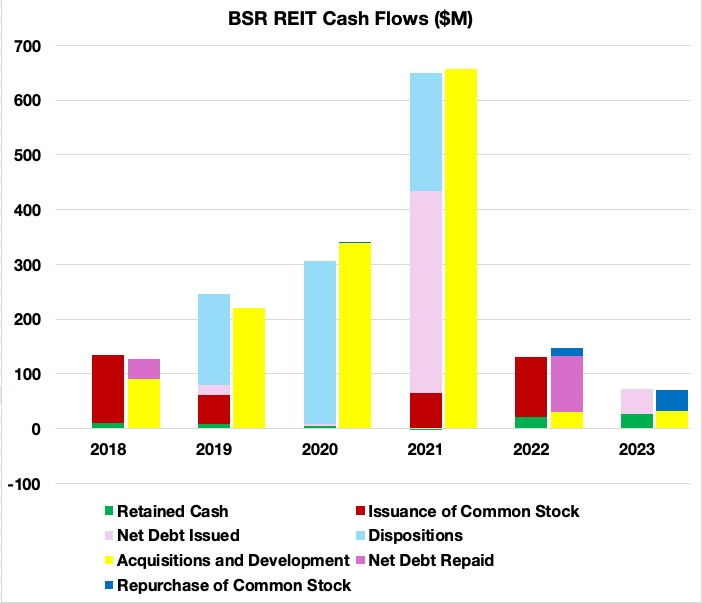

You can see the related cash flows quite clearly in the cash flow plot:

Here for each year there is a left stacked bar for sources of funds and a right stacked bar for uses of funds. You can see that the main activity from 2019 through 2021 was capital recycling, with dispositions (light blue) supporting acquisitions (yellow). Acquisitions here include their development and redevelopment activity, running about $30M per year.

The cash flows mentioned were accompanied by some new debt (pink) and some stock issuance (red). Retained earnings (green) were quite small, reflecting high payouts before 2022.

What is remarkable and unfortunate is that BSR bought a very large amount of property in 2021, right at the peak of the market. That timing cost their shareholders more than $100M as asset values dropped into 2023.

The skeptic’s view of all this would be that they issued equity with the IPO and during the next year, then burned it all up by buying properties at the top of the market. It is a positive, though, to have ended up with much newer properties.

At the end of 2021, the assessed value of the weighted average cap rate was 4.1%. Today it is 5.1%.

BSR claimed that those transactions in 2021 were individually accretive to shareholder value at the time. I agree.

But that conclusion had limited legs, because of the rising cap rates in the sector for the past two years. NOI/sh increased 30% from 2021 through 2023, but cap rates also increased 20%. Overall, and despite the buybacks in 2023, assessed NAV/sh decreased 10% from 2021 through 2023.

On net, the stock price is up 20% in the 6 years since the IPO.

With that overview, lets dig into the details to see what we can say about the reasonable upside, risks, and uncertainties associated with this REIT.