How is the oversupply cycle going?

Most of my investments don’t warrant close monitoring. The companies have stable business models and the main question is how fast they will grow cash earnings. And deviations of such growth from predicted values are rarely large.

So a lot of my time is focused more on the big picture in their markets, instead of spent hanging on the company news (or worse, scrutinizing market fluctuations). Reading the industry press helps me identify the many errors and unjustified scare stories in material in the mainstream media.

But Alexandria Real Estate (ARE) is more risky at the moment, because of a massive wave of oversupply in life-science properties and a recent drop in occupancy. So more of my attention goes both on those markets and on details of Alexandria. I reviewed Alexandria as such earlier this year.

Recently I spent time with the March 2025 Cushman & Wakefield Report and the JLL “U.S. Life Sciences Property Report,” covering Q1 2025. You can sign up to download the JLL report here. I also drew on reports in CRE Daily and BisNow, often citing research by CBRE or other primary sources.

My summary follows.

Major Sources of Life Science Funding

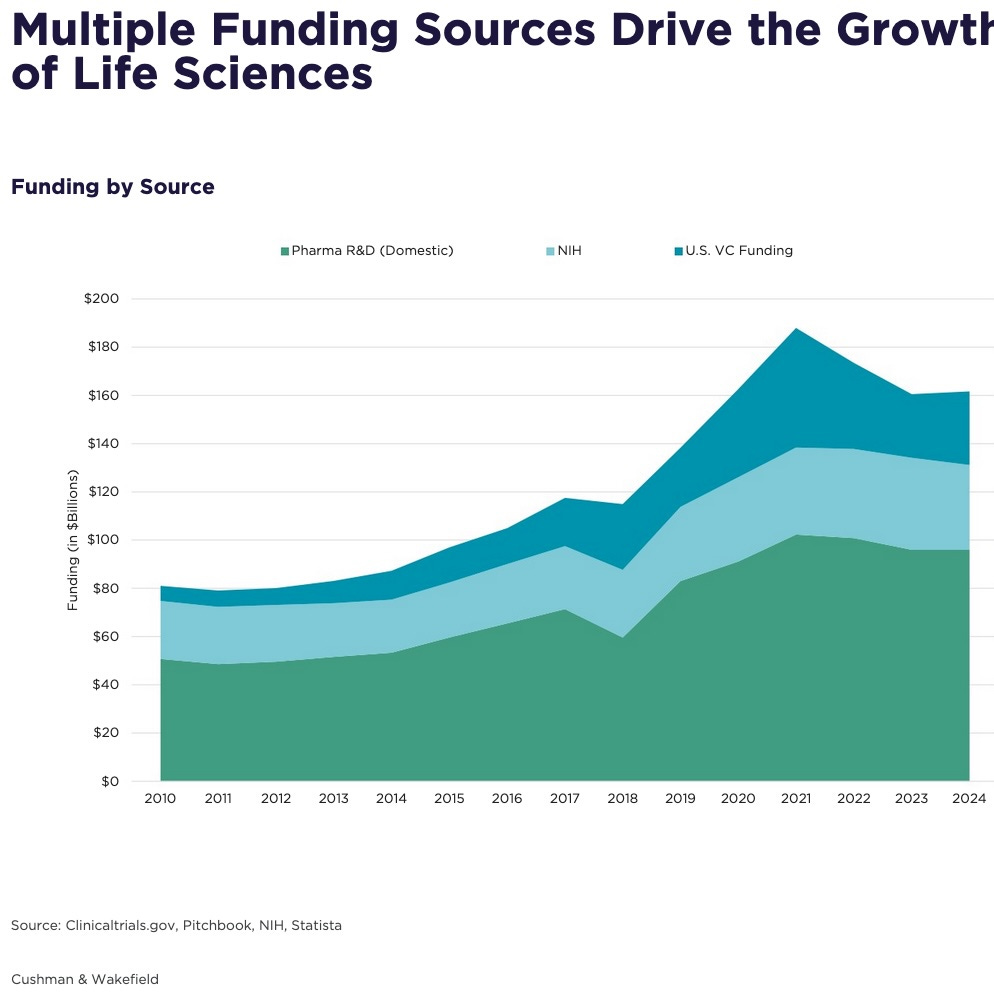

Here is a graphic showing major sources of life-science funding in the US:

You can see that R&D by Pharmaceutical companies is more than half of it. NIH is somewhat more than 20% while VC Funding is somewhat less.

We saw a lot of silly comments last winter from people in the wake of attacks on NIH funding at universities by the Trump administration. Those people misunderstood three things.

First, NIH is only a minority of overall life science funding.

Second, NIH funding has a smaller relative impact on life-science property markets because it is concentrated in universities that own most of their own buildings.

Third, these initiatives by new administrations nearly always get rolled back to a significant degree.

One also sees speculation that AI will lead to a need for less lab space. My daughter, a veteran senior manager in the drug research industry, expects the opposite. AI may produce far more candidates for exploration. But the exploration will require “wet labs.”

The Inventory Story

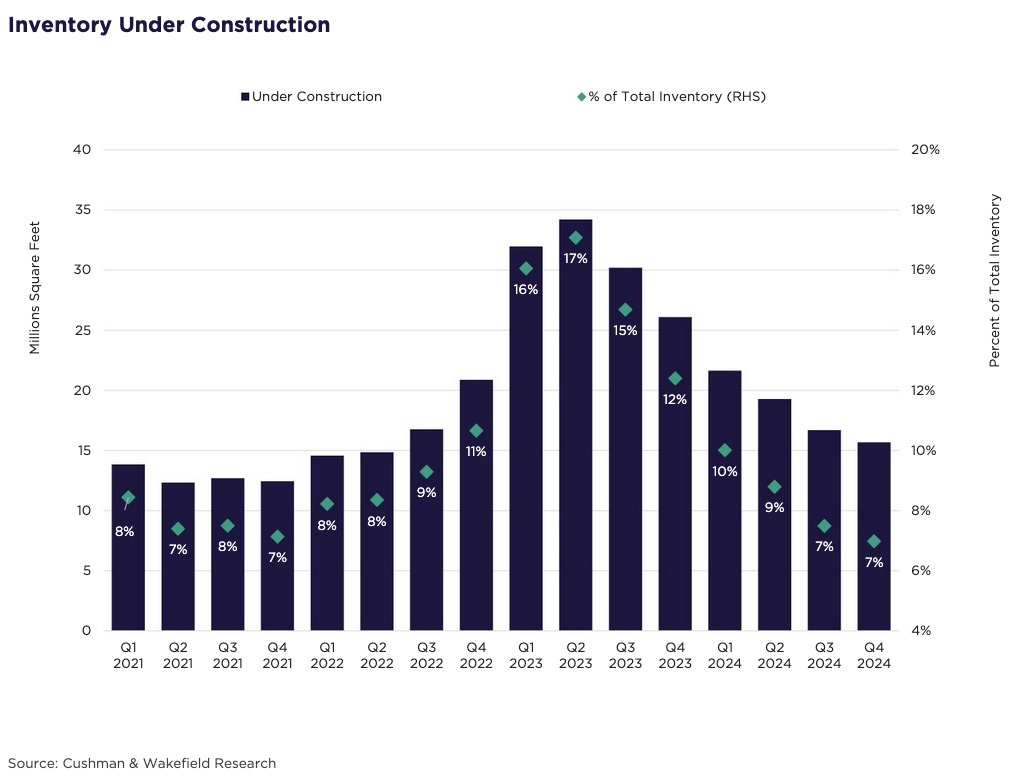

That rapid increase of funding through 2021 continued a long trend of rapidly increasing demand for life-science space. Construction activity responded, with many firms having no background in life science stepping in to fill projected demand by building on spec. The result was that inventory under construction more than doubled by mid 2023:

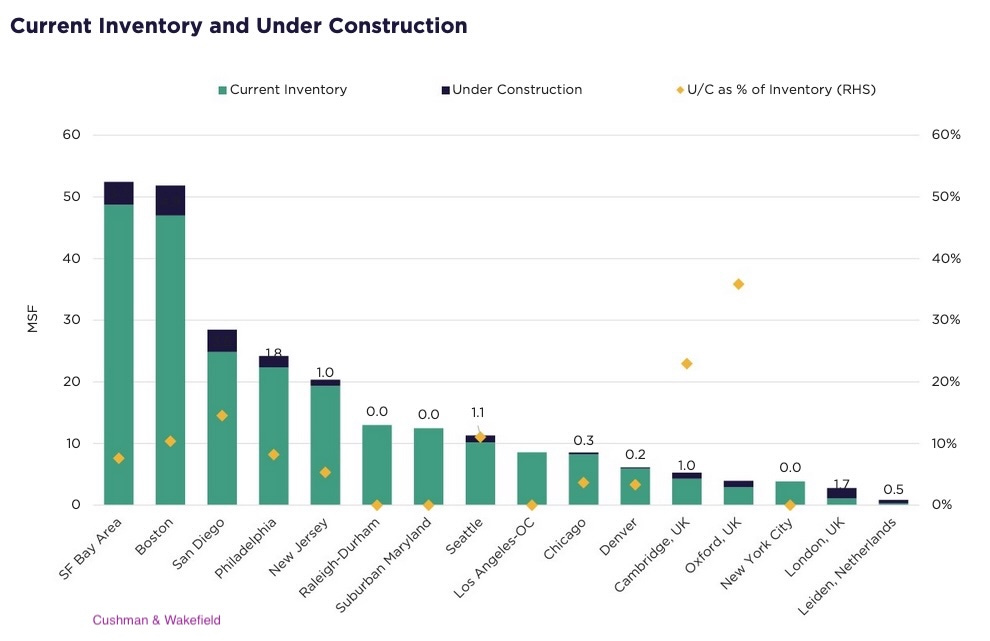

As one would expect, that construction was heavily weighted to the “big-three” life science markets of Boston, the Bay Area, and San Diego:

But since mid-2023 inventory growth has rapidly slowed, as you can see. C&W notes that:

In the U.S., Boston experienced the fastest growth in the last five years, adding nearly 19 million square feet (msf) of new lab and cGMP [current Good Manufacturing Practice] space since 2020. Such a large influx of new space has pushed up the vacancy rate in Boston, prompting a slowdown in the current pipeline to 10% of existing inventory.

and

The San Francisco Bay Area also added a significant amount of new space to the market, with nearly 9 msf of new construction since 2020. The Bay Area’s construction pipeline has also slowed, now representing just 7.6% of total inventory.

Overall, the pipeline of new construction is rapidly decreasing from a torrent to a trickle. C&W note that

Of the nearly 16 msf currently under construction in the U.S., the bulk of it —14 msf —is due for completion in 2025. This marks a significant slowdown in the life sciences construction pipeline, with less than 2 msf expected to deliver beyond 2025.”

Some markets will need time to work down their unleased supply, led by the Bay Area. Within very few years, most markets will transform to being very undersupplied with the quality space that companies actually want.

As an example, C&W notes that “The Boston market, which has seen the highest volume of vacant new space delivered, has slowed its construction pipeline. Of the 3 msf slated for delivery this year, only 51% remains available.” That available 1.5 msf is only 6% of the total inventory in Boston.

A year ago JLL assessed that 40% of the unleased space in Boston was not likely to ever be leased, because of location, quality, or other issues. This drives a decline in supply via changes of use away from life science. Here is JLL’s take on that:

Most of the current inventory contractions are located in the Bay Area. This area has often been described as having a lot of “stupid supply.” C&W says that “current and planned development has been dominated by speculative projects—both ground-up and conversions from office.”

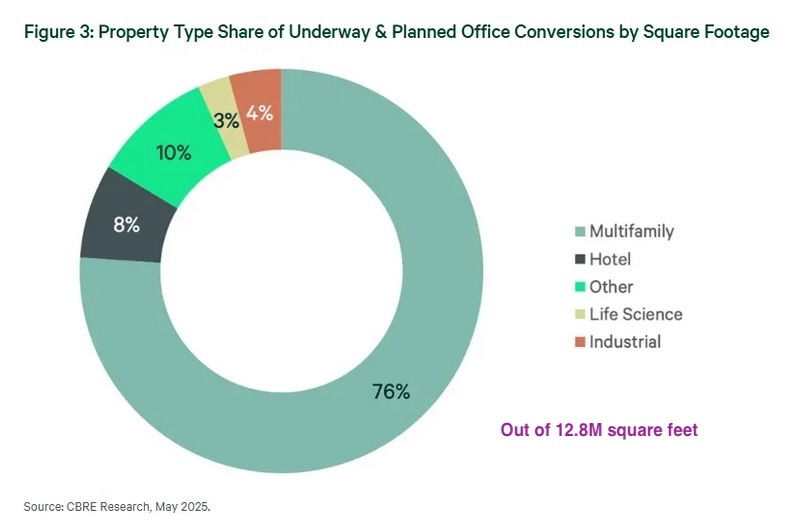

There has been a lot of noise, and some extreme claims, around the idea that life-science conversions were a threat to the recovery of the market. But this is all just worry porn. CBRE has this:

The total of the life-science conversions underway and planned is 400ksf. That’s compared to tens of Msf under construction and hundreds of Msf of total inventory.

A report from BisNow confirms this, stating that:

With the glut of new lab space in Greater Boston, tenants have been attracted to purpose-built life sciences space rather than conversions and "subpar" lab buildings, developers said at a Bisnow event last month. With vacancy climbing to 25% in Q1, according to CBRE, tenants have had the upper hand and have been picky about the type of space they lease.

What Vacancies are Doing

So construction is falling, but vacancies are still high. Vacancy rates have increased to above 20% in Q4 2024. But this trend will reverse. CBRE has this remark:

The total market vacancy rate has increased due to the influx of vacant sublease space and some new construction projects delivering vacant. This trend should start winding down in 2025 as the life sciences construction pipeline contracts and occupiers absorb more available space.

and JLL already sees the expected bifurcation by quality:

[Total availability rate includes vacancies and subleases available.]

JLL also sees some millions of sf of incremental demand for biomanufacturing, driven by reshoring:

The total is nearing 3.5 Msf. That is a significant fraction of the 7.4 Msf of space available from expected construction completions in the Big 3 markets for 2025 and 2026 from C&W:

Takeaways

The life sciences market is nearing the end of a cycle of oversupply. Construction of new space has fallen rapidly and new sources of demand are emerging.

Unless government actions lead to a broad contraction of the sector, we should see occupancy rise over the next year or two in most markets. The San Francisco Bay Area may take longer.

If you are looking for one-year returns from related investments, you may not find them. In contrast, strong returns within 5 years seem very likely to me.

My own holding of ARE is paying me great dividends while we wait.

Please click that ♡ button. This helps push Focused Investing up on the Substack feed. And please subscribe, restack, and share. Thanks!

This is very helpful, so thank you. Especially debunking the office conversion narrative.

Thanks Paul for sharing your take. As usual, very insightful. Do you see an opportunity in other med space? Senior and nursing facilities? Outpatient medical offices? DOC, CTRE, OHI, SBHA?