The headlines go to gold, silver, lithium, copper, and iron. What about tin, at times described as the forgotten industrial metal? Is there investing opportunity there?

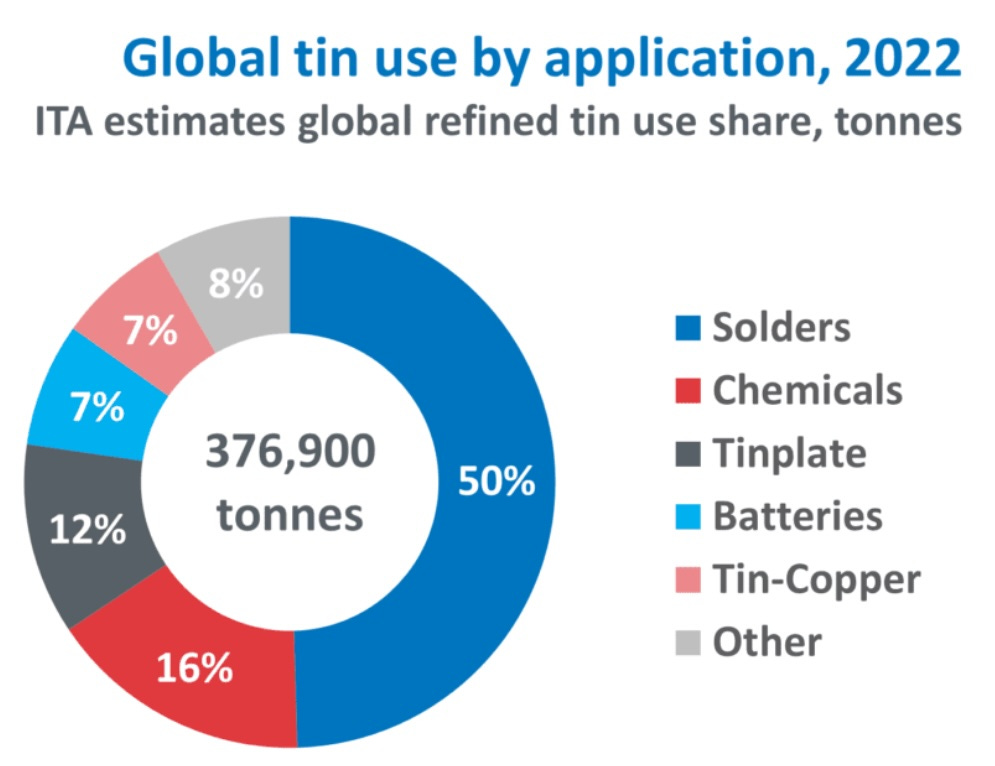

Tin is curious metal. Its properties make it essential for various applications. The largest by far is for solder:

ITA is the International Tin Association, no wonder.

A chat room denzien shared this view, which strikes home to me: The cost of tin is very rarely a significant part of the cost of any product or process. As a result, demand is not elastic overall, and price will adjust to pull in the needed supply.

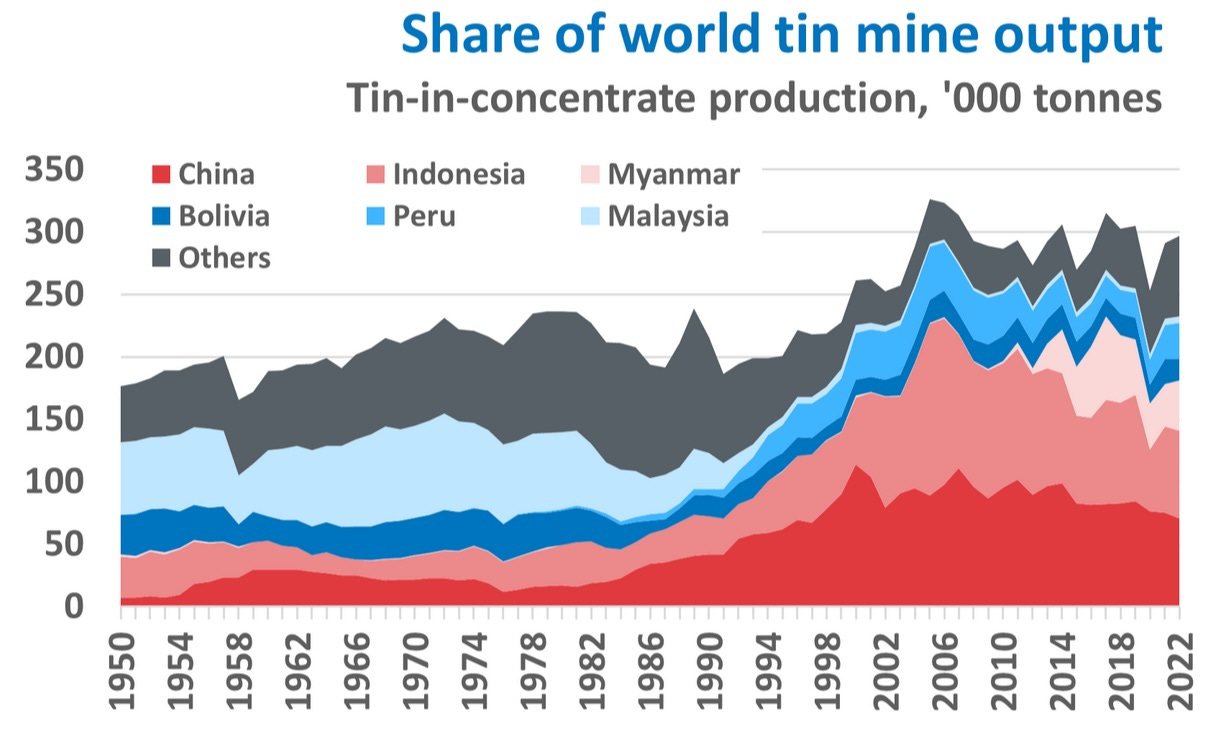

About a third of tin supply comes from recycling, with the rest from mining. There are a lot of sources for mined tin:

You can see that Malaysia was a dominant source for some decades, more than supplanted by Indonesia and China in this century. But China has constrained tin mining and is unlikely to rise up and dominate this commodity.

Indeed, one thing to like about the tin markets is the limited role of China. For copper, iron ore, lithium, and numerous rare-earth elements, Chinese supply and/or processing makes the world market heavily dependent on their economic path forward. Being a pessimist regarding that path, my strong preference is for commodities where they are not the dog, with the rest of world being the tail.

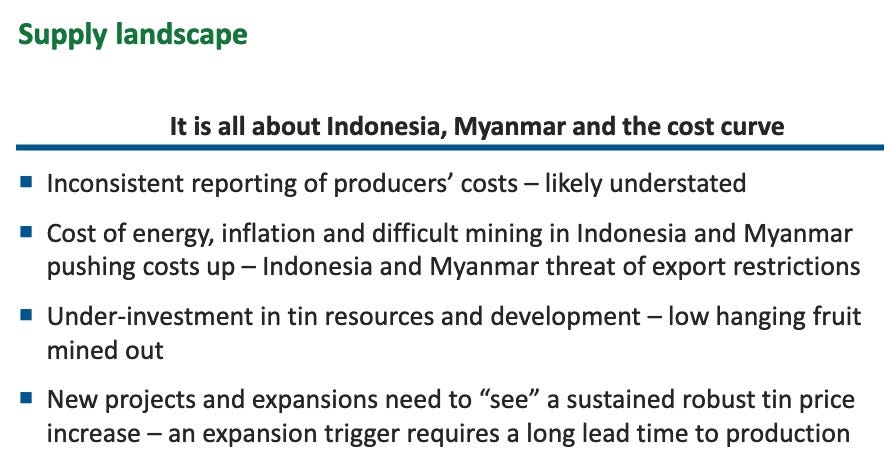

Here is Alphamin’s summary of the tin supply landscape. Note that Indonesia and Myanmar are 28% of supply.

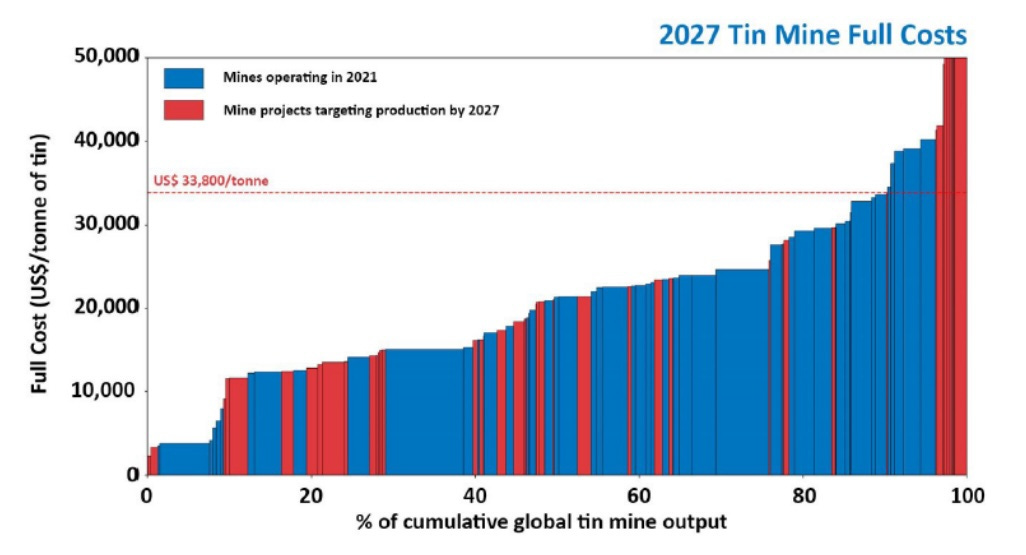

As with most commodity resources, it is the global cost curve that matters for investing. Here is that curve from the International Tin Association based on 2022:

Compare that with tin prices from tradingeconomics.com:

The bottom 40% of the cost curve would be generating cash flow at all tin prices over the past decade. That portion is highly profitable today.

Overall, to generate adequate forward supply, the tin price needs to increase from here. That said, we are not talking 2x. Any tin investment needs to make sense at current (or somewhat lower) tin prices.

Enter Aphamin

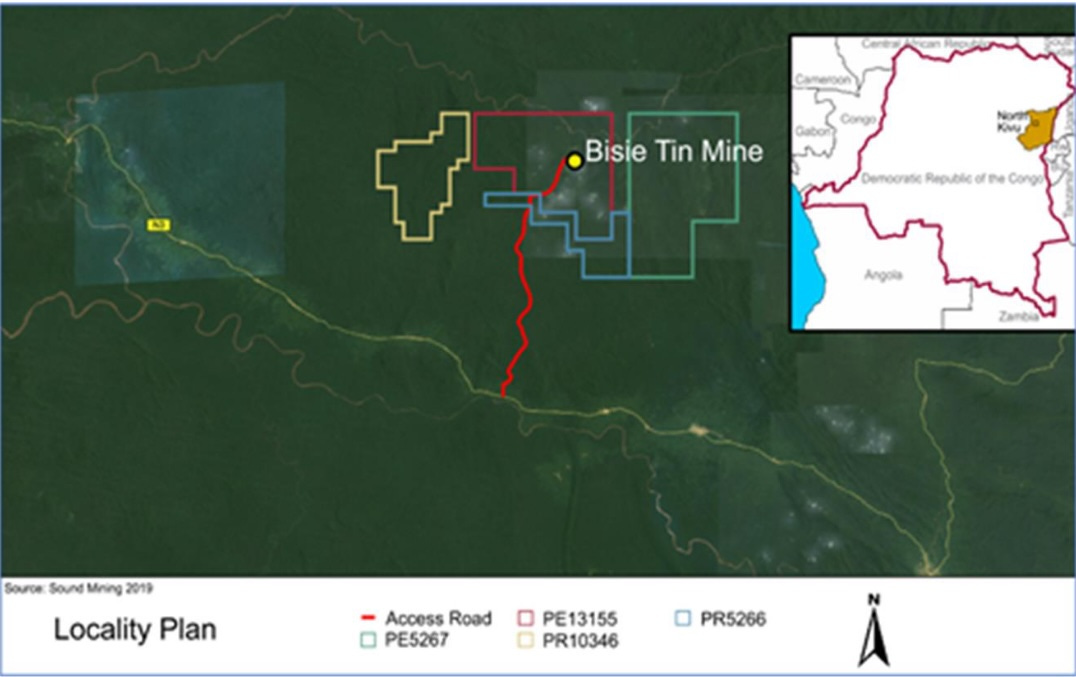

Alphamin (TSX:AFM; OTC:AFMJF) is a mineral resource company originally incorporated in 1981. They chose more recently to focus on a tin opportunity in the Democratic Republic of the Congo (“DRC”). It is up on a mountain above a river valley full of small villages. Alphamin has a “Social Commitment” to 28 of them.

The city of Goma, with a population near 2 million, is just off the map to the right. Goma is notorious for getting all their energy from biomass, much of which is charcoal from trees whose harvesting threatens the famous Gorilla population in Virunga National Park.

Here is another view of that same region showing the permits held by Alphamin and where this lies within the DRC:

Here is what has Alphamin has accomplished there:

In 2013 they secured anchor investors and began to explore and assess feasibility.

In 2016 they announced positive feasibility study results.

In 2019 they started commercial production, ramping to 10,000 tonnes/yr in 2020.

In 2022 they formally identified a second nearby deposit.

From that “Maiden Resource” data to first ore processing was two years (!).

They are now at 20,000 tonnes/yr, 7% of world production.

That’s six years from go to starting production on the first mine. This is an insanely short number.

What I infer from that is two things. First, these guys are really, really good. Second, politics is in their favor.

Some context for the latter is from the history recounted on the website:

Bisie is a story of astonishing transformation. The Walikale territory has a difficult history primarily due to conflict minerals. Up to 16,000 people are said to have lived at Bisie supporting ~ 2,000 artisanal miners. The miners exploited shallow Bisie deposits between 2002 and 2012.

This illicit production, which at one point represented about 4% of global tin supply, helped finance conflict in the region and created profound hardship for the miners themselves, who were forced to work in appalling conditions.

The international effort to stamp out the sale of conflict minerals, spearheaded by the USA’s Dodd–Frank Act, made irresponsibly produced tin from this region difficult to sell. Artisanal mining operations in the area became economically unviable. This led to Alphamin becoming the first formal mining company to begin operating in the province.

So that’s why Alphamin first knew there were good tin deposits at Bisie. They still had to put a working mine in place.

What Stuff Had to Work

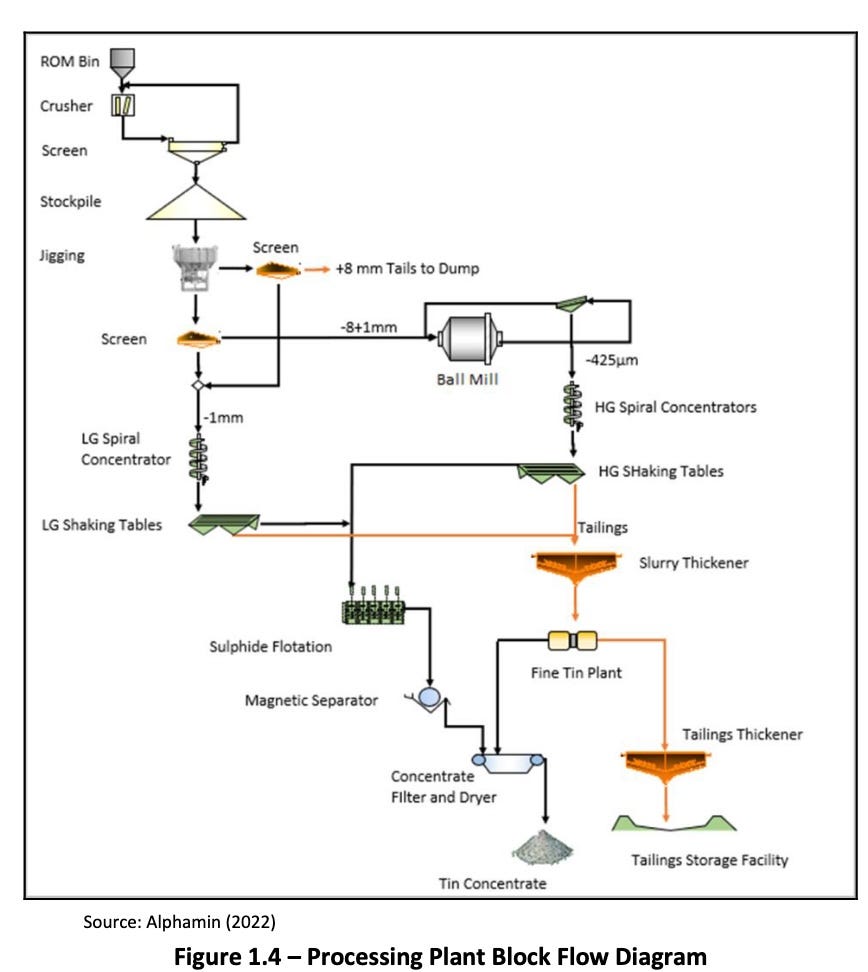

To give you an idea of the achievement here, let’s take a look at what had to be put in place and made to work together. Here is a schematic ot the processing plant:

These components are big hardware, which must be modified for the specific properties of the ore being worked, and which likes to break. Sustaining production reflects both quality of design and ability to respond quickly to problems.

One nice thing about relatively small miners is that they often share more detail than the big boys can. Let me share photos of some components of this plant.

Back to Production and Money

At a tin grade of roughly 4.5%, Mpama North is the world’s highest-grade tin resource. That concentration is four times higher than most other operating tin mines in the world. Mpama South, at a grade of roughly 2%, is the world’s second highest-grade tin resource.

Now let’s dig deeper into the Alphamin resources and their future.