All financial quantities are in Canadian Dollars unless otherwise indicated.

I’ve long admired Pembina Pipeline Corporation (NYSE:PBA and TSX:PPL) and owned them a few years ago. A goal has been to increase my wealth enough to get the income I want by holding firms such as Pembina that pay somewhat less and carry less risk.

But the market loves them too and at the moment I’m getting more yield from less-loved names such as Enbridge (ENB). Despite all that there has been no publication from me on Pembina, ever (at least per memory).

So join me in taking a look.

Western Canada is Where It’s At

Pembina is a midstream energy corporation, so it primarily transmits hydrocarbons extracted by upstream firms and received by downstream firms. Their primary area of activity is within the Western Canada Sedimentary Basin (WCSB), an enormous hydrocarbon resource.

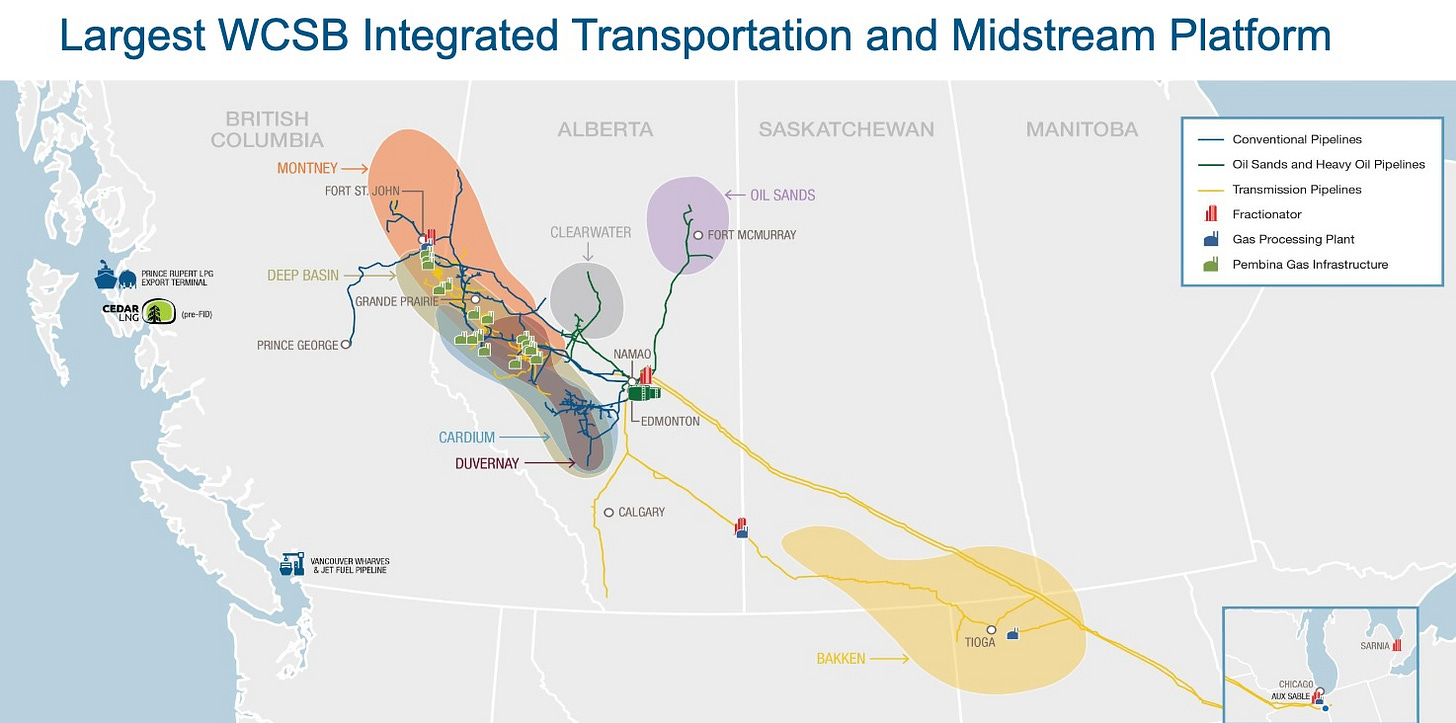

This summary map of their midstream assets will help set the stage:

Five major producing areas are shaded here. Activity in the Baaken is today centered in North Dakota. The oil sands near Fort McMurray produce both heavy oil and synthetic crude oil (SCO). Clearwater is a source of heavy, flowing oil.

The other three areas overlap on the surface, but differ in the depth of the resource. The Duvernay lies within Alberta, the Deep Basin extends a bit into British Columbia, and the Montney has a substantial fraction in British Columbia. These areas all produce light oil, natural gas, Natural Gas Liquids (NGLs) and “condensate”.

It is NGLs and condensate that matter centrally for Pembina. The use of these two terms is inconsistent, but roughly speaking the meaning is as follows.

Condensate refers to heavier hydrocarbons that are liquid at normal temperatures. These liquids must be removed from natural gas before it can be transported via pipeline.

Condensate is added to the heavy bitumen extracted from the oil sands to produce heavy oil that can flow in pipelines. Condensate must be imported to Canada, which does not generate the volumes that are needed.

NGLs refers to lighter hydrocarbons that must be removed from the natural gas stream by some combination of freezing and pressurizing. They include ethane, propane, and butane, among others. Fractionators can separate out these so-called “purity products.”

Much of the activity of Pembina is focused on NGLs and condensate. Let’s start with an incomplete summary list.

One of the pipelines to the Chicago area exports NGL-rich natural gas.

The other one imports condensate for use in the oil sands.

The pipeline to the south of these on the map is dedicated to Ethane (see below).

Many of their plants contribute to processing natural gas and fractionating NGLs.

They are involved in a couple of terminals on the coast with much more to come.

Some of their pipelines do transport various kinds of crude oil.

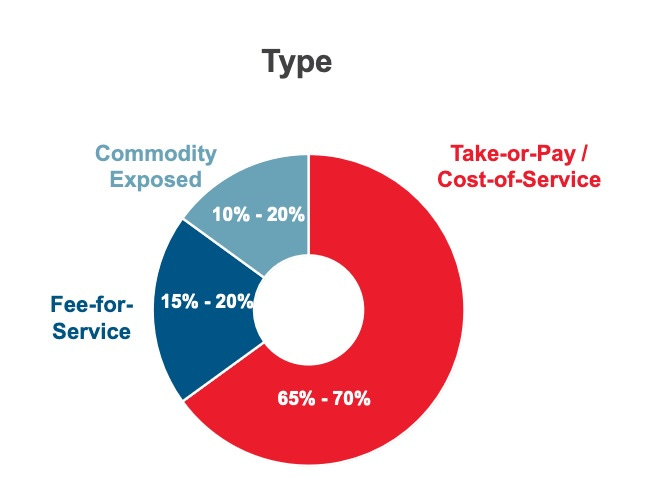

Pembina’s revenues are distributed as shown here:

Two-thirds of these are not contingent in the short run. Contractual counterparties are obligated to pay those amounts (without such commitments, the infrastructure would never get built).

The Fee-for-Service component does depend on volumes transported. The Commodity-Exposed segment is the revenue they generate by selling commodities they own. This part can be quite profitable but is volatile.

More on Ethane

Ethane is the lightest hydrocarbon molecule, having only two carbon atoms. It is often referred to as C2+.

Ethane is the most common purity product, as the others have at least 3 carbon atoms per molecule. There is often more ethane produced than can be used, so the remainder is “rejected” and put back into the natural gas stream.

But ethane is more potent than the methane that makes up most natural gas, so there is a limit as to how much can go into a normal natural-gas flow. This is one of the issues that complicates management of gas and oil fields.

Ethane is also useful stuff. It is easily converted to ethylene, which is a preferred feedstuff for producing plastics.

Pembina has taken advantage of this, with a set of pipelines dedicated to ethane transport. This in turn has enabled them to profit both from marketing ethane they produce and from transporting ethane for others. Building out this infrastructure to meet the coming new demand will cost a few hundred $M, which we will see below is well within their scope.

Sources of Growth

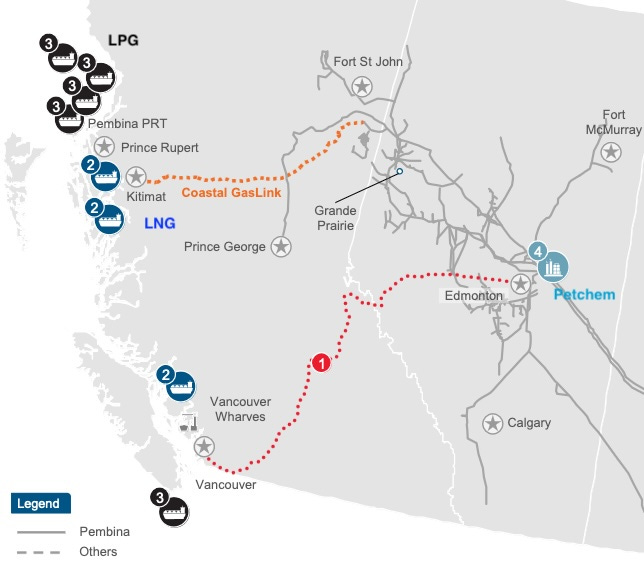

Pembina is well-positioned for growth. This slide from them illustrates how and where.

Projects of others create opportunities for growth by Pembina. The Trans Mountain Express expansion increases crude oil demand, which in turn increases demand for the condensate they transport.

The Coastal GasLink pipeline will drive increased demand for natural gas, producing additional NGLs for Pembina. Plus Pembina has direct participation in Cedar LNG, one of the export terminals.

They are obligated for a 20% Equity contribution to Cedar LNG costs and will have 49% ownership. The project reached its Final Investment Decision on June 25.

The increase in LPG exports will specifically increase demand for propane transportation. Again Pembina participates in one of the export terminals.

Recent big news is the decision by Dow to expand their petchem production near Edmonton. Existing ethane demand is ~250 Mbpd. Incremental ethane demand will be more than 100 Mbpd.

Pembina has made an agreement to supply 50 Mbpd of ethane and has capacity to fractionate and transport the rest. Significant earnings increases at low cost seem likely.

Growth Outcomes and Plans

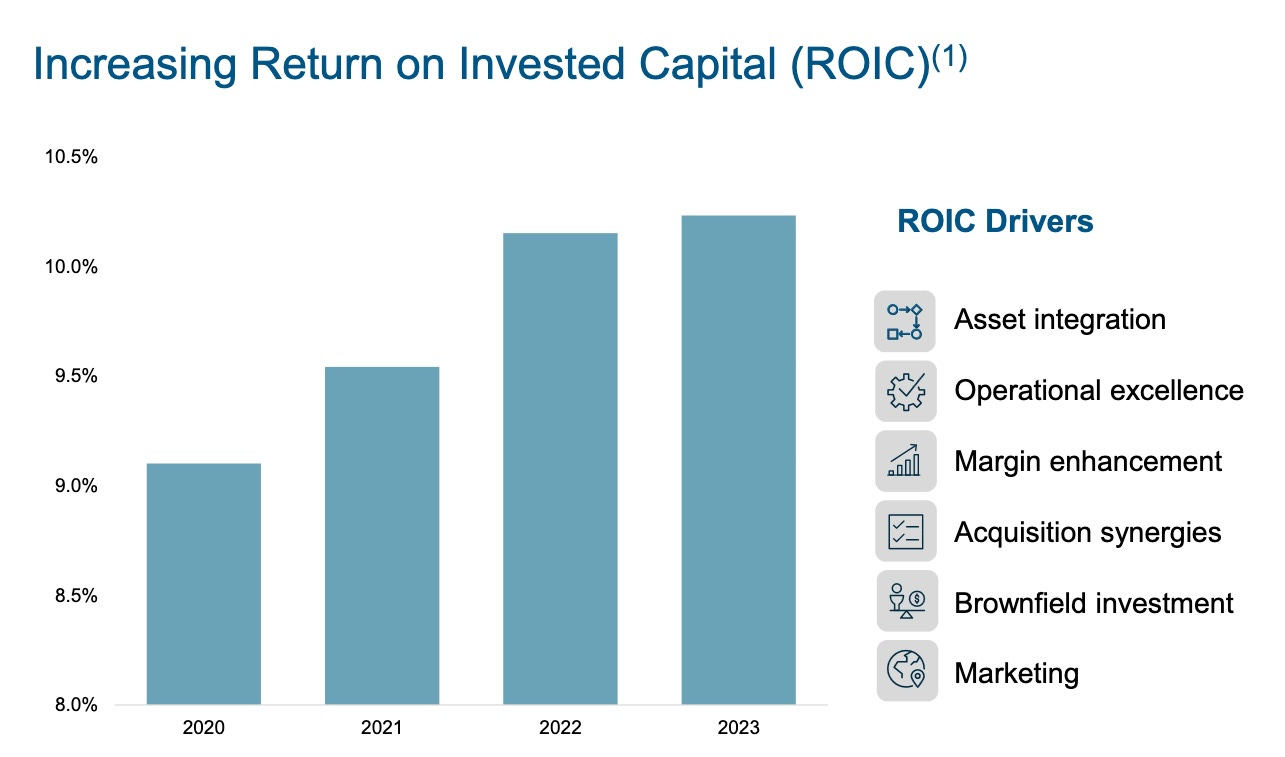

Pembina has significantly improved their Return on Invested Capital on their growth projects:

From scanning earlier presentations, this was not enough of a focus to mention before 2020. They were very, very focused on growing shareholder returns.

But note that they got 9% in 2020. With 2022 and 2023 being more typical years, Pembina is not quite matching Enterprise Products Partners (EPD) on this score, but at rates near 10% they can certainly still grow shareholder value.

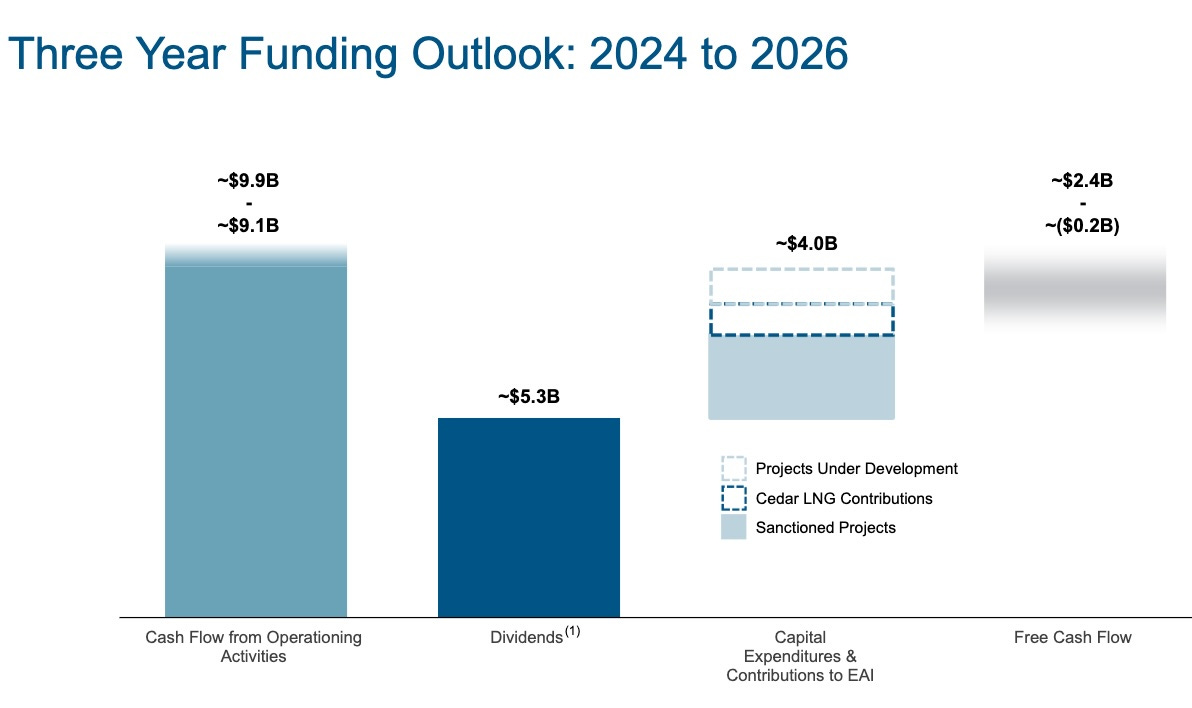

Their projects have a great track record of coming in on time and at or under budget. Looking forward, here is how they see the near future:

They have just over $2B in already sanctioned projects, a commitment of about $1B to the Cedar LNG project mentioned above, and scope for some additional projects (or M&A). At a 10% ROIC, that $4B total would generate $400M in incremental NOI.

That increase would itself grow Cash from Operations (CfO), adjusted to remove changes in working capital) by more than 4% per year. Some of this will overlap with their guided EBITDA/sh growth of 4% to 6% from fee based customers.

Their 25-year CAGR of the dividend is 4.3%. Continuing that seems likely.

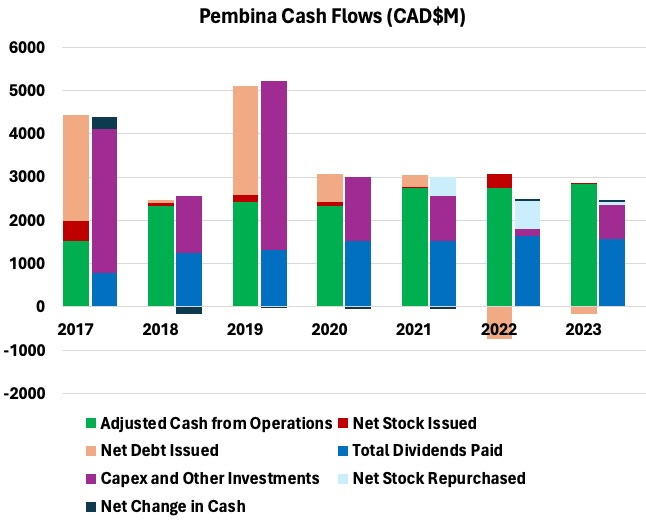

We can see here that their cash flows have become simple and sustainable:

There are two sets of stacked bars for each year. The left stack is sources of funds. This is mainly the green of CfO, especially recently.

Pembina has substantially ceased issuing stock to raise funds (red). They also have been paying down debt (beige) lately, having taken on quite a bit to drive capex before 2020. Not seen here is new shares used to directly support mergers.

The right stack for each year shows uses of funds. Blue is the dividend, which has mostly been near half of CfO. Purple shows the funds spent (mostly) for capex.

This is today a very simple financial model. Use the cash coming in to cover dividends and capex.

Balance Sheet

Pembina has reduced Debt-to-EBITDA to below their lower-end target of 3.5x. This is on the low end for the midstream space, too, although the general trend seems to be to go lower.

Their maturities are well-distributed as you can see here. Typical maturities are running about 20% of CfO, a very manageable number:

Notably, they closed in January on $1.8B of new senior unsecured notes. These included a $600M tranche of 30-year debt. It warms my heart to see companies that can issue such long debt at good rates.

The rates were on average 130 bps (and no more than 210) above those for their current debt. The incremental interest expenses from rolling the maturing debt to those rates over the next 10 years would be $88M. This is only 20% of their current expense of $450M, an insignificant fraction.

Pembina has also more recently issued $950M aggregate principal amount of senior unsecured medium-term notes. These again include a tranche of 30-year debt.

No wonder Pembina has a credit rating from S&P of BBB.

In other recent activity, Pembina agreed to acquire a 50% working interest in Whitecap Resources' (OTCPK:SPGYF) Kaybob complex in Alberta and executed an agreement to support the future infrastructure development for Whitecap's Lator growth area.

In turn, Whitecap will enter into a long-term take-or-pay agreement for Pembina’s capacity in the Kaybob complex and commit to an area of dedication for all volumes Whitecap produces out of the area.

Price and Value

Here are some valuation metrics for Pembina:

Price to CfO is 7.2 and Price to EBITDA is 6.7

EV/EBITDA is 9.1

Dividend Yield is 5.4%

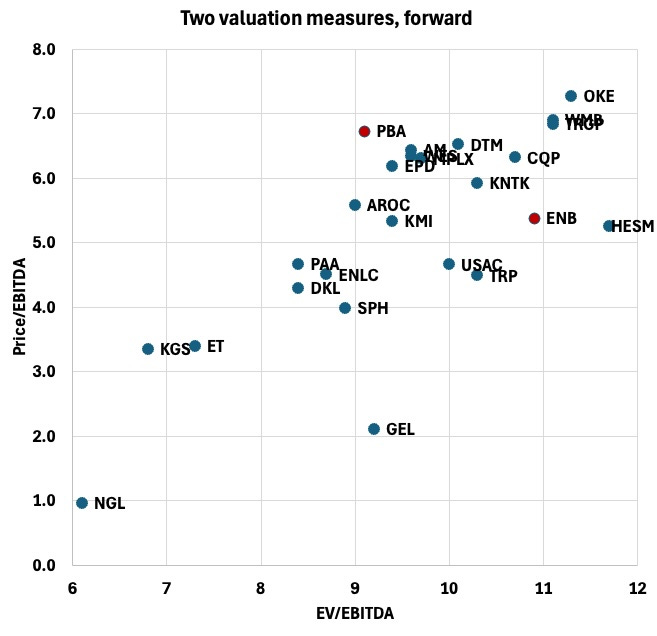

This gives me a chance to rant a bit, looking at this graphic based on Michael Boyd’s tabulation:

This plot shows Price vs Enterprise value, each as a ratio to EBITDA. PBA and Enbridge (ENB) are highlighted in red.

Many analysts speak exclusively to EV/EBITDA. This is a liquidation-based quantity, where the idea is that the value relates to what is left after you pay off debt.

My preference is to value (growing) cash flows rather than liquidation values. In that context, debt is an enabler but value depends on the incremental cash flows that debt lets you generate.

Through the lens of EV/EBITDA, Enbridge (ENB) appears more highly valued than PBA. But through the lens of Price/EBITDA PBA is more highly valued.

This makes a lot more sense to me. Moving to the right on the plot above just means you have more debt. This is not, to my mind, a positive.

We see that PBA is priced at a larger multiple of EBITDA than every midstream except PR-master OneOak (OKE) and Transco holder Williams (WMB). My skepticism of those two comes through, eh?

In the event, it seems that Pembina is a great company but PBA is not undervalued. Still it might be worth holding.

Suppose you hold a $100k position in ENB, which pays you about $7.5k in dividends per year. Moving those funds to PBA would cost you about $2k in dividends. That might be worth it.

Please click that ♡ button. And please subscribe and share. Thanks!

I'm a bit late to comment on this article but it is well written.. I'd consider buying a bit more Pembina to reach the same size as my Keyera position.

One of my measures is how management talks about dividends. I held ARX for a while, narry a mention about dividends. I switched to TOU as a similar company but with some management focus on dividends. It was a comment from you that prompted me to make the change.

So how does this management talk about dividends? Their five year history seems relatively flat with a change from monthly to quarterly a year ago which makes it harder to eyeball, but still seem like it is flat to me. Has management expressed dividend growth as a focus for them?